New Hampshire Form

What is the New Hampshire Form?

The New Hampshire Form refers to various official documents used for different legal and administrative purposes within the state. These forms may include applications, tax documents, or other official requests that require completion and submission to state agencies. Understanding the specific purpose of each form is crucial for ensuring compliance with state regulations and fulfilling legal obligations.

How to Use the New Hampshire Form

Using the New Hampshire Form involves several steps to ensure proper completion and submission. First, identify the specific form you need based on your requirements. Next, gather all necessary information and documentation required to fill out the form accurately. Once completed, review the form for any errors or omissions before submission. Depending on the form, you may submit it online, by mail, or in person at designated locations.

Steps to Complete the New Hampshire Form

Completing the New Hampshire Form requires careful attention to detail. Follow these steps for successful completion:

- Identify the correct form for your needs.

- Gather all required information and documents.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any mistakes or missing information.

- Submit the form according to the specified submission methods.

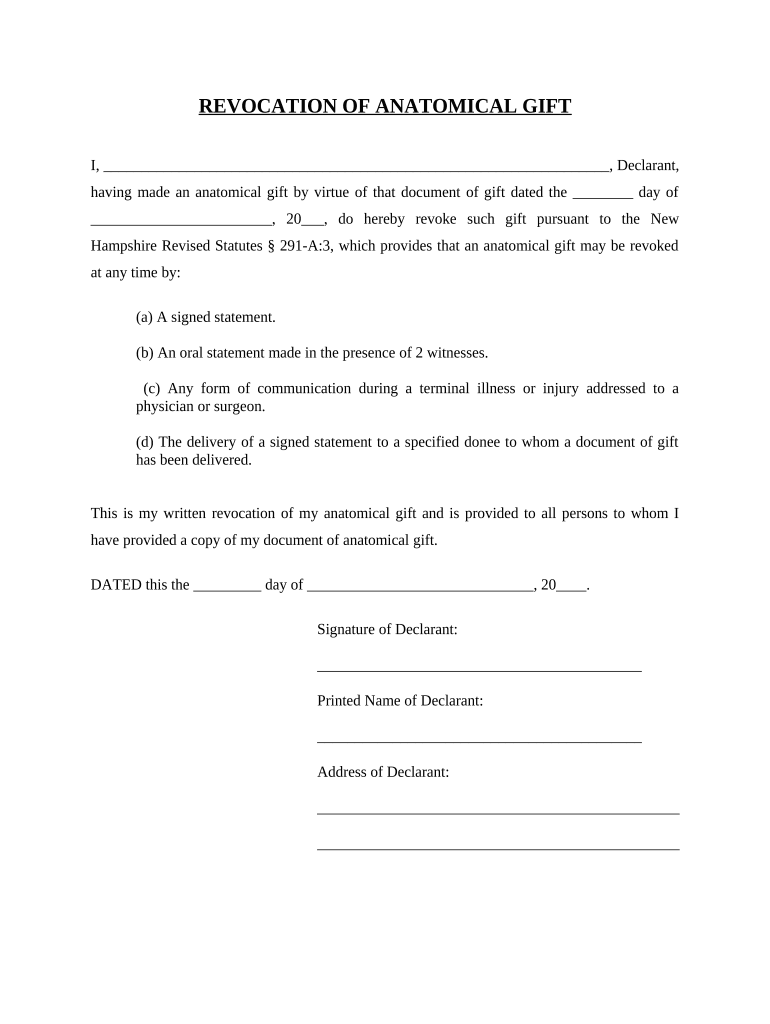

Legal Use of the New Hampshire Form

The legal use of the New Hampshire Form is governed by state laws and regulations. To ensure the form is legally binding, it must be completed in accordance with specific requirements, including proper signatures and any necessary supporting documents. Utilizing a reliable eSignature solution can enhance the legal validity of the form by providing a digital certificate and ensuring compliance with relevant eSignature laws.

Key Elements of the New Hampshire Form

Key elements of the New Hampshire Form typically include:

- Identification of the form type and purpose.

- Personal or business information of the applicant.

- Detailed instructions for completing the form.

- Signature lines for verification and consent.

- Submission guidelines and deadlines.

State-Specific Rules for the New Hampshire Form

Each New Hampshire Form may have state-specific rules that dictate how it should be completed and submitted. These rules can include deadlines for submission, specific formatting requirements, and any necessary accompanying documentation. Familiarizing yourself with these rules is essential to ensure compliance and avoid potential penalties.

Quick guide on how to complete new hampshire form 497318879

Prepare New Hampshire Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the correct template and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle New Hampshire Form on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The easiest way to alter and eSign New Hampshire Form without stress

- Obtain New Hampshire Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the papers or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign New Hampshire Form and ensure optimal communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the new hampshire form feature in airSlate SignNow?

The new hampshire form feature in airSlate SignNow allows users to create, send, and eSign essential documents specific to New Hampshire. This ensures compliance with local regulations while providing a user-friendly interface. With this feature, you can expedite your document workflow efficiently.

-

How does airSlate SignNow help with the management of new hampshire forms?

airSlate SignNow streamlines the management of new hampshire forms by organizing and storing your documents in a secure cloud environment. This means you can easily retrieve and manage all your forms from anywhere at any time. Additionally, our platform supports collaboration and real-time updates for all your team members.

-

What are the pricing options for using airSlate SignNow for new hampshire forms?

airSlate SignNow offers a range of pricing plans to cater to different business needs, including options specifically for new hampshire forms. You can choose a plan that provides all the essential features without compromising on functionality. Visit our pricing page to find the suitable plan that fits your organization’s requirements.

-

Can I customize my new hampshire forms using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your new hampshire forms to meet your business specifications. You can add logos, change fonts, and include specific fields relevant to New Hampshire. This ensures that your documents are tailored to your brand while adhering to local legal requirements.

-

What are the key benefits of using airSlate SignNow for new hampshire forms?

The key benefits of using airSlate SignNow for new hampshire forms include increased efficiency and reduced turnaround time for document processing. You'll also experience enhanced security for sensitive information and improved tracking for completed documents. Overall, this helps streamline your workflow, making it easier to manage important forms.

-

Does airSlate SignNow integrate with other applications for handling new hampshire forms?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage new hampshire forms more effectively. Integrations with tools like CRM systems, cloud storage services, and productivity applications enhance your document management process. This connectivity ensures that data flows smoothly throughout your business.

-

Is there customer support available for new hampshire form inquiries?

Absolutely! airSlate SignNow provides excellent customer support for any inquiries regarding new hampshire forms. Our dedicated support team is available via chat, email, or phone to assist you with any questions or issues you may encounter. We are committed to helping you maximize the benefits of our platform.

Get more for New Hampshire Form

- Integrated dairy services form

- Caregiver name time card in by check mailed by phone form

- 29 4364 form

- Vissit tsbvi form

- Young leaders training course confidential appli form

- Fillable online formulario de inscripcin exhibitors

- Demolition permit city chicago form

- Construction permit application byron il form

Find out other New Hampshire Form

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple