Complex Will with Credit Shelter Marital Trust for Large Estates New Mexico Form

Understanding the Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico

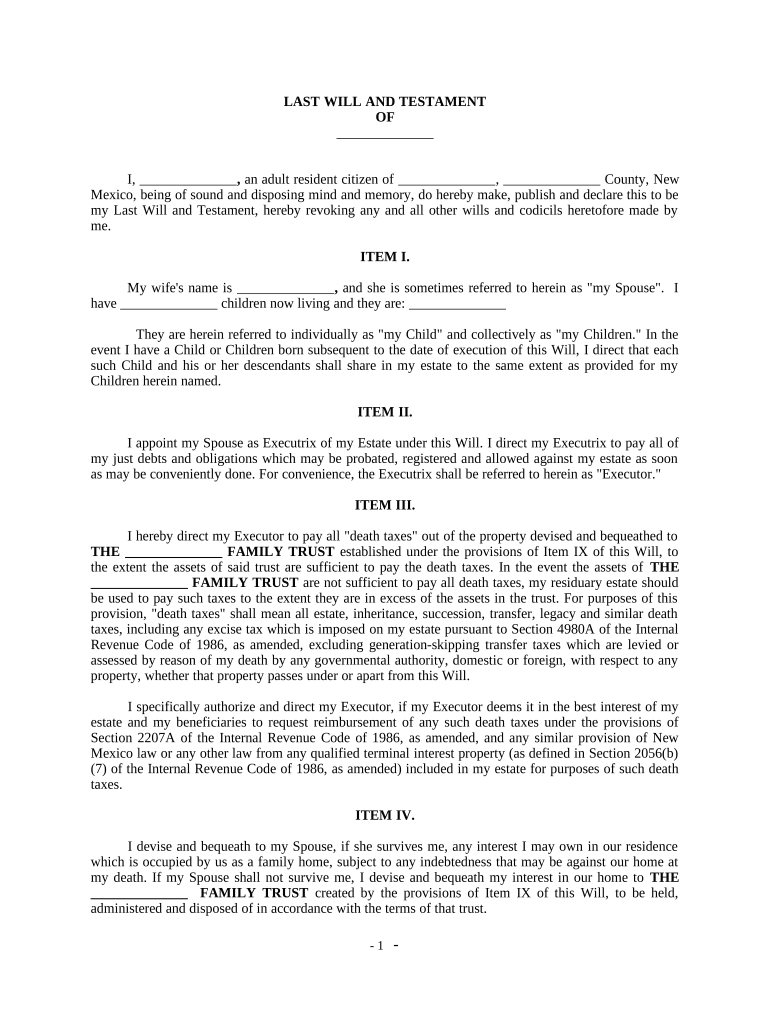

The Complex Will With Credit Shelter Marital Trust for Large Estates in New Mexico is a sophisticated estate planning tool designed to minimize estate taxes and ensure the efficient transfer of wealth. This type of will incorporates a credit shelter trust, which allows a portion of the estate to be exempt from federal estate taxes, benefiting surviving spouses while preserving wealth for future generations. It is particularly advantageous for high-net-worth individuals, as it helps to maximize the use of the estate tax exemption available to each spouse.

Steps to Complete the Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico

Completing the Complex Will With Credit Shelter Marital Trust involves several key steps:

- Gather necessary information about your assets, liabilities, and beneficiaries.

- Consult with an estate planning attorney to understand the implications of your choices.

- Draft the will, ensuring it includes provisions for the credit shelter trust.

- Review the document carefully to ensure all details are accurate and reflect your intentions.

- Sign the will in the presence of witnesses, as required by New Mexico law.

- Store the will in a safe location and inform trusted individuals about its whereabouts.

Key Elements of the Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico

Several key elements define the Complex Will With Credit Shelter Marital Trust:

- Credit Shelter Trust: This trust holds assets up to the exemption limit, avoiding estate taxes upon the death of the first spouse.

- Marital Trust: This trust benefits the surviving spouse, providing income and access to principal as needed.

- Beneficiary Designations: Clear instructions on how assets are to be distributed among beneficiaries.

- Tax Considerations: Provisions to address potential estate tax liabilities and strategies to minimize them.

Legal Use of the Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico

The legal use of the Complex Will With Credit Shelter Marital Trust in New Mexico requires adherence to state laws governing wills and trusts. It must be executed in compliance with New Mexico's requirements for validity, including proper witnessing and notarization. This ensures that the will is enforceable and can effectively carry out the testator's wishes regarding the distribution of their estate. Additionally, understanding the implications of federal estate tax laws is crucial for maximizing the benefits of this estate planning strategy.

State-Specific Rules for the Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico

New Mexico has specific rules that govern the execution and validity of wills and trusts. Key points include:

- Wills must be signed by the testator and witnessed by at least two individuals.

- Trusts must be funded properly to ensure assets are transferred into the trust.

- New Mexico does not recognize holographic wills, which are handwritten and unwitnessed.

- It is important to comply with state tax laws and regulations regarding estate taxes.

Examples of Using the Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico

Utilizing the Complex Will With Credit Shelter Marital Trust can take various forms, depending on individual circumstances:

- A couple with a combined estate valued at over ten million dollars may use this trust to preserve their wealth and minimize taxes.

- A single individual with significant assets may establish a credit shelter trust to ensure that their estate is managed according to their wishes after their passing.

- Families with complex financial situations, such as business ownership or multiple properties, can benefit from this structure to protect their assets and provide for future generations.

Quick guide on how to complete complex will with credit shelter marital trust for large estates new mexico

Effortlessly Prepare Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico on Any Device

The management of documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without any hindrances. Manage Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

Effortless Ways to Modify and Electronically Sign Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico

- Find Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico and select Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with specialized tools that airSlate SignNow offers for this purpose.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico and guarantee efficient communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Complex Will With Credit Shelter Marital Trust For Large Estates in New Mexico?

A Complex Will With Credit Shelter Marital Trust For Large Estates in New Mexico is a legal document that helps manage and protect signNow assets for married couples. It provides for a trust that can shelter part of the estate from taxes, preserving wealth for heirs. This type of will is particularly beneficial for those with large estates looking to minimize tax implications.

-

How can airSlate SignNow assist me with creating a Complex Will With Credit Shelter Marital Trust For Large Estates in New Mexico?

airSlate SignNow offers an intuitive platform that simplifies the process of drafting and executing a Complex Will With Credit Shelter Marital Trust For Large Estates in New Mexico. With eSigning capabilities, you can ensure your documents are legally binding without the hassle of physical signatures. Our templates can guide you in incorporating necessary legal language.

-

What are the pricing options for using airSlate SignNow for my Complex Will With Credit Shelter Marital Trust For Large Estates?

airSlate SignNow provides flexible pricing plans suited for different needs, starting from affordable monthly subscriptions. The cost is designed to provide great value, especially for those managing Complex Wills With Credit Shelter Marital Trusts For Large Estates in New Mexico. Pricing includes unlimited document sending and signing features, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing Complex Wills?

airSlate SignNow features include customizable templates, easy document sharing, and secure eSigning, all essential for managing a Complex Will With Credit Shelter Marital Trust For Large Estates in New Mexico. The platform ensures compliance with state laws, allowing you to track document status and maintain audit trails for all transactions.

-

What are the benefits of using airSlate SignNow for my estate planning needs?

Using airSlate SignNow for estate planning, especially for a Complex Will With Credit Shelter Marital Trust For Large Estates in New Mexico, streamlines the documentation process. It enhances efficiency, reduces the potential for errors, and ensures that all signed documents are securely stored and easily accessible. This can provide peace of mind as you navigate complex estate planning.

-

Can I integrate airSlate SignNow with other tools for estate management?

Yes, airSlate SignNow can integrate seamlessly with various business tools and applications, enhancing the management of your Complex Will With Credit Shelter Marital Trust For Large Estates in New Mexico. This allows for better collaboration among estate planners, lawyers, and clients while providing a centralized platform for all documentation and communication.

-

Is it safe to use airSlate SignNow for sensitive legal documents?

Absolutely! airSlate SignNow employs top-notch security protocols to protect your sensitive legal documents, including your Complex Will With Credit Shelter Marital Trust For Large Estates in New Mexico. Advanced encryption and compliance with legal standards ensure that your information remains confidential and secure throughout the signing process.

Get more for Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico

- Home occupational application henry bcountyb co henry ga form

- Terry l basin clayton county tax commissioner 121 form

- Motor bus ad valorem tax report general instructionsvehicle taxestitle ad valorem tax tavt and annual admotor bus ad valorem form

- Tn tangible personal property form

- Organization phone no form

- Application for service or early retirement benefits form

- Tangible personal property tax form

- 1500010263 kentucky department of revenue form

Find out other Complex Will With Credit Shelter Marital Trust For Large Estates New Mexico

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template