Account Trust Nevada Form

What is the Account Trust Nevada

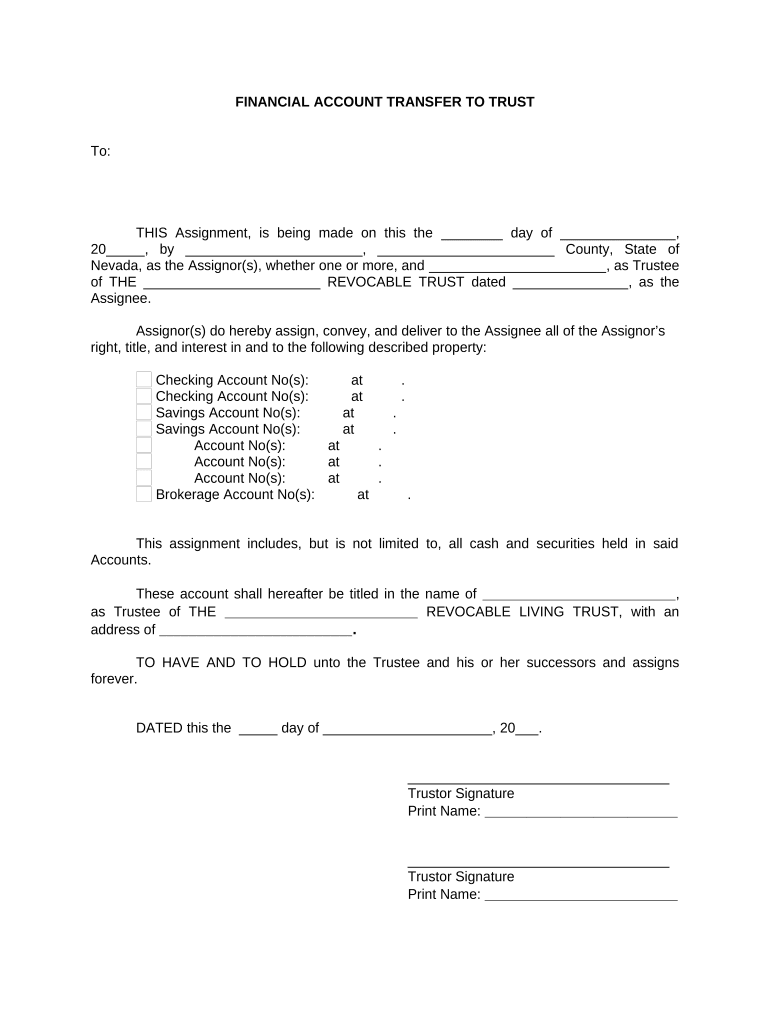

The Account Trust Nevada is a legal instrument designed to manage assets and provide benefits to designated beneficiaries. This trust structure is particularly advantageous for individuals seeking to secure their assets while maintaining control over their distribution. It allows for the efficient management of property and can help in minimizing estate taxes. The trust is governed by Nevada state law, which offers favorable conditions for trust administration, including strong privacy protections and asset protection features.

How to use the Account Trust Nevada

Using the Account Trust Nevada involves several steps to ensure compliance with state regulations. First, it is essential to draft the trust document, which outlines the terms, beneficiaries, and trustee responsibilities. Once the document is prepared, it must be signed and notarized to be legally binding. The next step is funding the trust by transferring assets into it, which can include real estate, bank accounts, and other valuable properties. Regularly reviewing and updating the trust is also crucial to reflect any changes in circumstances or laws.

Steps to complete the Account Trust Nevada

Completing the Account Trust Nevada involves a systematic approach:

- Draft the trust document: Clearly outline the terms, including beneficiaries and trustee roles.

- Notarize the document: Ensure the trust is legally binding by having it signed in the presence of a notary public.

- Fund the trust: Transfer assets into the trust, ensuring they are properly titled in the name of the trust.

- Maintain records: Keep detailed records of all transactions and changes related to the trust.

- Review regularly: Periodically assess the trust to ensure it meets current legal standards and personal needs.

Legal use of the Account Trust Nevada

The legal use of the Account Trust Nevada is governed by state laws that outline how trusts must be established and maintained. This includes adhering to regulations regarding the management of trust assets, the rights of beneficiaries, and the responsibilities of trustees. Proper legal use ensures that the trust operates within the framework of Nevada law, providing the intended benefits while protecting the interests of all parties involved. It is advisable to consult with a legal professional familiar with Nevada trust law to navigate these requirements effectively.

Key elements of the Account Trust Nevada

Key elements of the Account Trust Nevada include:

- Trustee: The individual or entity responsible for managing the trust and ensuring compliance with its terms.

- Beneficiaries: Individuals or entities designated to receive benefits from the trust.

- Assets: Property and resources held within the trust, which can include cash, real estate, and investments.

- Terms of distribution: Specific guidelines on how and when assets are to be distributed to beneficiaries.

- Revocability: The ability to alter or dissolve the trust, depending on the type of trust established.

State-specific rules for the Account Trust Nevada

Nevada has specific rules governing the establishment and operation of trusts, which include:

- Privacy protections: Nevada law offers strong privacy for trust documents, making them less accessible to the public.

- No state income tax: Trusts in Nevada benefit from the absence of state income tax, enhancing asset growth.

- Asset protection: Nevada provides robust protections against creditors, making it an attractive state for trust formation.

- Flexible trustee rules: The state allows for various types of trustees, including individuals and corporate entities.

Quick guide on how to complete account trust nevada

Effortlessly Prepare Account Trust Nevada on Any Device

Managing documents online has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Account Trust Nevada on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Account Trust Nevada without Stress

- Locate Account Trust Nevada and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal authority as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Account Trust Nevada and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an account trust in Nevada?

An account trust in Nevada is a legal arrangement allowing individuals or businesses to manage and protect their assets. In Nevada, these trusts provide signNow advantages, such as asset protection and tax benefits. Understanding how an account trust Nevada operates can help you leverage its features for your financial planning.

-

How can airSlate SignNow help with establishing an account trust in Nevada?

airSlate SignNow offers a seamless platform for creating and managing documents related to an account trust in Nevada. Users can easily eSign trust agreements and related documentation, ensuring a streamlined process. With our user-friendly interface, setting up an account trust in Nevada becomes quick and efficient.

-

What are the pricing options for using airSlate SignNow with an account trust in Nevada?

airSlate SignNow provides various pricing plans that cater to different user needs for managing an account trust in Nevada. Our plans are designed to be cost-effective while offering powerful features. You can choose the plan that best fits your requirements for document management and eSignature features.

-

What features does airSlate SignNow offer for account trust management in Nevada?

airSlate SignNow includes features like customizable templates, secure eSigning, and document management tailored specifically for account trusts in Nevada. These tools help users efficiently create, share, and sign trust-related documents. Ensuring compliance and security in your account trust Nevada is easier with our robust features.

-

Are there any benefits to using airSlate SignNow for an account trust in Nevada?

Using airSlate SignNow for your account trust in Nevada streamlines the documentation process and enhances security. Our platform ensures that all signed documents are securely stored and easily accessible. Additionally, the efficiency provided by airSlate SignNow saves time and reduces hassle for users managing their account trusts.

-

Can airSlate SignNow integrate with other tools for account trust management in Nevada?

Yes, airSlate SignNow offers integration capabilities with various software solutions that can assist in managing an account trust in Nevada. This allows users to connect their existing tools and automate workflows. These integrations enhance the overall functionality and efficiency for handling your account trust Nevada.

-

Is airSlate SignNow user-friendly for individuals new to account trusts in Nevada?

Absolutely! airSlate SignNow is designed with a user-friendly interface that makes it easy for individuals unfamiliar with account trusts in Nevada. With straightforward navigation and helpful resources, users can efficiently learn how to set up and manage their account trusts. Our platform supports new users every step of the way.

Get more for Account Trust Nevada

- Ohio traffic tickets ampamp violationsdmv org form

- Motor vehicle services us armed forces affidavit form

- Virginia alcohol safety action program asap virgi form

- Driveway permit application 12 18 ta doc form

- Required grooming form the barking dog ltd the

- Oregon department of transportation report your taxes form

- Wayzata beginning band interest form wayzata public schools

- Bradley county building inspections form

Find out other Account Trust Nevada

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement