Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children New Hampshire Form

What is the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in New Hampshire

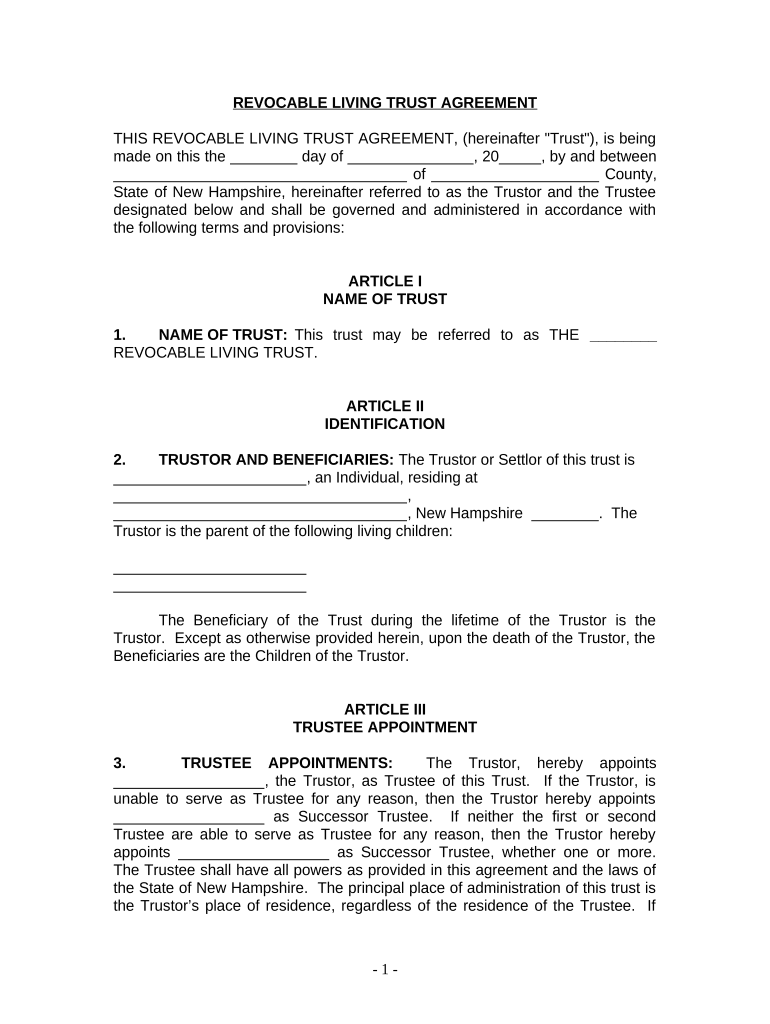

A living trust is a legal document that allows an individual to manage their assets during their lifetime and dictate how those assets will be distributed after their death. For individuals who are single, divorced, or widowed with children in New Hampshire, a living trust can provide significant advantages. It helps avoid probate, ensures privacy regarding asset distribution, and allows for the seamless transfer of assets to beneficiaries. This type of trust is particularly useful for parents, as it can specify how and when children will receive their inheritance, providing peace of mind regarding their financial future.

Steps to Complete the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in New Hampshire

Completing a living trust involves several key steps. First, individuals should gather all relevant information about their assets, including property, bank accounts, and investments. Next, they should decide on the beneficiaries and how the assets will be distributed among them. After that, it is essential to choose a trustee, who will manage the trust. Once these decisions are made, the individual can draft the trust document, ensuring it complies with New Hampshire laws. Finally, the trust should be signed and notarized to make it legally binding.

Legal Use of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in New Hampshire

The legal use of a living trust in New Hampshire is governed by state laws that outline the requirements for creating and executing such a document. A living trust is recognized as a valid legal entity, allowing the trust creator to maintain control over their assets while designating specific instructions for their distribution. It is crucial to ensure that the trust is properly funded by transferring ownership of assets into the trust to avoid potential legal disputes or complications after the individual's passing.

State-Specific Rules for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in New Hampshire

New Hampshire has specific regulations regarding living trusts, including the need for the trust document to be in writing and signed by the trust creator. Additionally, New Hampshire law allows for revocable living trusts, meaning the creator can alter or dissolve the trust at any time while they are alive. It is important to consult with a legal professional familiar with New Hampshire estate laws to ensure compliance and to address any unique circumstances that may affect the trust.

Key Elements of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in New Hampshire

Key elements of a living trust include the trust creator (grantor), the trustee, and the beneficiaries. The trust document should clearly outline the roles and responsibilities of each party. It should also specify the assets included in the trust and detail the distribution plan for those assets upon the creator's death. Additionally, it is beneficial to include provisions for the management of the trust in the event the creator becomes incapacitated, ensuring that their wishes are honored even if they cannot manage the trust themselves.

How to Use the Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children in New Hampshire

Using a living trust involves several practical steps. Once the trust is created, the individual must transfer ownership of their assets into the trust. This process, known as funding the trust, may involve changing titles on property deeds, bank accounts, and investment accounts. After the trust is funded, the trustee will manage the assets according to the terms of the trust. It is essential to keep the trust updated, especially after significant life events such as marriage, divorce, or the birth of a child, to ensure that it reflects the individual's current wishes.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children new hampshire

Finish Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire seamlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-driven task today.

The most efficient way to modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire with ease

- Find Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method to share your form, whether by email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire?

A Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire is a legal arrangement that allows you to manage your assets during your lifetime and specify how they will be distributed after your passing. It helps avoid probate, ensuring your children receive their inheritance smoothly and quickly.

-

How much does it cost to establish a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire?

The cost of establishing a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire can vary based on complexity and the services you choose. Generally, you can expect to invest between $1,000 and $3,000 if you work with an attorney, while online options may be more affordable.

-

What are the main benefits of a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire?

The main benefits of a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire include avoiding probate, maintaining privacy, and having control over your assets during your lifetime. Additionally, it ensures that your children are financially protected according to your wishes.

-

Can a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire be modified?

Yes, a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire is revocable, meaning it can be modified or terminated at any time while you are alive and competent. This flexibility allows you to adapt to changes in your financial situation or family dynamics.

-

What types of assets can be included in a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire?

You can include various types of assets in a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire, such as real estate, bank accounts, investment portfolios, and personal property. It is important to fund your trust properly to ensure it operates effectively.

-

How does airSlate SignNow help with Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire?

airSlate SignNow provides a cost-effective solution that simplifies the signing and management of documents related to your Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire. Our platform allows you to eSign important documents securely and efficiently, streamlining the process.

-

Is a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire necessary if I have a will?

While having a will is important, a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire offers distinct advantages, such as avoiding probate and ensuring the timely distribution of assets. It can complement your will, providing additional protection and clarity for your children's inheritance.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire

- Maricopa county superior court probate forms

- N95 voluntary respirator use form

- Province of nova scotia temporary event food permit application form

- The document you are trying to load requires adobe 628151313 form

- Maintenance work order wo windfield co op windfieldcoop form

- Recognition of previous experience covenant health recognizes previous experience for the purposes of determining employees form

- Eligibility for funding form

- Donation form please fill out your personal inform

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children New Hampshire

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent