Business Credit Application New Hampshire Form

What is the Business Credit Application New Hampshire

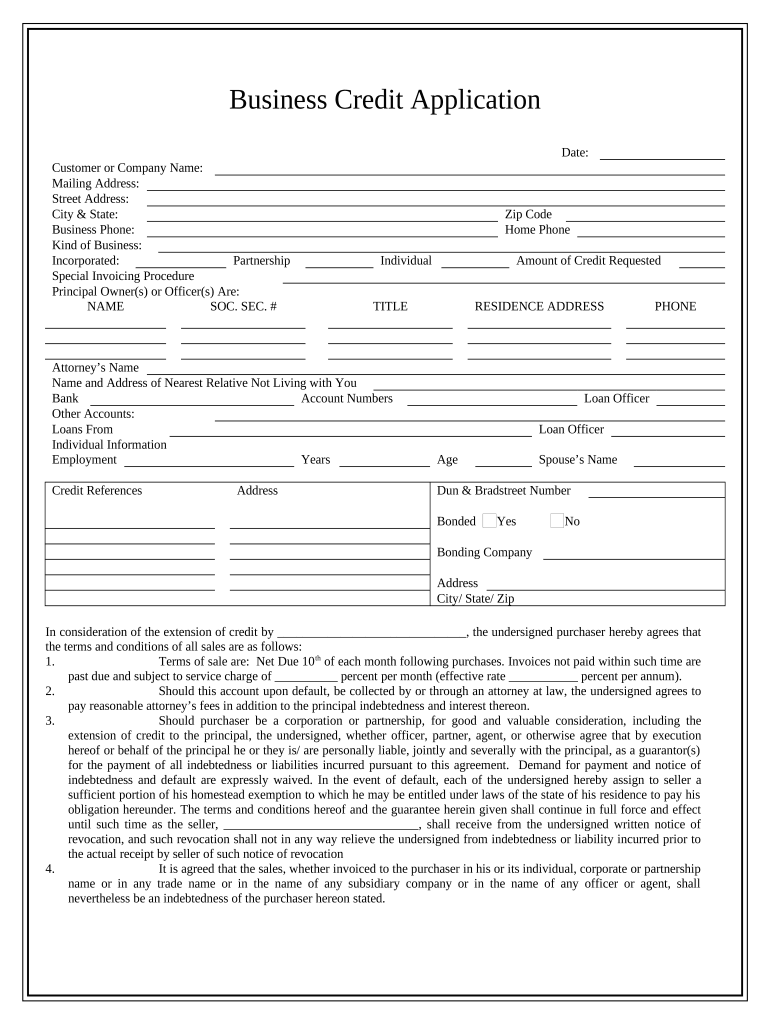

The Business Credit Application New Hampshire is a formal document that businesses in New Hampshire use to apply for credit from lenders or suppliers. This application collects essential information about the business, including its legal structure, financial status, and credit history. By providing this information, businesses can demonstrate their creditworthiness and secure necessary funding or credit lines to support their operations.

Steps to complete the Business Credit Application New Hampshire

Completing the Business Credit Application New Hampshire involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business's legal name, address, and tax identification number. Next, provide details about your business structure, such as whether it is an LLC, corporation, or partnership. Include financial information, such as annual revenue, existing debts, and assets. Finally, review the application for completeness and accuracy before submitting it to the lender or supplier.

Legal use of the Business Credit Application New Hampshire

The Business Credit Application New Hampshire must adhere to specific legal requirements to be considered valid. It should be completed truthfully, as providing false information can lead to legal consequences, including denial of credit or legal action from lenders. Additionally, the application should comply with state and federal regulations regarding privacy and data protection. Using a secure platform for submission, such as signNow, can help ensure that the application is legally binding and protected.

Key elements of the Business Credit Application New Hampshire

Several key elements are essential to include in the Business Credit Application New Hampshire. These elements typically consist of:

- Business Information: Legal name, address, and type of business entity.

- Contact Information: Names and contact details of owners or authorized representatives.

- Financial Information: Annual revenue, existing loans, and assets.

- Credit History: Information about previous credit accounts and payment history.

Eligibility Criteria

To qualify for credit through the Business Credit Application New Hampshire, businesses must meet certain eligibility criteria. Generally, lenders will assess the business's creditworthiness based on factors such as credit score, financial stability, and operational history. New businesses may need to provide additional documentation, such as a business plan or personal guarantees from owners, to demonstrate their ability to repay the credit sought.

Application Process & Approval Time

The application process for the Business Credit Application New Hampshire can vary depending on the lender or supplier. Typically, after submitting the application, it undergoes a review process where the lender evaluates the provided information. Approval times can range from a few hours to several days, depending on the complexity of the application and the lender's internal processes. It is advisable to follow up with the lender if there are delays in receiving a response.

Quick guide on how to complete business credit application new hampshire

Complete Business Credit Application New Hampshire effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly option compared to conventional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your paperwork promptly without any delays. Manage Business Credit Application New Hampshire on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Business Credit Application New Hampshire effortlessly

- Obtain Business Credit Application New Hampshire and then click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize important sections of the documents or conceal sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Business Credit Application New Hampshire and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application New Hampshire and why is it important?

A Business Credit Application New Hampshire is a formal request that businesses use to apply for credit with lenders or suppliers. It is important because it helps establish a business's creditworthiness, allowing them to secure financing and manage cash flow effectively.

-

How does airSlate SignNow streamline the Business Credit Application New Hampshire process?

airSlate SignNow streamlines the Business Credit Application New Hampshire process by enabling businesses to create, send, and eSign applications online. This digital approach reduces paperwork, saves time, and enhances accuracy, ensuring a smoother application experience.

-

What are the costs associated with using airSlate SignNow for a Business Credit Application New Hampshire?

The pricing for using airSlate SignNow for a Business Credit Application New Hampshire is competitive and varies based on the chosen plan. Our cost-effective packages provide flexible options depending on your business size and needs, ensuring accessibility for all budgets.

-

What features does airSlate SignNow offer for Business Credit Application New Hampshire?

airSlate SignNow offers features like templates, customizable workflows, and real-time tracking for Business Credit Application New Hampshire. These tools aid in efficiently managing documents, enhancing collaboration, and ensuring compliance with legal standards.

-

Can airSlate SignNow integrate with other applications for Business Credit Application New Hampshire?

Yes, airSlate SignNow integrates seamlessly with a variety of applications such as CRMs and accounting software. This capability enhances the Business Credit Application New Hampshire process, allowing for seamless data transfer and improved efficiency.

-

What benefits do businesses gain from using airSlate SignNow for their Business Credit Application New Hampshire?

Businesses using airSlate SignNow for their Business Credit Application New Hampshire gain benefits like increased efficiency, reduced errors, and expedited processing times. Additionally, the platform ensures security and compliance, which are essential for sensitive financial transactions.

-

Is airSlate SignNow user-friendly for completing a Business Credit Application New Hampshire?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for businesses of any size to navigate the Business Credit Application New Hampshire process. With an intuitive interface, users can quickly create and manage applications without requiring extensive training.

Get more for Business Credit Application New Hampshire

- Dd 1172 for housing form

- Santa cruz masonic temple foundation sc slv38 org form

- Raffle prize request letter form

- Hqp pff 053 100408326 form

- Centum mortgage application doc www3 telus form

- D20a form 03 request for setting

- Schedule z additional information required for net metering service

- Vr 308 03 04 qxd form

Find out other Business Credit Application New Hampshire

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now