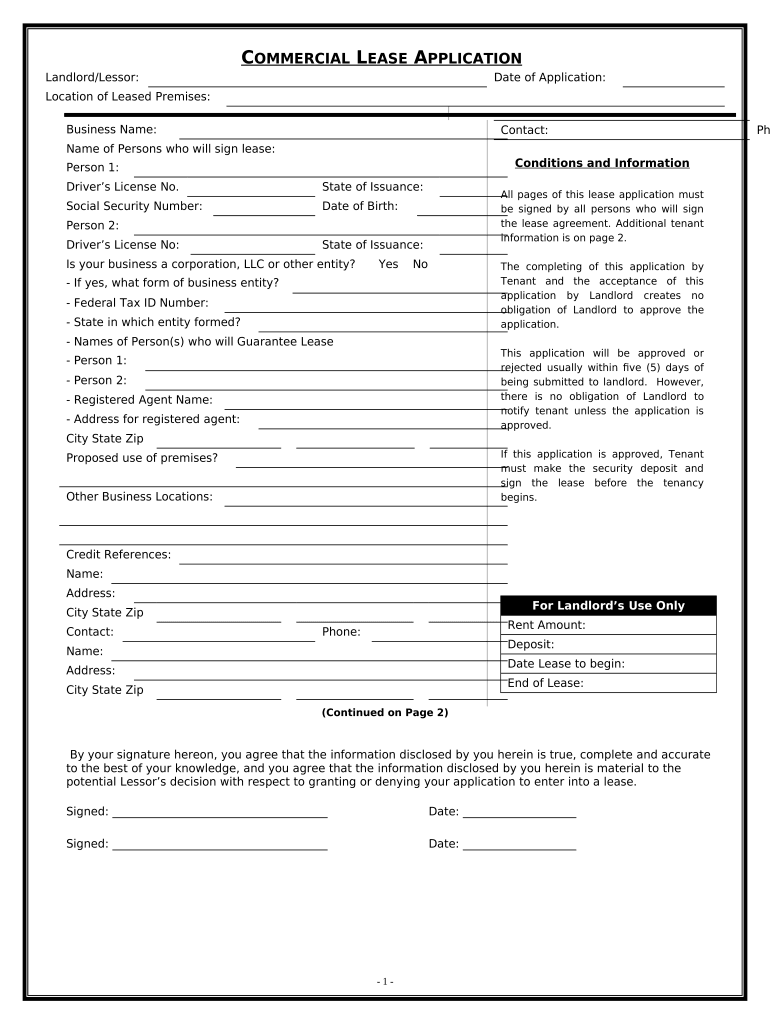

Commercial Rental Lease Application Questionnaire North Carolina Form

IRS Guidelines

The IRS provides essential guidelines for completing application taxes, ensuring compliance with federal tax laws. Understanding these guidelines is crucial for taxpayers, as they outline the necessary steps and requirements for accurate tax filing. The IRS updates these guidelines regularly, so staying informed about any changes is important. Key areas covered include income reporting, allowable deductions, and credits that may apply to your situation. Taxpayers should refer to the IRS website or consult a tax professional for the most current information.

Filing Deadlines / Important Dates

Filing deadlines for application taxes are critical for compliance and avoiding penalties. Typically, individual tax returns are due on April 15 each year, unless that date falls on a weekend or holiday, in which case the deadline may be extended. It's important to note that extensions can be requested, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these dates can help ensure timely submissions and reduce stress during tax season.

Required Documents

Gathering the necessary documents is a vital step in the application taxes process. Commonly required documents include W-2 forms from employers, 1099 forms for freelance income, and records of any other income sources. Additionally, taxpayers should collect receipts for deductible expenses, such as medical costs, charitable donations, and business expenses. Having all relevant documents organized can streamline the filing process and help ensure accuracy when completing tax forms.

Form Submission Methods

Application taxes can be submitted through various methods, allowing flexibility based on individual preferences. Taxpayers can file electronically using tax software, which often provides an efficient and user-friendly experience. Alternatively, forms can be completed on paper and mailed to the appropriate IRS address. In-person submission is also an option at designated IRS offices. Each method has its advantages, and choosing the right one depends on personal comfort and the complexity of the tax situation.

Penalties for Non-Compliance

Understanding the potential penalties for non-compliance with application taxes is essential for all taxpayers. Failure to file on time can result in significant fines, and underreporting income may lead to additional penalties and interest on unpaid taxes. In some cases, the IRS may impose criminal charges for fraudulent activities. Being aware of these consequences can motivate timely and accurate filing, helping to avoid unnecessary financial burdens.

Taxpayer Scenarios

Different taxpayer scenarios can influence the application taxes process significantly. For instance, self-employed individuals may need to file additional forms, such as Schedule C, to report business income and expenses. Retired individuals might have different considerations, such as pension income and Social Security benefits. Students may qualify for specific credits and deductions related to education expenses. Recognizing how these scenarios affect tax obligations can help individuals prepare more effectively for their filing responsibilities.

Quick guide on how to complete commercial rental lease application questionnaire north carolina

Effortlessly Prepare Commercial Rental Lease Application Questionnaire North Carolina on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Commercial Rental Lease Application Questionnaire North Carolina on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Commercial Rental Lease Application Questionnaire North Carolina with Ease

- Locate Commercial Rental Lease Application Questionnaire North Carolina and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, SMS, an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Commercial Rental Lease Application Questionnaire North Carolina and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are application taxes in the context of airSlate SignNow?

Application taxes refer to the fees or charges associated with using electronic signature solutions like airSlate SignNow for document management and signing. Utilizing application taxes effectively can enhance your business operations by simplifying compliance and reducing paper-related costs.

-

How does airSlate SignNow handle application taxes during the signing process?

airSlate SignNow streamlines the signing process by ensuring that application taxes are calculated and presented clearly to all signers. This makes it easy for businesses to manage their financial obligations without any confusion or delays.

-

Are there any integration options for tracking application taxes?

Yes, airSlate SignNow offers several integrations with popular accounting and tax software to help you track application taxes efficiently. This integration ensures seamless financial reporting and compliance with tax regulations that's essential for your business.

-

What pricing options are available for businesses using airSlate SignNow for application taxes?

airSlate SignNow provides flexible pricing plans suited for businesses of all sizes looking to manage application taxes conveniently. You can choose from monthly or annual subscriptions, with the option to scale as your business needs grow.

-

Can airSlate SignNow help reduce application taxes for my business?

While airSlate SignNow does not directly reduce application taxes, it helps streamline your document workflows, potentially lowering overall administrative and operational costs. By minimizing paperwork and enhancing efficiency, you can allocate more resources towards tax management.

-

What features of airSlate SignNow are beneficial for application taxes?

Key features of airSlate SignNow that assist with application taxes include customizable templates, automated workflows, and real-time tracking of document status. These features ensure a smooth signing process while maintaining compliance with tax-related requirements.

-

Is airSlate SignNow compliant with application tax regulations?

Absolutely! airSlate SignNow is designed with compliance in mind, adhering to industry standards for electronic signatures. This ensures that your application taxes and related documentation are handled securely and in accordance with legal regulations.

Get more for Commercial Rental Lease Application Questionnaire North Carolina

- Sun financial dental form

- Prescription verification form

- Azdwm online pisr form

- Hh 36 designation of another person to consent for medical care 00040383 6docx nationwidechildrens form

- Form b280

- Form nc 4 web 11 01

- Americans with disabilities act ada accommodation request form date employee information part 1 name work site address position

- Release of claims agreement template form

Find out other Commercial Rental Lease Application Questionnaire North Carolina

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile