New Jersey Partner Form

What is the New Jersey Partner

The New Jersey Partner form is a crucial document for entities operating as partnerships within the state. This form is used to report income, deductions, and other pertinent information to the New Jersey Division of Taxation. It is essential for ensuring compliance with state tax laws and facilitating proper tax assessments. Partnerships must accurately complete this form to reflect their financial activities and obligations in New Jersey.

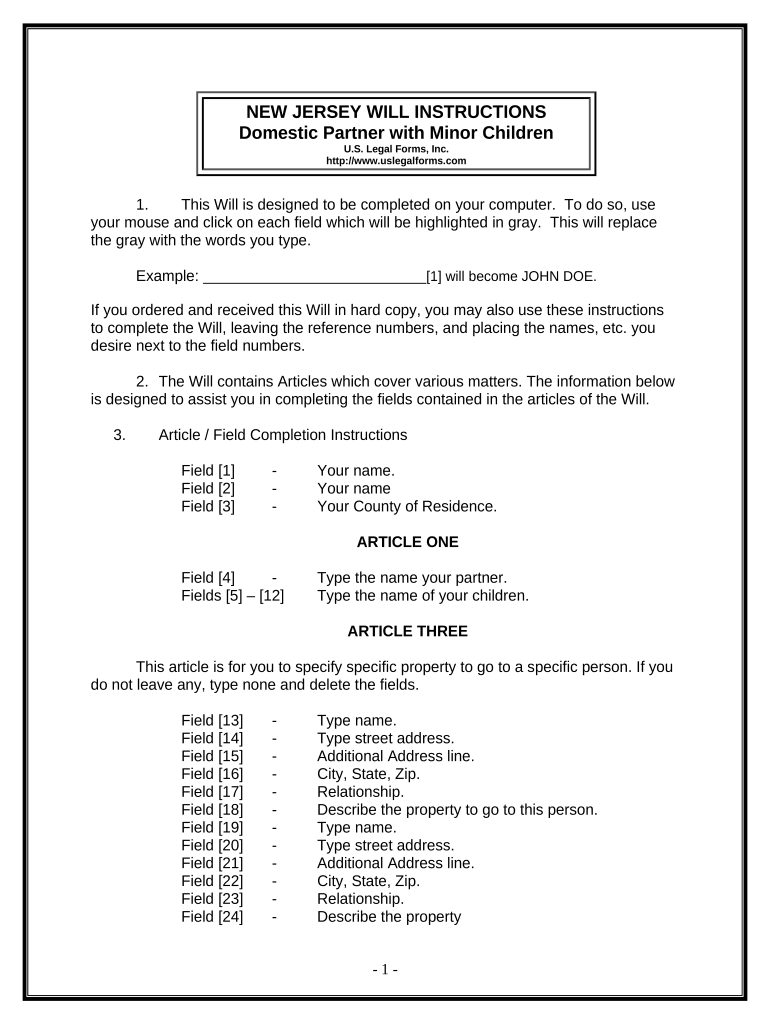

How to use the New Jersey Partner

Using the New Jersey Partner form involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with precise information regarding the partnership's financial activities. It is important to ensure that all partners' details are correctly included, as this information is vital for tax calculations. Once completed, the form must be submitted to the appropriate tax authority, either electronically or by mail.

Steps to complete the New Jersey Partner

Completing the New Jersey Partner form requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents, including income and expense reports.

- Access the New Jersey Partner form from the official state website or authorized sources.

- Fill in the partnership's name, address, and tax identification number.

- Report all sources of income and applicable deductions accurately.

- Ensure all partners are listed with their respective shares of income and deductions.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline through the chosen method.

Legal use of the New Jersey Partner

The legal use of the New Jersey Partner form is governed by state tax laws. It is essential for partnerships to file this form to remain compliant with New Jersey tax regulations. Failure to submit the form accurately and on time can lead to penalties and interest charges. The form serves as an official record of the partnership's financial activities, which may be reviewed by tax authorities during audits.

State-specific rules for the New Jersey Partner

New Jersey has specific rules that govern the use of the New Jersey Partner form. These include:

- Partnerships must file the form annually, regardless of income levels.

- All partners must be reported, including their share of income and deductions.

- Partnerships are required to maintain accurate records to support the information reported on the form.

- Compliance with both state and federal tax regulations is mandatory.

Required Documents

To complete the New Jersey Partner form, several documents are required. These include:

- Partnership agreement outlining the roles and responsibilities of each partner.

- Financial statements detailing income and expenses for the reporting period.

- Tax identification numbers for both the partnership and individual partners.

- Any supporting documentation for deductions claimed on the form.

Quick guide on how to complete new jersey partner 497319728

Effortlessly Prepare New Jersey Partner on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle New Jersey Partner on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign New Jersey Partner with Ease

- Find New Jersey Partner and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize key sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method of sending the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign New Jersey Partner to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit my business as a New Jersey partner?

airSlate SignNow is a powerful tool that enables businesses to send and eSign documents seamlessly. As a New Jersey partner, you can streamline your document workflows, enhance collaboration, and reduce turnaround time on contracts and agreements, making it easier to manage your operations.

-

What pricing plans does airSlate SignNow offer for New Jersey partners?

airSlate SignNow provides flexible pricing plans to suit the needs of New Jersey partners, including options for small businesses and larger enterprises. You can choose from monthly or annual subscriptions, with features that scale with your business requirements, ensuring you only pay for what you need.

-

Does airSlate SignNow offer any integrations that are beneficial for New Jersey partners?

Yes, airSlate SignNow integrates with a variety of popular applications that can enhance your workflow. New Jersey partners can connect with CRM systems, cloud storage, and productivity tools, allowing for a seamless transition of documents and data across platforms.

-

How secure is airSlate SignNow for New Jersey partners handling sensitive documents?

Security is a top priority at airSlate SignNow, especially for New Jersey partners who may handle sensitive information. The platform employs bank-level encryption, advanced authentication methods, and compliance with industry regulations to ensure your documents are protected.

-

What features make airSlate SignNow stand out for New Jersey partners?

airSlate SignNow offers a range of features designed to improve efficiency for New Jersey partners. With customizable templates, in-person signing, and mobile support, the platform allows you to streamline your eSigning process and enhance the overall customer experience.

-

Can New Jersey partners customize their documents using airSlate SignNow?

Absolutely! New Jersey partners can easily customize their documents using airSlate SignNow's user-friendly interface. You can create templates, add branding, and incorporate interactive fields to collect information from signers, making each document unique to your business needs.

-

Is customer support available for New Jersey partners using airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support to assist New Jersey partners. Whether you have questions about features, integration, or billing, you can signNow out to our support team via chat, email, or phone for timely assistance.

Get more for New Jersey Partner

Find out other New Jersey Partner

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form