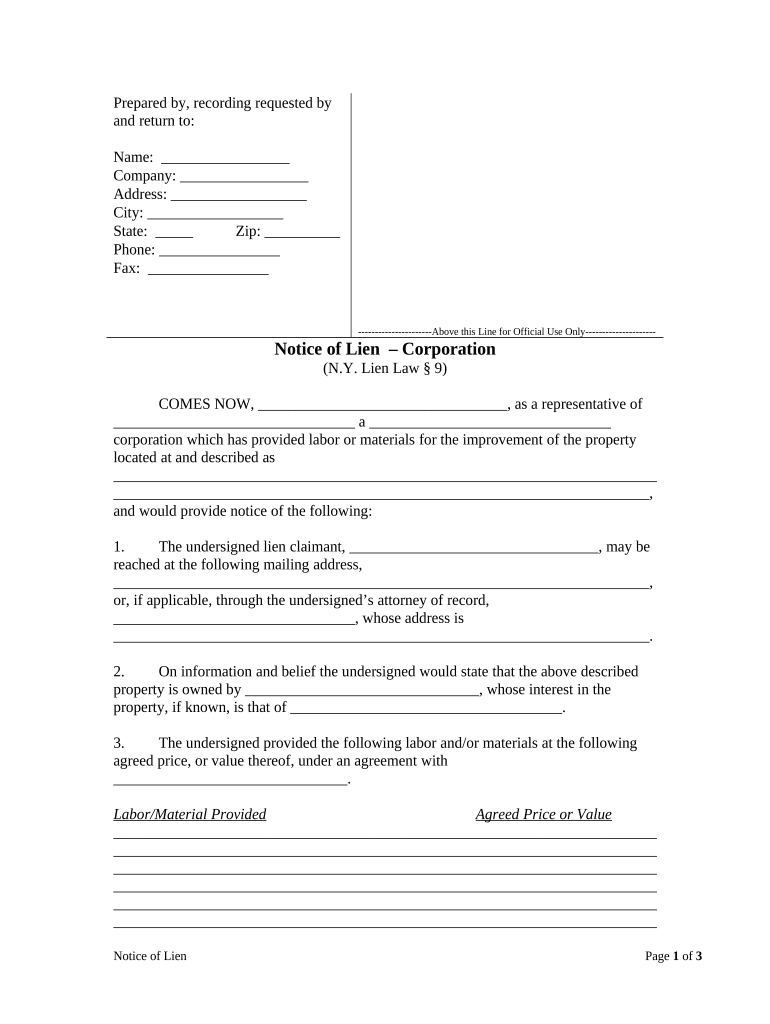

New York Lien Form

What is the New York Lien

A New York lien is a legal claim against a property or asset, typically used to secure payment for a debt or obligation. This form serves as a public notice that a creditor has a right to the property until the debt is satisfied. Liens can arise from various situations, including unpaid taxes, loans, or contractor services. Understanding the nature of a New York lien is crucial for both creditors and debtors, as it impacts property ownership and creditworthiness.

How to use the New York Lien

Using the New York lien involves several steps to ensure that the claim is properly documented and enforceable. First, the creditor must gather relevant information about the debt and the property in question. This includes details such as the debtor's name, property address, and the amount owed. Next, the creditor must complete the appropriate lien form, ensuring all required information is accurately filled out. Once completed, the form must be filed with the county clerk's office where the property is located to make the lien effective.

Key elements of the New York Lien

Several key elements must be present for a New York lien to be valid. These include:

- Identification of the debtor: The lien must clearly state the name and address of the person or entity that owes the debt.

- Description of the property: The property subject to the lien must be accurately described, including its location and type.

- Amount owed: The lien must specify the exact amount of the debt, including any interest or fees that may apply.

- Signature of the creditor: The creditor or their authorized representative must sign the lien form to validate it.

Steps to complete the New York Lien

Completing a New York lien requires careful attention to detail. Here are the essential steps:

- Gather all necessary information about the debtor and the property.

- Obtain the correct lien form from the county clerk's office or online.

- Fill out the form, ensuring all fields are completed accurately.

- Sign the form as the creditor or have an authorized representative sign it.

- File the completed form with the county clerk's office, either in person or by mail.

- Pay any required filing fees to finalize the lien.

Legal use of the New York Lien

Legally, a New York lien must comply with state laws governing liens and property rights. Creditors must ensure that they follow the correct procedures for filing and enforcing the lien. Failure to adhere to these regulations can result in the lien being deemed invalid. It is essential for creditors to understand their rights and obligations under New York law to effectively utilize a lien as a tool for debt collection.

Filing Deadlines / Important Dates

Filing deadlines for a New York lien can vary based on the type of lien and the circumstances surrounding it. Generally, creditors should file a lien as soon as they become aware of the unpaid debt to protect their interests. Certain types of liens, such as tax liens, may have specific statutory deadlines that must be adhered to. It is advisable for creditors to consult legal resources or professionals to ensure compliance with all relevant timelines.

Quick guide on how to complete new york lien 497321238

Complete New York Lien with ease on any device

Digital document management has become prevalent among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents promptly without delays. Manage New York Lien on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and eSign New York Lien without hassle

- Find New York Lien and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Edit and eSign New York Lien and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New York notice and how can airSlate SignNow help with it?

A New York notice is a legal document that communicates important information regarding a real estate transaction or legal proceeding. airSlate SignNow simplifies the process of creating, sending, and signing New York notices electronically, ensuring that your documents are executed quickly and securely.

-

How can I send a New York notice using airSlate SignNow?

To send a New York notice with airSlate SignNow, simply create your document using our user-friendly interface, add the necessary signers, and then send it for electronic signature. The platform allows you to track the status of your notice in real time, providing peace of mind throughout the process.

-

What are the pricing options for using airSlate SignNow for New York notices?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs. Whether you're a small business or a large enterprise, our plans provide an affordable solution for managing New York notices and other important documents efficiently.

-

Is airSlate SignNow compliant with New York laws regarding notices?

Yes, airSlate SignNow is fully compliant with New York laws, ensuring that your notices and other legal documents meet all regulatory requirements. Our platform is designed with security and compliance in mind, so you can trust that your New York notices are legally binding and accepted.

-

What features does airSlate SignNow offer for managing New York notices?

airSlate SignNow offers a range of features tailored for effectively managing New York notices, including customizable templates, eSignature capabilities, and document tracking. These features streamline the process, saving you time and ensuring accuracy in your legal communications.

-

Can I integrate airSlate SignNow with other tools I use for New York notices?

Absolutely, airSlate SignNow integrates seamlessly with various third-party applications, such as CRM systems and document management tools. This means you can easily manage your New York notices alongside your existing workflows without the need for cumbersome data transfers.

-

How does airSlate SignNow enhance the efficiency of sending New York notices?

airSlate SignNow increases efficiency by automating the sending and signing process for New York notices. With real-time notifications and reminders, your clients are prompted to sign promptly, reducing turnaround times and ensuring that your important documents are processed without delay.

Get more for New York Lien

- Studies in diabetes it is a well established fact that in diabetes the jbc form

- Air permit applicationslouisiana department of environmental quality form

- Va form 29 8636 780762476

- Deposit contract template form

- Event decorator contract template form

- Paid internship contract template form

- Pain contract template form

- Paint and sip contract template form

Find out other New York Lien

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later