North Carolina Widow Form

What is the North Carolina Widow

The North Carolina Widow form is a legal document used primarily in the context of estate management and inheritance. This form is designed for individuals who have lost their spouse and need to address various legal and financial matters that arise as a result of this loss. The form facilitates the transfer of assets, claims, and responsibilities from the deceased spouse to the surviving spouse, ensuring that the widow can manage the estate efficiently and in accordance with state laws.

How to use the North Carolina Widow

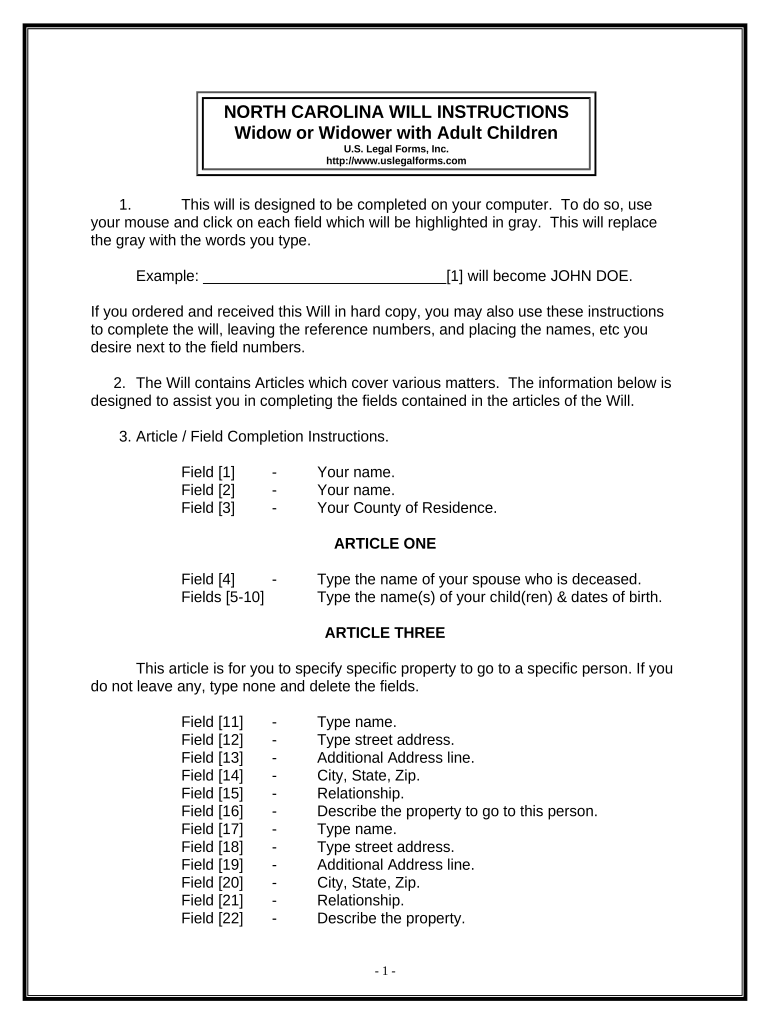

Using the North Carolina Widow form involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant documents, including the death certificate, marriage certificate, and any existing wills or trusts. Next, complete the form by providing personal details, including the deceased spouse's information and the widow's identification. Once completed, the form must be signed and dated by the widow, and may require notarization depending on the specific legal requirements in North Carolina.

Steps to complete the North Carolina Widow

Completing the North Carolina Widow form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as the death certificate and marriage certificate.

- Fill out the form with accurate personal and estate information.

- Review the form for completeness and accuracy.

- Sign and date the form in the designated areas.

- Consider having the form notarized if required by local regulations.

- Submit the completed form to the appropriate court or agency.

Legal use of the North Carolina Widow

The legal use of the North Carolina Widow form is critical for ensuring that the widow's rights are protected under state law. This form serves as a formal declaration of the widow's status and rights to the deceased spouse's estate. It is essential to comply with all legal requirements when using this form, as failure to do so may result in delays or complications in the estate settlement process.

State-specific rules for the North Carolina Widow

North Carolina has specific rules governing the use of the Widow form, which may vary from other states. It is important to be aware of local laws regarding the distribution of assets, inheritance rights, and any applicable deadlines for submitting the form. Understanding these regulations can help ensure that the widow navigates the legal landscape effectively and protects her interests during the estate settlement process.

Eligibility Criteria

To use the North Carolina Widow form, certain eligibility criteria must be met. The individual must be the surviving spouse of the deceased, and the marriage must have been legally recognized in North Carolina. Additionally, the widow must be able to provide necessary documentation, such as the marriage certificate and death certificate, to validate her claim. Meeting these criteria is essential for the successful completion and acceptance of the form.

Quick guide on how to complete north carolina widow

Complete North Carolina Widow effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed materials, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle North Carolina Widow on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and eSign North Carolina Widow seamlessly

- Locate North Carolina Widow and click Get Form to begin.

- Utilize the available tools to fill out your document.

- Emphasize important sections of the documents or obscure confidential information with tools specifically offered by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign North Carolina Widow and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What benefits does airSlate SignNow offer for a North Carolina widow managing documents?

airSlate SignNow provides North Carolina widows with an easy-to-use platform for managing important documents. This service offers features such as secure electronic signatures and document storage, which can be crucial for handling legal and financial matters efficiently. By using airSlate SignNow, North Carolina widows can streamline their administrative tasks, saving time and reducing stress.

-

How much does airSlate SignNow cost for a North Carolina widow?

The pricing for airSlate SignNow is designed to be affordable, making it accessible to North Carolina widows who need effective document management solutions. Plans start at a competitive rate, with flexible options depending on the features required. This ensures that North Carolina widows can find a package that fits their budget while still gaining access to essential tools.

-

What features make airSlate SignNow ideal for North Carolina widows?

airSlate SignNow includes features such as customizable templates, mobile access, and secure cloud storage, making it ideal for North Carolina widows. These features facilitate efficient document handling, allowing users to send, receive, and sign documents from anywhere. Additionally, the intuitive interface ensures that North Carolina widows can easily navigate the platform without prior technical expertise.

-

Can I integrate airSlate SignNow with other tools that a North Carolina widow might use?

Yes, airSlate SignNow offers several integrations that can benefit a North Carolina widow. This includes popular applications like Google Drive, Dropbox, and various CRM systems, which helps streamline workflows. These integrations allow North Carolina widows to centralize their document management and enhance productivity.

-

Is airSlate SignNow secure for North Carolina widows handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security, implementing features such as encryption and compliance with industry standards. For North Carolina widows managing sensitive documents, this means peace of mind knowing that their information is safe and secure. The platform regularly updates its security measures to provide the highest level of protection.

-

How does airSlate SignNow enhance collaboration for a North Carolina widow?

airSlate SignNow enhances collaboration by allowing North Carolina widows to easily share documents for review and signing with family members or legal advisors. The platform provides real-time updates and notifications, ensuring that everyone involved is informed throughout the process. This collaborative feature simplifies communication, making it easier for North Carolina widows to get necessary approvals quickly.

-

What customer support options are available for a North Carolina widow using airSlate SignNow?

airSlate SignNow offers robust customer support options including email, live chat, and an extensive help center. For North Carolina widows navigating the platform, these resources ensure that assistance is readily available whenever needed. The support team is trained to address specific concerns that may arise during document management.

Get more for North Carolina Widow

Find out other North Carolina Widow

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors