New Hampshire Form

What is the New Hampshire Form

The New Hampshire civil union form is a legal document used to establish a civil union between two individuals in the state of New Hampshire. This form is essential for couples seeking to formalize their relationship and gain legal recognition. Civil unions in New Hampshire provide many of the same rights and responsibilities as marriage, allowing couples to enjoy legal protections in areas such as healthcare, inheritance, and taxation.

How to use the New Hampshire Form

To effectively use the New Hampshire civil union form, individuals must first ensure they meet the eligibility criteria. Once eligibility is confirmed, the form must be completed accurately, providing all required information. After filling out the form, it must be submitted to the appropriate state authority, typically the town or city clerk's office, for processing. It is important to retain a copy of the completed form for personal records.

Steps to complete the New Hampshire Form

Completing the New Hampshire civil union form involves several key steps:

- Gather necessary information: Collect personal details such as names, addresses, and identification numbers.

- Fill out the form: Carefully complete the form, ensuring all sections are filled out accurately.

- Review for accuracy: Double-check all information to prevent errors that could delay processing.

- Submit the form: Deliver the completed form to the local town or city clerk's office, either in person or by mail.

Legal use of the New Hampshire Form

The New Hampshire civil union form serves a critical legal purpose. Once filed and approved, it grants couples the same legal rights as married couples under state law. This includes rights related to property ownership, medical decisions, and tax benefits. Understanding the legal implications of the civil union is essential for couples to navigate their rights and responsibilities effectively.

State-specific rules for the New Hampshire Form

New Hampshire has specific regulations governing civil unions. Couples must be at least 18 years old and not currently married or in another civil union. Additionally, both partners must be present when submitting the form. It is important to familiarize oneself with these state-specific rules to ensure compliance and avoid any potential legal issues.

Required Documents

When completing the New Hampshire civil union form, certain documents are typically required. These may include:

- Valid identification (such as a driver's license or passport)

- Proof of residency in New Hampshire

- Any previous marriage dissolution documents, if applicable

Having these documents ready can streamline the application process and help ensure that the form is processed without delays.

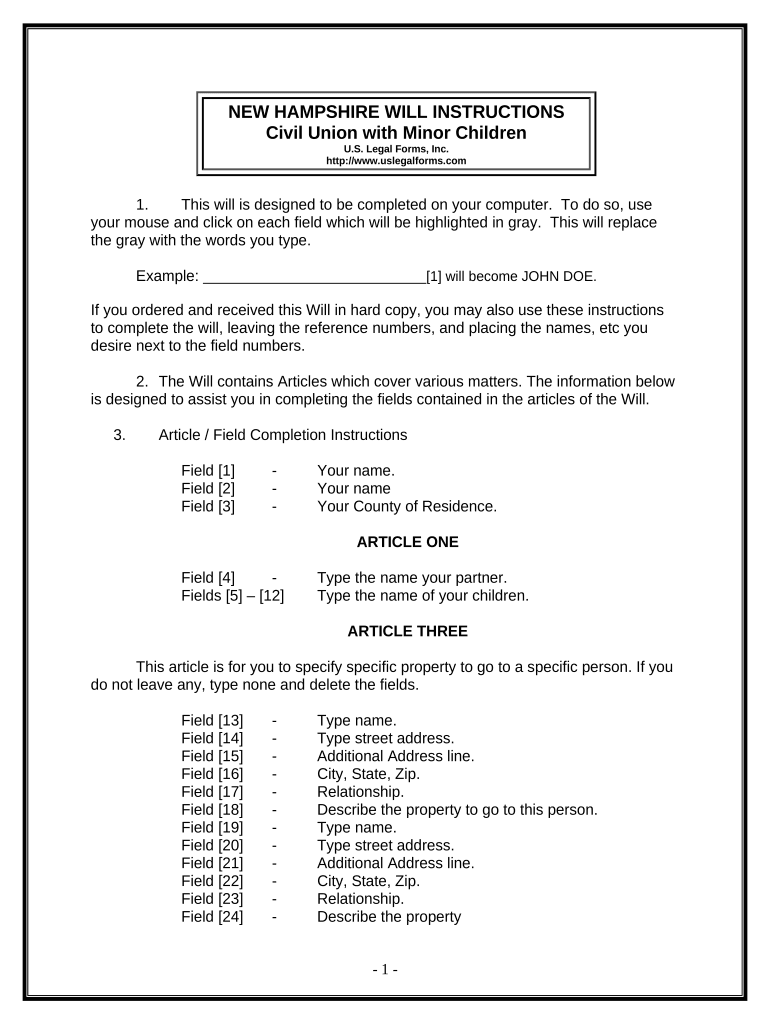

Quick guide on how to complete new hampshire form 497318993

Complete New Hampshire Form with ease on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as it allows you to find the appropriate form and securely store it online. airSlate SignNow supplies all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage New Hampshire Form on any platform using airSlate SignNow’s Android or iOS applications and streamline your document-related processes today.

The simplest way to edit and eSign New Hampshire Form effortlessly

- Find New Hampshire Form and click Get Form to begin.

- Use our provided tools to fill out your form.

- Emphasize important sections of your documents or obscure confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign New Hampshire Form and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an NH civil union, and how does it differ from marriage?

An NH civil union is a legal relationship established in New Hampshire that provides many of the same rights and responsibilities as marriage, but is distinct from it. For same-sex couples or those who prefer a civil union, it can be a meaningful alternative to traditional marriage, ensuring legal recognition and protection.

-

How can airSlate SignNow simplify the process of creating an NH civil union?

airSlate SignNow streamlines the paperwork involved in establishing an NH civil union by allowing couples to easily eSign necessary documents online. Our easy-to-use platform ensures you can focus on what matters most, while we take care of the required documentation.

-

What are the costs associated with using airSlate SignNow for NH civil union paperwork?

airSlate SignNow offers cost-effective pricing plans tailored to fit various needs, starting with affordable monthly subscriptions. Investing in our services can save you time and ensure that your NH civil union documents are handled professionally and efficiently.

-

Are there any specific features of airSlate SignNow that cater to NH civil unions?

Yes, airSlate SignNow includes features specifically designed to facilitate NH civil unions, such as customizable templates for documents and integrations with various applications. These features enhance the user experience, making it easier to complete the civil union process.

-

Can I use airSlate SignNow on any device for managing my NH civil union documents?

Absolutely! airSlate SignNow is accessible on any device, including smartphones, tablets, and desktops. This flexibility allows you to manage and eSign your NH civil union documents wherever you are, making the process convenient and efficient.

-

What benefits does airSlate SignNow offer for NH civil unions compared to traditional methods?

airSlate SignNow provides numerous benefits over traditional methods, such as faster processing times and reduced paper usage. With our platform, you can complete your NH civil union documentation quickly and securely, freeing you from the hassles of in-person meetings and mailing paper forms.

-

Is it secure to use airSlate SignNow for NH civil union paperwork?

Yes, security is a top priority for airSlate SignNow. Our platform employs advanced encryption and security protocols to ensure that your NH civil union documents are protected throughout the entire signing and storage process.

Get more for New Hampshire Form

Find out other New Hampshire Form

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation