New Jersey Partner Form

What is the New Jersey Partner?

The New Jersey Partner form is a crucial document used for various legal and tax purposes within the state. It primarily serves as a declaration of partnership for businesses operating in New Jersey. This form outlines the partnership's structure, responsibilities, and the distribution of profits and losses among partners. Understanding the specifics of this form is essential for compliance with state regulations and for ensuring that all partners are on the same page regarding their roles and obligations.

How to Use the New Jersey Partner

Using the New Jersey Partner form involves several steps to ensure accuracy and compliance. First, gather all necessary information about the partnership, including the names and addresses of all partners, the nature of the business, and the partnership's tax identification number. Next, fill out the form carefully, ensuring that all details are correct. Once completed, the form must be submitted to the appropriate state agency, which may vary depending on the type of partnership. It is advisable to keep a copy for your records and provide copies to all partners involved.

Steps to Complete the New Jersey Partner

Completing the New Jersey Partner form requires attention to detail. Follow these steps:

- Gather all relevant information about the partnership and its partners.

- Access the New Jersey Partner form through the state’s official website or authorized sources.

- Fill in the required fields, including partner names, addresses, and business details.

- Review the completed form for accuracy and completeness.

- Submit the form online, by mail, or in person, depending on the submission guidelines.

Legal Use of the New Jersey Partner

The legal use of the New Jersey Partner form is vital for establishing a formal partnership. This form ensures that the partnership is recognized by the state and complies with local laws. It also protects the rights of all partners by clearly defining their roles and responsibilities. In legal disputes, having a properly filled and submitted New Jersey Partner form can serve as evidence of the partnership agreement, making it an essential document for any business operating in New Jersey.

Key Elements of the New Jersey Partner

Several key elements must be included in the New Jersey Partner form to ensure its validity. These elements typically include:

- Names and addresses of all partners.

- The partnership's tax identification number.

- A description of the business activities.

- Details regarding profit and loss distribution among partners.

- Signatures of all partners, indicating their agreement to the terms outlined.

State-Specific Rules for the New Jersey Partner

New Jersey has specific rules governing the use of the Partner form. These rules dictate how partnerships must be structured and what information must be disclosed. It is essential for partners to familiarize themselves with these regulations to ensure compliance. Failure to adhere to state-specific rules can lead to penalties or complications in legal matters. Consulting with a legal professional familiar with New Jersey partnership laws can provide clarity and guidance.

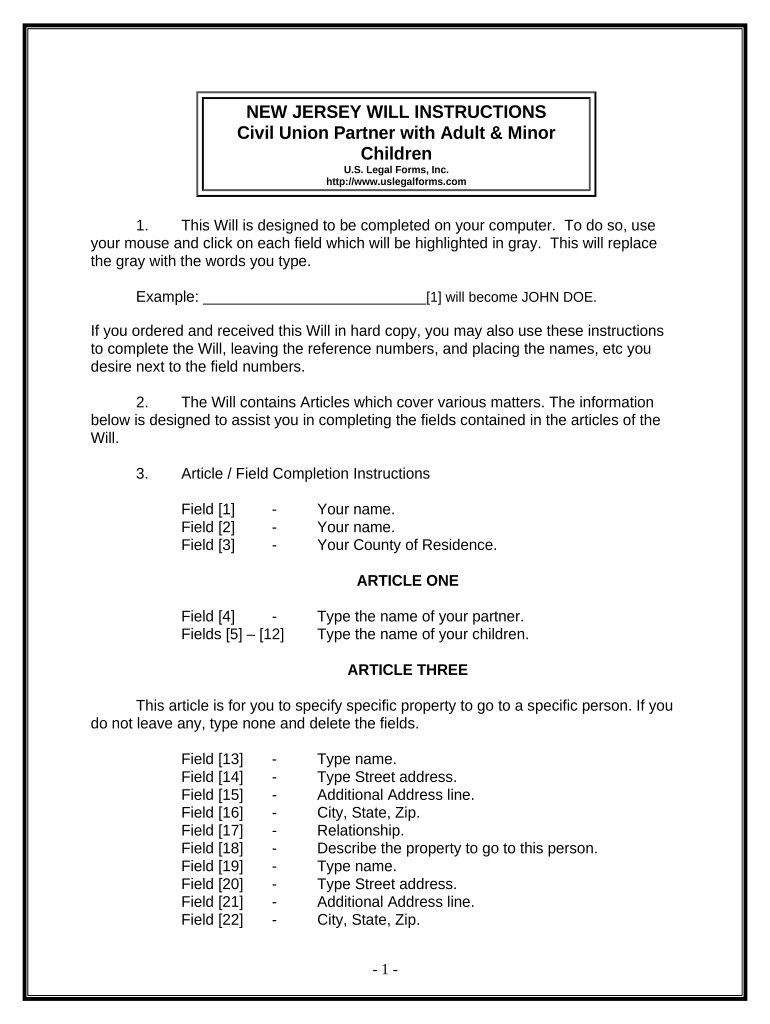

Quick guide on how to complete new jersey partner 497319736

Effortlessly Prepare New Jersey Partner on Any Device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct template and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage New Jersey Partner on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign New Jersey Partner without Stress

- Locate New Jersey Partner and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign New Jersey Partner and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the pricing options for a New Jersey partner using airSlate SignNow?

As a New Jersey partner, you can choose from several pricing plans tailored to fit your business needs. Our options range from individual to enterprise solutions, providing flexibility as you grow. Each plan includes access to our robust eSigning features and integrations, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer for New Jersey partners?

airSlate SignNow provides New Jersey partners with a comprehensive set of features designed to streamline document management. This includes eSigning, customizable templates, advanced workflows, and real-time tracking. By leveraging these features, New Jersey partners can enhance productivity and improve client satisfaction.

-

How can a New Jersey partner benefit from using airSlate SignNow?

A New Jersey partner can signNowly benefit from airSlate SignNow by simplifying the document signing process, thereby saving time and reducing costs. Our platform enables teams to collaborate seamlessly and manage documents from anywhere, making it an ideal solution for busy professionals. This flexibility empowers New Jersey partners to stay competitive and meet client demands efficiently.

-

Is airSlate SignNow compliant with New Jersey regulations?

Yes, airSlate SignNow is compliant with applicable New Jersey regulations, ensuring that all electronic signatures are legally binding. Our platform adheres to industry standards, providing peace of mind for New Jersey partners who rely on secure and compliant document handling. We prioritize security, allowing you to focus on your business without concern.

-

What integrations are available for New Jersey partners with airSlate SignNow?

New Jersey partners can take advantage of various integrations that enhance the functionality of airSlate SignNow. Our platform seamlessly connects with popular tools like Salesforce, Google Drive, and Dropbox, allowing for efficient workflow automation. This means New Jersey partners can streamline their operations and improve collaboration across their teams.

-

Can New Jersey partners customize their templates in airSlate SignNow?

Absolutely! New Jersey partners can easily customize templates in airSlate SignNow to meet their specific needs. This flexibility allows for the creation of tailored documents that reflect your brand and streamline the signing process. Customization helps ensure that all signed documents align with your company's guidelines.

-

How does airSlate SignNow improve the signing process for New Jersey partners?

airSlate SignNow signNowly enhances the signing process for New Jersey partners by providing a user-friendly interface and efficient document handling. With features like mobile eSigning and automated reminders, your clients receive a seamless experience. By reducing turnaround times, New Jersey partners can close deals faster and improve overall satisfaction.

Get more for New Jersey Partner

Find out other New Jersey Partner

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF