Grant, Bargain, Sale Deed from Husband and Wife to a Trust Nevada Form

What is the Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada

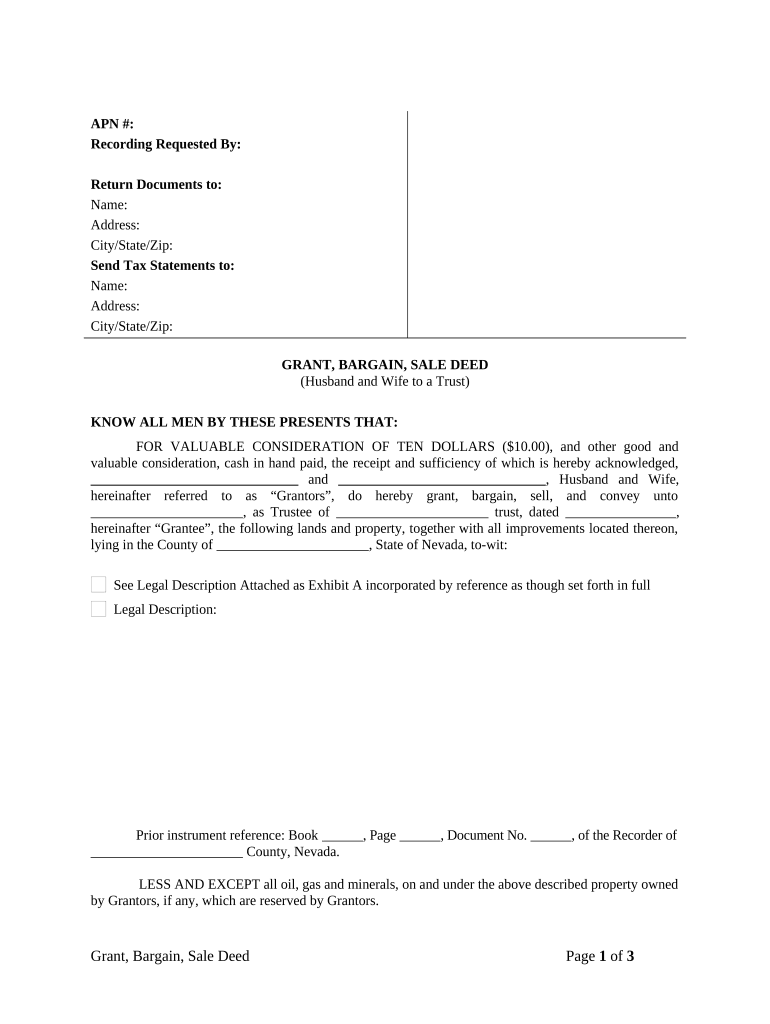

The Grant, Bargain, Sale Deed from Husband and Wife to a Trust in Nevada is a legal document that facilitates the transfer of property ownership from a married couple to a trust. This type of deed is particularly useful for estate planning, allowing the couple to designate a trust as the new owner of their real estate assets. The trust can then manage these assets according to the terms set forth in the trust agreement. This deed is essential for ensuring that the property is transferred smoothly and legally, providing clarity and security for both the grantors and the beneficiaries of the trust.

Steps to Complete the Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada

Completing the Grant, Bargain, Sale Deed from Husband and Wife to a Trust in Nevada involves several key steps:

- Gather necessary information, including the legal description of the property, the names of the husband and wife, and the details of the trust.

- Draft the deed, ensuring that it includes all required elements such as the names of the parties, the property description, and the signature lines.

- Both spouses must sign the deed in the presence of a notary public to ensure its validity.

- File the completed deed with the appropriate county recorder's office to make the transfer official.

- Retain a copy of the recorded deed for your records.

Key Elements of the Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada

Several key elements must be included in the Grant, Bargain, Sale Deed from Husband and Wife to a Trust in Nevada to ensure its legality:

- Grantors: The names of the husband and wife transferring the property.

- Grantee: The name of the trust receiving the property.

- Property Description: A detailed legal description of the property being transferred.

- Consideration: The value exchanged for the property, which can be nominal in some cases.

- Signatures: Signatures of both spouses, along with a notary acknowledgment.

Legal Use of the Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada

The legal use of the Grant, Bargain, Sale Deed from Husband and Wife to a Trust in Nevada is primarily for the transfer of real property into a trust. This deed serves to protect the interests of the grantors and beneficiaries by clearly outlining the terms of the transfer. It is essential for estate planning, as it helps avoid probate and ensures that the property is managed according to the wishes of the grantors. Additionally, this deed can provide tax benefits and facilitate the management of assets during the grantors' lifetime and after their passing.

State-Specific Rules for the Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada

Nevada has specific rules governing the Grant, Bargain, Sale Deed from Husband and Wife to a Trust. These include:

- The deed must be executed by both spouses to be valid.

- It must be notarized to ensure authenticity.

- The deed must be recorded with the county recorder's office where the property is located to provide public notice of the transfer.

- Compliance with Nevada Revised Statutes regarding property transfers and trusts is required.

How to Use the Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada

Using the Grant, Bargain, Sale Deed from Husband and Wife to a Trust in Nevada involves several practical steps:

- Consult with a legal professional to ensure that the deed meets all legal requirements and aligns with your estate planning goals.

- Prepare the deed with accurate information regarding the property and the trust.

- Have both spouses sign the deed in front of a notary public.

- Submit the deed to the county recorder's office for official recording.

- Keep a copy of the recorded deed for your personal records and for the trust’s documentation.

Quick guide on how to complete grant bargain sale deed from husband and wife to a trust nevada

Complete Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers a clean eco-friendly substitute to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada effortlessly

- Find Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada?

A Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada is a legal document that transfers property ownership from a couple to a trust. This deed ensures that the property is managed according to the trust’s terms, providing a straightforward process for asset management. Using airSlate SignNow, you can easily create and eSign this type of deed for your estate planning needs.

-

How do I create a Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada?

To create a Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada, simply use airSlate SignNow's document creation tools. You can start from a template or draft your deed directly on our platform, ensuring it meets Nevada's legal requirements. Our user-friendly interface allows you to customize all necessary details with ease.

-

What are the benefits of using airSlate SignNow for this type of deed?

Using airSlate SignNow for drafting a Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada offers several benefits. It simplifies the eSigning process, ensures legal compliance, and enhances document security. Additionally, our platform saves you time and money, ensuring a quick and efficient transaction.

-

Is there a cost associated with preparing a Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada on your platform?

Yes, there is a cost associated with preparing a Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada on airSlate SignNow. Pricing varies based on the specific features you choose, but we offer affordable plans designed to fit various budgets. Explore our pricing options to find the best fit for your needs.

-

Can I use airSlate SignNow to integrate my Grant, Bargain, Sale Deed From Husband And Wife To A Trust with other software?

Absolutely! airSlate SignNow provides various integration options, allowing you to seamlessly connect your Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada with other applications. Whether you need to sync documents with CRM systems or collaborate with team members, our integration capabilities enhance workflow efficiency.

-

What features should I look for when drafting a Grant, Bargain, Sale Deed From Husband And Wife To A Trust?

When drafting a Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada, look for features that ensure ease of use, template customization, and eSigning capabilities. airSlate SignNow provides robust features that allow you to create legally compliant documents while also enabling multiple users to review and sign easily.

-

How long does it take to complete a Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada using airSlate SignNow?

Completing a Grant, Bargain, Sale Deed From Husband And Wife To A Trust in Nevada using airSlate SignNow can be done in a matter of minutes. With our intuitive design and efficient signing process, you can draft, review, and get your document signed quickly. This means you can have your deed finalized without unnecessary delays.

Find out other Grant, Bargain, Sale Deed From Husband And Wife To A Trust Nevada

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online