Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Aka Land Contr Form

What is the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina

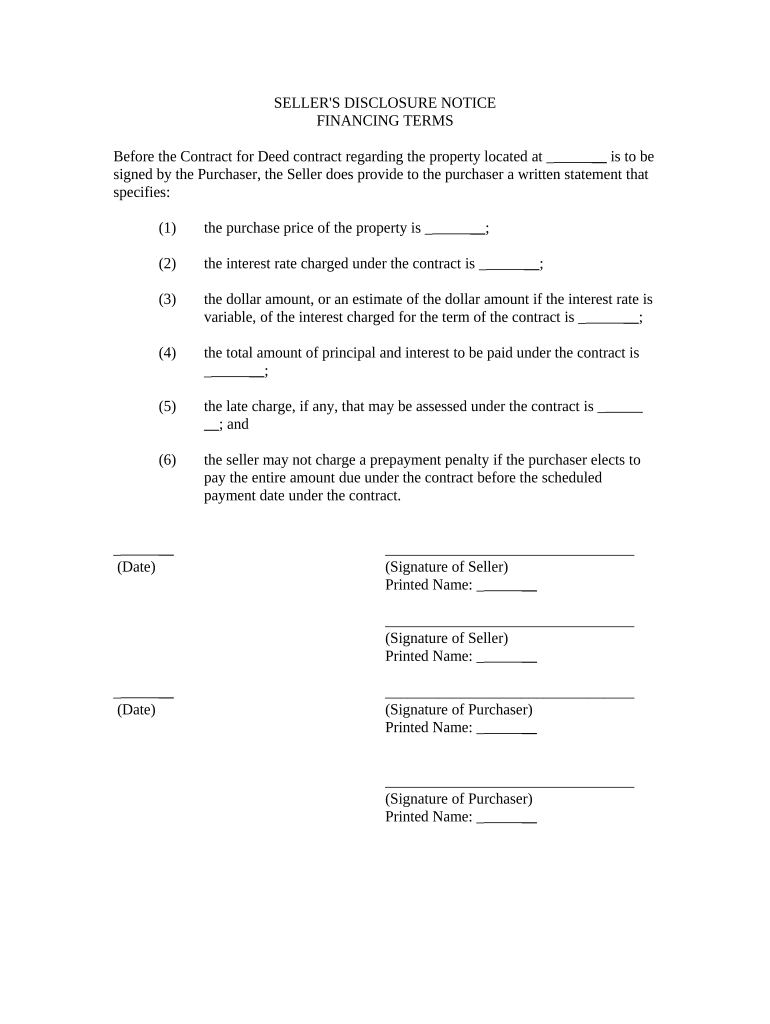

The Seller's Disclosure of Financing Terms for Residential Property in connection with a contract or agreement for deed, commonly known as a land contract in North Carolina, is a crucial document that outlines the financing terms agreed upon by the seller and buyer. This disclosure ensures transparency regarding the financial obligations associated with the property purchase. It typically includes details such as the purchase price, down payment, interest rate, payment schedule, and any other specific conditions that may affect the transaction. This form serves to protect both parties by clearly stating the terms of the agreement, thus minimizing misunderstandings and potential disputes.

Steps to Complete the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina

Completing the Seller's Disclosure of Financing Terms involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the property and the financing terms. Next, fill in the details such as the buyer's name, property address, and financing specifics, including the total purchase price and payment terms. It is important to review the document thoroughly to ensure all information is correct and complete. Once filled out, both the seller and buyer should sign the document to validate the agreement. Retaining copies for both parties is essential for future reference.

Key Elements of the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina

Several key elements are essential in the Seller's Disclosure of Financing Terms. These include:

- Purchase Price: The total amount agreed upon for the property.

- Down Payment: The initial amount paid upfront by the buyer.

- Interest Rate: The percentage charged on the outstanding balance of the financing.

- Payment Schedule: Details on how often payments are due and the duration of the payment period.

- Default Terms: Conditions that outline what happens if the buyer fails to make payments.

Legal Use of the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina

The legal use of the Seller's Disclosure of Financing Terms is governed by North Carolina real estate laws. This document must comply with state regulations to be considered valid. It is essential for both parties to understand their rights and obligations as outlined in the disclosure. The document serves as a legally binding agreement once signed, which means that both the seller and buyer are obligated to adhere to the terms specified. Failure to comply with the terms may result in legal consequences, including potential lawsuits or financial penalties.

State-Specific Rules for the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina

In North Carolina, specific rules apply to the Seller's Disclosure of Financing Terms. The state mandates that sellers provide accurate and complete disclosures to buyers. This includes any known defects in the property and the financial terms of the sale. Additionally, North Carolina law requires that all disclosures be made in writing and signed by both parties. Understanding these state-specific rules is crucial for ensuring compliance and protecting the interests of both the seller and buyer throughout the transaction process.

How to Use the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina

Using the Seller's Disclosure of Financing Terms effectively involves understanding its purpose and how it fits into the overall transaction process. This document should be presented during negotiations to clarify the financing terms and conditions. Both parties should review the disclosure carefully to ensure mutual understanding and agreement. Once both the seller and buyer are satisfied with the terms, they should sign the document to formalize the agreement. Keeping a copy of the signed disclosure is important for future reference and to ensure both parties adhere to the agreed terms.

Quick guide on how to complete sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497316758

Complete Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a highly eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to draft, modify, and electronically sign your documents promptly without any delays. Manage Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr with ease

- Locate Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina?

A Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina is a legal document that outlines the financing terms agreed upon between the buyer and seller in a land contract. This disclosure includes critical information regarding payment schedules, interest rates, and any additional terms that may affect the sale. Understanding this disclosure is essential for both parties to ensure clarity in the transaction.

-

Why is a Seller's Disclosure important in real estate transactions?

The Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina protects both buyers and sellers by clearly stating the financing options available. It helps prevent misunderstandings about the financial obligations involved in the transaction. By providing this information upfront, it fosters transparency and trust, which are crucial in any real estate deal.

-

How does airSlate SignNow simplify the process of creating a Seller's Disclosure?

airSlate SignNow streamlines the process of creating a Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina by offering easy-to-use templates and document customization features. This enables users to generate compliant disclosures quickly and efficiently. Additionally, our platform allows for electronic signatures, making the process faster and more convenient.

-

What features does airSlate SignNow offer for managing Seller's Disclosures?

AirSlate SignNow provides several features to enhance the management of Seller's Disclosures, including customizable templates, document tracking, and templates specifically designed for the Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina. Users can also take advantage of integrations with other tools, ensuring a seamless workflow. These features make it easy to manage important real estate documents.

-

Are there any costs associated with creating Seller's Disclosures using airSlate SignNow?

Using airSlate SignNow to create a Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina is both budget-friendly and efficient. Our competitive pricing plans offer various levels of service, ensuring you can choose an option that fits your needs. With the potential cost savings from streamlined document processes, using our service can be a highly beneficial investment.

-

How can I ensure compliance when drafting a Seller's Disclosure?

To ensure compliance when drafting a Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina, it's essential to familiarize yourself with North Carolina real estate laws. Using airSlate SignNow’s templates can help guide you in including all necessary legal language and disclosures. Additionally, consulting a legal expert may provide further assurance that your document adheres to state regulations.

-

Can airSlate SignNow integrate with other real estate software?

Yes, airSlate SignNow offers integrations with various real estate software solutions to ease the management of a Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contract North Carolina. These integrations enhance your workflow by allowing seamless data transfer and combined functionalities. This capability means you can manage all your real estate documents in one place.

Get more for Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr

- Big brother big sister application form

- Personal data record department of workforce development dwd wisconsin form

- Mc 501 990 reporterrecorder certificate of forms

- Epa financial data request form

- Warranty deed texas form

- Va form 21 0960f 2

- House house lease agreement template form

- House rental lease agreement template form

Find out other Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed Aka Land Contr

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT