Partial Release of Property from Mortgage by Individual Holder New Hampshire Form

What is the Partial Release Of Property From Mortgage By Individual Holder New Hampshire

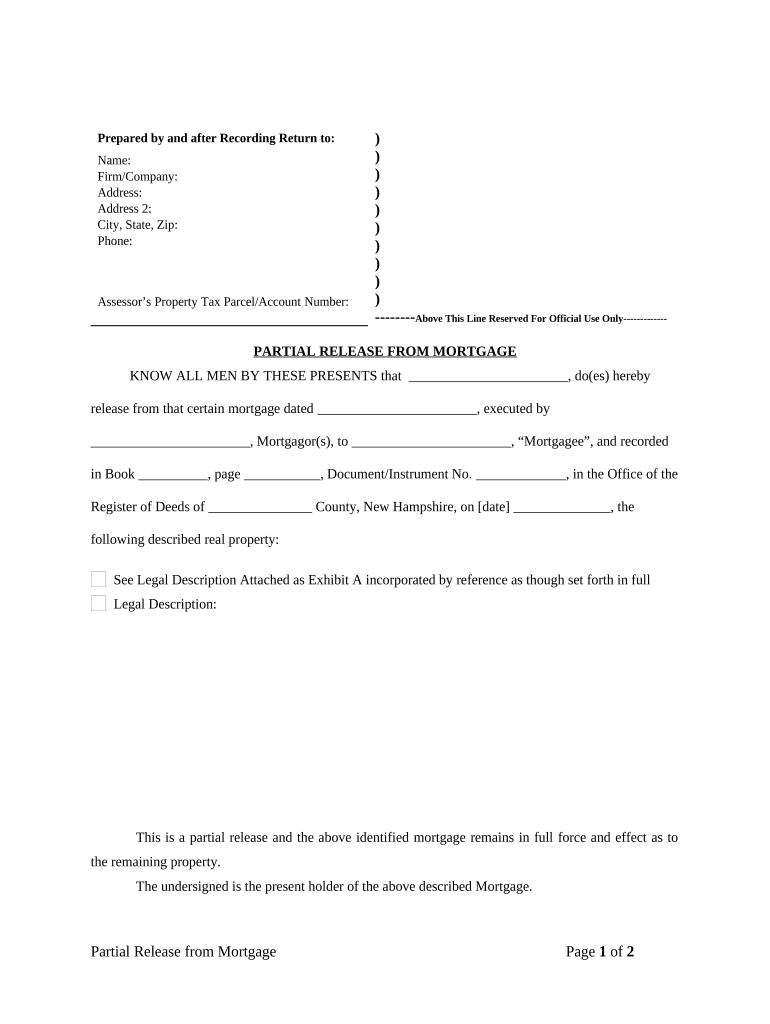

The Partial Release Of Property From Mortgage By Individual Holder in New Hampshire is a legal document that allows a property owner to remove a portion of their property from a mortgage agreement. This process is often necessary when a property is subdivided or when the owner sells a part of the property while retaining ownership of the remaining portion. The release ensures that the lender relinquishes their claim on the specified part of the property, allowing the owner to manage their assets more freely.

How to use the Partial Release Of Property From Mortgage By Individual Holder New Hampshire

Steps to complete the Partial Release Of Property From Mortgage By Individual Holder New Hampshire

Completing the Partial Release Of Property From Mortgage By Individual Holder involves several key steps:

- Gather necessary documents, including the original mortgage agreement and property description.

- Consult with a legal expert to understand the implications of the release.

- Fill out the partial release form, ensuring all details are accurate.

- Obtain signatures from all relevant parties, including the lender.

- Submit the completed form to the appropriate local government office for recording.

Legal use of the Partial Release Of Property From Mortgage By Individual Holder New Hampshire

The legal use of the Partial Release Of Property From Mortgage By Individual Holder in New Hampshire is governed by state laws that outline the requirements for a valid release. This includes ensuring that the document is signed by all necessary parties and properly recorded with the local registry of deeds. The release must also comply with federal and state regulations regarding mortgage agreements to be enforceable.

Key elements of the Partial Release Of Property From Mortgage By Individual Holder New Hampshire

Key elements of the Partial Release Of Property From Mortgage By Individual Holder include:

- The legal description of the property being released.

- The names and signatures of all parties involved, including the lender.

- The date of the agreement.

- A statement indicating the specific portion of the property being released from the mortgage.

State-specific rules for the Partial Release Of Property From Mortgage By Individual Holder New Hampshire

In New Hampshire, specific rules govern the Partial Release Of Property From Mortgage By Individual Holder. These rules include requirements for notarization, the need for the document to be recorded with the local registry of deeds, and adherence to state laws regarding property transfers. It is crucial for property owners to be aware of these regulations to ensure the validity of the release.

Quick guide on how to complete partial release of property from mortgage by individual holder new hampshire

Complete Partial Release Of Property From Mortgage By Individual Holder New Hampshire effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for standard printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Handle Partial Release Of Property From Mortgage By Individual Holder New Hampshire on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Partial Release Of Property From Mortgage By Individual Holder New Hampshire without breaking a sweat

- Obtain Partial Release Of Property From Mortgage By Individual Holder New Hampshire and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Partial Release Of Property From Mortgage By Individual Holder New Hampshire and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Partial Release Of Property From Mortgage By Individual Holder New Hampshire?

A Partial Release Of Property From Mortgage By Individual Holder New Hampshire allows homeowners to remove specific portions of their mortgaged property from the mortgage obligation. This process is crucial when you want to sell a portion of your property or refinance a specific lot. It’s important to ensure all required documents are properly prepared to facilitate this release.

-

How can airSlate SignNow assist with the Partial Release Of Property From Mortgage By Individual Holder New Hampshire?

airSlate SignNow simplifies the process of handling a Partial Release Of Property From Mortgage By Individual Holder New Hampshire by providing easy-to-use eSigning features. With our platform, you can quickly prepare, send, and sign relevant documents online, ensuring a hassle-free experience. This streamlines your workflow and speeds up the overall process.

-

Are there specific fees associated with the Partial Release Of Property From Mortgage By Individual Holder New Hampshire?

Fees for a Partial Release Of Property From Mortgage By Individual Holder New Hampshire typically vary based on lenders or county regulations. It is essential to check with your mortgage holder or local authorities for any applicable recording fees and legal costs. Utilizing airSlate SignNow can minimize paperwork and processing time, potentially lowering overall costs.

-

What features does airSlate SignNow offer for managing mortgage releases?

airSlate SignNow provides several features beneficial for managing a Partial Release Of Property From Mortgage By Individual Holder New Hampshire. These include customizable templates, automated workflows, document tracking, and secure storage. Our platform is designed to enhance efficiency, ensuring documents are signed quickly and securely.

-

Is airSlate SignNow compliant with legal requirements for mortgage documents in New Hampshire?

Yes, airSlate SignNow is fully compliant with legal requirements for handling mortgage documents, including the Partial Release Of Property From Mortgage By Individual Holder New Hampshire. All documents processed through our platform meet federal and state eSign laws, ensuring that your document's legal integrity remains intact during the signing process.

-

Can I integrate other tools with airSlate SignNow for a more streamlined mortgage process?

Absolutely! airSlate SignNow offers integration options with various tools and software to enhance the process of managing a Partial Release Of Property From Mortgage By Individual Holder New Hampshire. This functionality allows you to connect with CRM systems, document management software, and other applications to create a seamless workflow that fits your business needs.

-

What are the benefits of using airSlate SignNow for my mortgage release documents?

Using airSlate SignNow for your Partial Release Of Property From Mortgage By Individual Holder New Hampshire provides numerous benefits, including efficiency, security, and cost savings. Our platform enables speedier document signings, reducing turnaround time and minimizing logistical hassles. Additionally, you benefit from a user-friendly interface, ideal for both individuals and organizations alike.

Get more for Partial Release Of Property From Mortgage By Individual Holder New Hampshire

- Bupa claim form pdf

- Autocertificazione di residenza form

- Basics of paint technology part 1 pdf download form

- Advicare prior authorization form advicare health

- Affidavit for military exemption from excise tax form

- Custom feeding cattle contract form

- Marriage contract template form

- Marriage pact contract template form

Find out other Partial Release Of Property From Mortgage By Individual Holder New Hampshire

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now