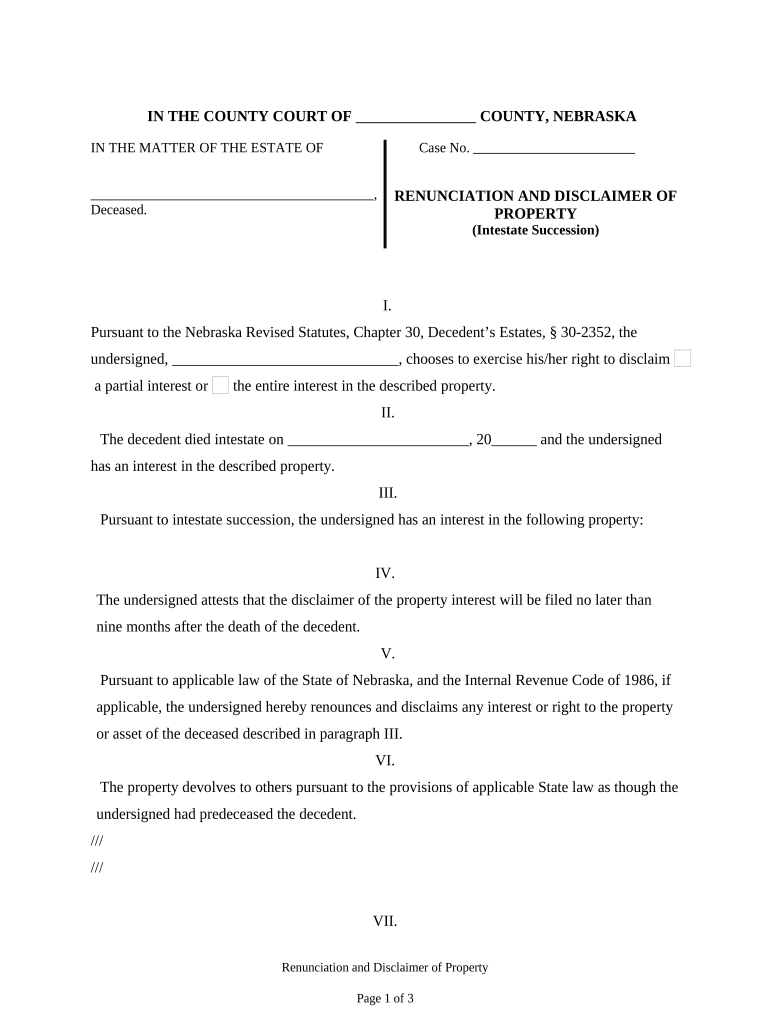

Nebraska Property Form

What is the Nebraska Property

The Nebraska property refers to the legal documentation and processes surrounding the ownership, transfer, and management of real estate within the state of Nebraska. This includes various forms and legal requirements necessary for buying, selling, and inheriting property. Understanding the nuances of Nebraska property law is essential for residents and investors to ensure compliance and protect their rights.

How to use the Nebraska Property

Using the Nebraska property involves understanding the specific forms and procedures required for various transactions. Whether you are buying a home, transferring ownership, or dealing with inheritance, each situation has its own set of requirements. It is advisable to familiarize yourself with the relevant forms, such as the Nebraska property form, and ensure that all necessary information is accurately filled out to avoid delays or legal issues.

Steps to complete the Nebraska Property

Completing the Nebraska property form requires a systematic approach. Start by gathering all necessary documents, including identification, property details, and any relevant financial information. Next, accurately fill out the form, ensuring that all sections are completed. After reviewing for accuracy, submit the form through the appropriate channels, whether online, by mail, or in person. Keeping copies of all submitted documents is also recommended for your records.

Legal use of the Nebraska Property

The legal use of Nebraska property encompasses the rights and responsibilities of property owners under state law. This includes adhering to zoning regulations, property taxes, and any restrictions that may apply to the land. It is crucial for property owners to understand these legalities to avoid potential disputes and ensure compliance with local regulations.

Required Documents

When dealing with Nebraska property, several documents are typically required. These may include proof of identity, property deeds, tax information, and any previous agreements related to the property. Ensuring that all required documents are prepared and submitted correctly can facilitate a smoother transaction process.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Nebraska property form can be done through various methods. Online submission is often the quickest and most efficient option, allowing for immediate processing. Alternatively, forms can be mailed to the relevant office or submitted in person. Each method has its own advantages, and choosing the right one depends on your specific situation and preferences.

Eligibility Criteria

Eligibility criteria for engaging with Nebraska property processes can vary based on the specific transaction type. Generally, individuals must be legal residents of Nebraska or have a legitimate interest in the property. Understanding these criteria is essential to ensure that you meet all necessary requirements before proceeding with any property-related actions.

Quick guide on how to complete nebraska property 497318020

Prepare Nebraska Property easily on any device

Online document management has become widely embraced by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Nebraska Property on any device using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Nebraska Property effortlessly

- Locate Nebraska Property and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as an ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Nebraska Property and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Nebraska property?

airSlate SignNow is a powerful eSignature solution that enables users to send and eSign documents quickly and efficiently. For those dealing with Nebraska property transactions, this tool simplifies the process, ensuring that contracts and agreements are signed promptly. Its user-friendly interface means anyone can manage their real estate documents with ease, making it ideal for Nebraska property professionals.

-

How much does airSlate SignNow cost for Nebraska property transactions?

airSlate SignNow offers several pricing plans to cater to different needs, making it an economical choice for Nebraska property transactions. Depending on the features required, users can select a plan that fits their budget while still accessing essential tools for document management. For those frequently handling Nebraska property agreements, our affordable options ensure that cost is never a barrier.

-

What features does airSlate SignNow offer for Nebraska property management?

airSlate SignNow provides several robust features beneficial for Nebraska property management, including customizable templates, secure cloud storage, and real-time tracking of document statuses. With these tools, property managers can streamline their workflow and ensure that every critical document related to Nebraska property transactions is efficiently handled. The platform prioritizes security, ensuring that all sensitive information is protected.

-

How can airSlate SignNow benefit my Nebraska property business?

Using airSlate SignNow can signNowly enhance your Nebraska property business by accelerating document turnaround times. With electronic signatures, you can close deals faster, allowing for more transactions in a shorter time frame. The platform improves operational efficiency, helping you keep your focus on growing your Nebraska property portfolio.

-

Is airSlate SignNow easy to integrate with other tools for managing Nebraska property?

Yes, airSlate SignNow is designed to easily integrate with a wide variety of tools and software commonly used in managing Nebraska property. This compatibility ensures that you can maintain your existing workflows without disruptions. By integrating airSlate SignNow with your CRM or accounting software, you can manage all aspects of your Nebraska property business more effectively.

-

Can I use airSlate SignNow for residential and commercial Nebraska properties?

Absolutely! airSlate SignNow is suitable for both residential and commercial Nebraska properties. Whether you're sending lease agreements for a residential unit or contracts for a commercial lease, the platform provides the flexibility needed to manage various types of property transactions. Users can customize documents to fit the specific requirements of any Nebraska property transaction.

-

Does airSlate SignNow comply with legal regulations for Nebraska property agreements?

Yes, airSlate SignNow complies with electronic signature laws and regulations, ensuring that all your Nebraska property agreements are legally binding. This compliance offers peace of mind when sending and signing documents digitally. You can rest assured that using airSlate SignNow meets all the legal standards required for property transactions in Nebraska.

Get more for Nebraska Property

- Letter of protection form

- National criminal record check consent form nsw health

- Parent signature form 269908509

- Eta 790 attachments form

- State of louisiana application for boat title form

- New vendor disclosures form c 0576 mass

- Association of realtors residential lease agreement template form

- Automotive lease agreement template form

Find out other Nebraska Property

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors