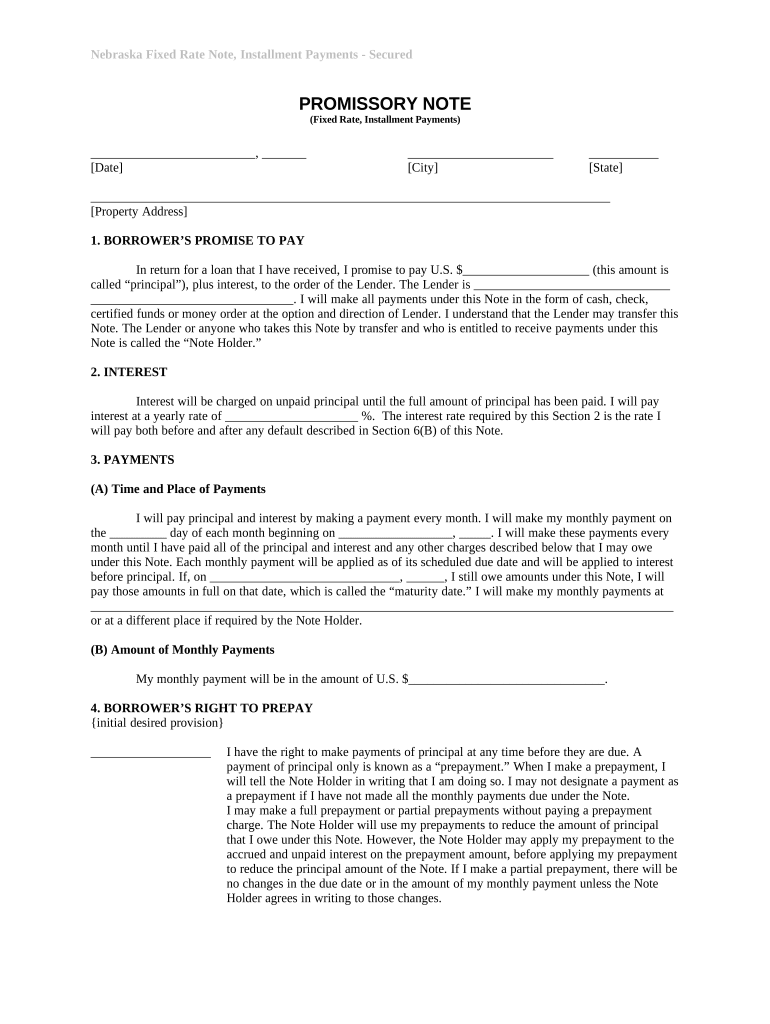

Nebraska Rate Form

What is the Nebraska Rate

The Nebraska rate refers to the specific tax rate applicable to various financial transactions and obligations within the state of Nebraska. This rate can vary depending on the type of tax or fee being assessed, such as income tax, sales tax, or property tax. Understanding the Nebraska rate is crucial for individuals and businesses to ensure compliance with state tax laws and to accurately calculate their financial responsibilities.

How to use the Nebraska Rate

To effectively use the Nebraska rate, individuals and businesses should first identify the specific tax category relevant to their situation. This may involve determining whether they are subject to income tax, sales tax, or any other applicable fees. Once the correct rate is identified, it can be applied to the relevant financial figures to calculate the total tax owed. Utilizing tax software or consulting with a tax professional can help ensure accurate calculations and compliance with Nebraska tax regulations.

Steps to complete the Nebraska Rate

Completing the Nebraska rate involves several key steps:

- Identify the applicable tax category based on your financial activities.

- Determine the current Nebraska rate for that category by consulting state resources or tax professionals.

- Calculate the tax owed by applying the Nebraska rate to the relevant income or sales figures.

- Complete any required forms, ensuring all information is accurate and up to date.

- Submit the completed forms to the appropriate state agency by the designated deadline.

Legal use of the Nebraska Rate

The legal use of the Nebraska rate is governed by state tax laws, which outline the requirements for compliance. It is essential for taxpayers to understand their obligations and the legal implications of failing to adhere to the established rates. This includes ensuring that calculations are accurate and that all forms are submitted on time to avoid penalties or legal repercussions.

Key elements of the Nebraska Rate

Key elements of the Nebraska rate include:

- The specific percentage or amount applicable to different tax categories.

- Any exemptions or deductions that may apply to certain taxpayers.

- The deadlines for filing and payment associated with the Nebraska rate.

- Relevant state statutes that govern the application of the Nebraska rate.

Filing Deadlines / Important Dates

Filing deadlines for the Nebraska rate vary depending on the type of tax being assessed. It is important for taxpayers to be aware of these dates to ensure timely compliance. Generally, income tax returns must be filed by April 15, while sales tax returns may have monthly or quarterly deadlines. Keeping a calendar of important dates can help prevent any late submissions or associated penalties.

Who Issues the Form

The Nebraska rate form is typically issued by the Nebraska Department of Revenue. This state agency is responsible for administering tax laws, collecting taxes, and providing resources to assist taxpayers in understanding their obligations. It is advisable to consult the Department of Revenue's official website or contact them directly for the most current forms and guidance related to the Nebraska rate.

Quick guide on how to complete nebraska rate

Effortlessly Complete Nebraska Rate on Any Device

Managing documents online has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Nebraska Rate on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Nebraska Rate with Ease

- Find Nebraska Rate and click on Get Form to start.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or conceal sensitive details using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds equivalent legal validity to a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Decide how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Adjust and eSign Nebraska Rate to ensure exceptional communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the current Nebraska rate for airSlate SignNow?

The Nebraska rate for airSlate SignNow is competitively priced to provide businesses with a cost-effective solution for electronic signatures. This rate varies slightly depending on the features you choose but is designed to be accessible for organizations of all sizes.

-

How can airSlate SignNow benefit my business in Nebraska?

airSlate SignNow offers several benefits for businesses in Nebraska, including streamlined document management and quick turnaround times for eSigning. By adopting our solution, companies can improve efficiency and reduce paper usage, which aligns with both budget and sustainability goals.

-

Are there any discounts available for Nebraska businesses using airSlate SignNow?

Yes, airSlate SignNow occasionally offers promotional rates specifically for Nebraska businesses. It's advisable to check our website or contact our sales team for current offers that could help reduce your overall Nebraska rate.

-

What features are included in the Nebraska rate for airSlate SignNow?

The Nebraska rate for airSlate SignNow includes features such as document templates, customizable workflows, and real-time tracking of signed documents. These tools are designed to enhance your document handling process and optimize your team's productivity.

-

Can airSlate SignNow integrate with other software I use in Nebraska?

Absolutely! airSlate SignNow supports integrations with various software platforms commonly used in Nebraska, including CRM and project management tools. This flexibility allows businesses to enhance their workflow while keeping the Nebraska rate manageable.

-

Is airSlate SignNow easy to use for first-time users in Nebraska?

Yes, airSlate SignNow is designed with user-friendliness in mind. Many users in Nebraska find that they can quickly adapt to our platform, thanks to its intuitive interface and helpful customer support resources.

-

What are the compliance measures associated with the Nebraska rate of airSlate SignNow?

airSlate SignNow complies with major regulations like ESIGN and UETA, ensuring that electronic signatures are legally binding in Nebraska. We prioritize security and compliance so that businesses can trust our platform for sensitive documents.

Get more for Nebraska Rate

- Direct deposit authorization use credit union form

- Jk international school ranchi form

- Application for re admission miami dade college mdc form

- Eapisfilecom form

- Maine adult education learner intake form maine gov maine

- Kansas independent living self sufficiency matrix form

- Voice over artist contract template form

- Fuel supply contract template form

Find out other Nebraska Rate

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy