Tod Form

What is the Tod Form

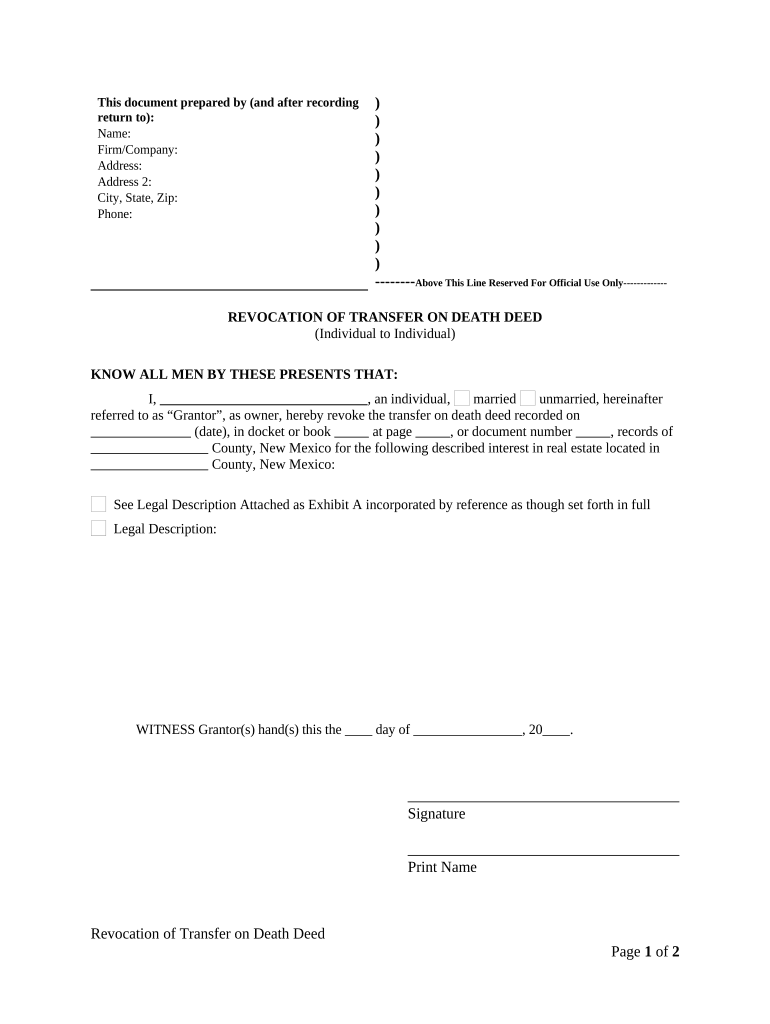

The Tod form, also known as the Transfer on Death form, is a legal document that allows an individual to designate beneficiaries for their assets upon their death. This form is particularly useful for transferring real estate, bank accounts, and other properties without the need for probate. By completing a Tod form, the owner can ensure a smooth transition of ownership, allowing beneficiaries to claim assets directly after the owner's passing.

How to use the Tod Form

Using the Tod form involves several straightforward steps. First, the owner must obtain the form, which can typically be found through state-specific resources or legal websites. Next, the owner fills out the form by providing essential details such as their name, the names of the beneficiaries, and a description of the assets being transferred. After completing the form, it must be signed and dated in the presence of a notary public to ensure its validity. Finally, the completed form should be filed with the appropriate county office to make the transfer official.

Steps to complete the Tod Form

Completing the Tod form requires careful attention to detail. Here are the steps to follow:

- Obtain the Tod form from a reliable source.

- Fill in your full name and address at the top of the form.

- List the beneficiaries by providing their names and addresses.

- Clearly describe the assets you wish to transfer, including any relevant identification numbers.

- Sign and date the form in front of a notary public.

- File the completed form with your local county recorder’s office.

Legal use of the Tod Form

The Tod form is recognized under U.S. law as a valid means to transfer assets upon death, provided it meets specific legal requirements. To be legally binding, the form must be properly executed, which includes being signed by the owner and notarized. Additionally, the form must comply with state laws regarding beneficiary designations and asset transfers. Understanding these legal aspects is crucial to ensure that the transfer is honored and that beneficiaries can claim their inheritance without complications.

State-specific rules for the Tod Form

Each state in the U.S. may have its own regulations regarding the Tod form. Some states may require additional information or have specific guidelines on how the form should be completed and filed. It is essential for individuals to check their state's requirements to ensure compliance. For example, certain states might mandate that the Tod form be recorded with the county clerk, while others may have different filing procedures or deadlines.

Key elements of the Tod Form

The Tod form includes several critical elements that must be accurately filled out to ensure its effectiveness. These elements typically include:

- The full name and address of the asset owner.

- The names and addresses of all designated beneficiaries.

- A detailed description of the assets being transferred.

- The signature of the owner, along with the date of signing.

- A notary public's signature and seal to validate the form.

Examples of using the Tod Form

There are various scenarios in which individuals might use the Tod form. For instance, a homeowner may wish to transfer their property to their children without going through probate. By completing the Tod form, they can ensure that their children automatically inherit the property upon their death. Similarly, a person with a bank account may use the form to designate a beneficiary, allowing that individual to access the funds directly after the account holder's passing. These examples illustrate the practical applications of the Tod form in estate planning.

Quick guide on how to complete tod form

Complete Tod Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Tod Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Tod Form effortlessly

- Locate Tod Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs within just a few clicks from any device you choose. Edit and eSign Tod Form and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a tod form and how does it work?

A tod form is a document designed for quick electronic signatures, streamlining the signing process for businesses. With airSlate SignNow, you can easily create, send, and manage tod forms for efficient document workflows. This ensures that your business can handle contracts, agreements, and various forms with minimal hassle.

-

How do I create a tod form using airSlate SignNow?

Creating a tod form with airSlate SignNow is simple and user-friendly. Just upload your document, customize the fields for signatures and information, and you're ready to send it out for signing. Our intuitive platform guides you through the process, ensuring your tod form meets your specific needs.

-

What are the key features of the tod form in airSlate SignNow?

The tod form in airSlate SignNow offers features like ease of use, customizable templates, real-time tracking, and secure storage. You can also integrate it with various applications to enhance functionality. These features are designed to improve workflow efficiency and provide better document management.

-

Is there a free trial available for the tod form?

Yes, airSlate SignNow offers a free trial that allows you to explore the functionalities of the tod form and other features. This is a great way to assess how the platform can meet your business needs before committing to a paid plan. Sign up today to get started without any financial risk.

-

How does the pricing for the tod form compare to other eSignature solutions?

airSlate SignNow offers competitive pricing for its tod form and eSignature services, making it a cost-effective solution for businesses of all sizes. Our flexible plans cater to different user needs without compromising on quality or features. You can easily find a plan that fits your budget and signing requirements.

-

Can I integrate the tod form with other software applications?

Absolutely! The tod form in airSlate SignNow can be integrated with a variety of third-party applications like CRM systems, payment processors, and document management tools. This capability enhances your workflow and allows for seamless data transfer between platforms, improving productivity.

-

Are the signatures on the tod form legally binding?

Yes, signatures obtained through the tod form in airSlate SignNow are legally binding and compliant with regulations such as the ESIGN Act and UETA. Our platform ensures that your documents are securely signed and stored, providing legal protection for your agreements. Trust airSlate SignNow to handle all your eSignature needs with confidence.

Get more for Tod Form

- Pediatric patient information the ultrawellness center of mark

- County disposition personal property form

- Interactive notice of appearance collier county clerk of the circuit form

- Orange county jail booking report 580304807 form

- Family law retainer agreement stilianopoulos law firm pa orlandolegal form

- Domestic support obligation worksheet as the chapter 7 dadelegalaid form

- Affidavit for stop payment request affidavit for stop payment request form

- Office of the state attorney larry basford 14th judicial circuit of florida form

Find out other Tod Form

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter