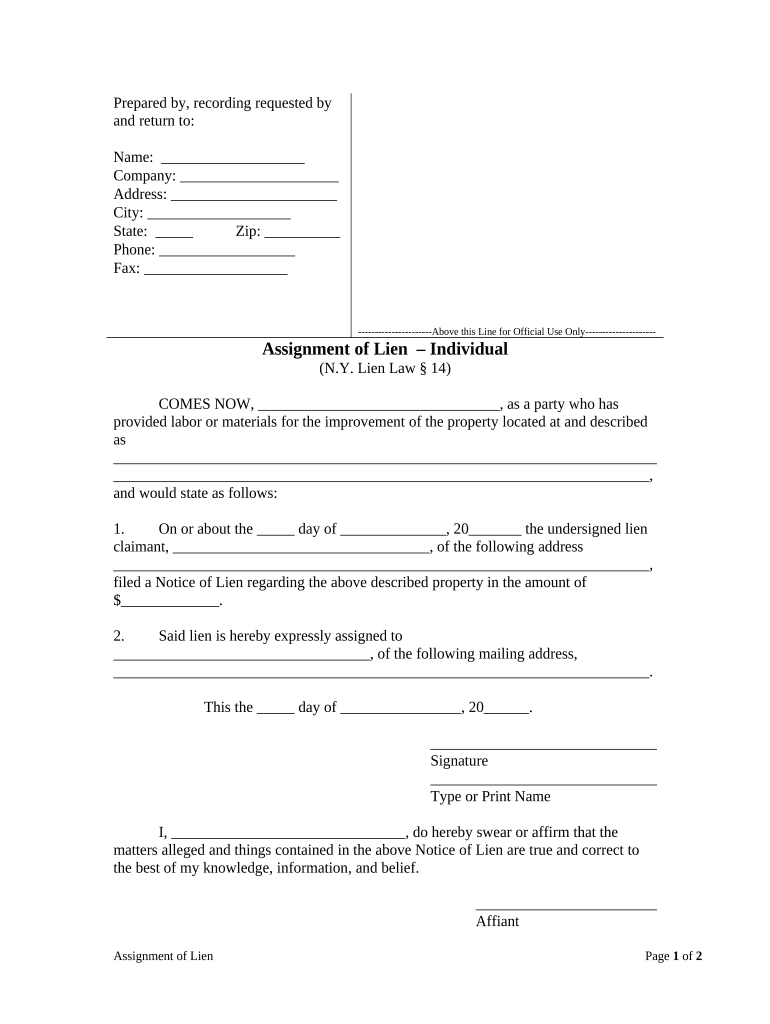

Ny Individual Form

What is the NY Individual?

The NY Individual form is a tax document used by residents of New York State to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, whether from employment, self-employment, or other sources. Completing this form accurately ensures compliance with state tax laws and helps taxpayers avoid penalties.

How to use the NY Individual

Using the NY Individual form involves several steps that ensure accurate reporting of income and deductions. Taxpayers should gather all necessary documentation, including W-2s, 1099s, and records of other income. Once the information is compiled, individuals can fill out the form either digitally or by hand. It is crucial to follow the instructions carefully to ensure that all sections are completed correctly, including personal information, income details, and applicable deductions.

Steps to complete the NY Individual

Completing the NY Individual form requires a systematic approach:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Claim any deductions or credits for which you are eligible.

- Review the completed form for accuracy before submission.

Legal use of the NY Individual

The NY Individual form is legally binding and must be filed in accordance with New York State tax laws. Filing this form accurately is essential to avoid legal repercussions, such as fines or audits. The form must be submitted by the designated deadline to ensure compliance with state regulations. Understanding the legal implications of this form helps individuals maintain good standing with tax authorities.

Required Documents

To complete the NY Individual form, taxpayers need to provide several key documents, including:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as receipts for charitable contributions or medical expenses

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the NY Individual form. Typically, the deadline for filing is April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may be available and the implications of late filings.

Quick guide on how to complete ny individual

Easily prepare Ny Individual on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to craft, modify, and electronically sign your documents swiftly without interruptions. Manage Ny Individual across any platform with airSlate SignNow's Android or iOS applications, and enhance any document-related task today.

The simplest method to modify and electronically sign Ny Individual effortlessly

- Locate Ny Individual and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Ny Individual to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow for NY individuals?

airSlate SignNow is a user-friendly eSignature solution designed for NY individuals to easily send, sign, and manage documents. It simplifies the signing process and is ideal for both personal and professional use, providing a reliable and efficient tool to handle important paperwork.

-

How much does airSlate SignNow cost for NY individuals?

airSlate SignNow offers competitive pricing plans tailored for NY individuals. Depending on the features you need, you can choose from various subscription options that make it cost-effective for solo use or small businesses, ensuring you get great value.

-

What features does airSlate SignNow offer for NY individuals?

For NY individuals, airSlate SignNow provides a range of features including document templates, real-time tracking, and secure cloud storage. These functionalities enable users to manage their documents efficiently while ensuring the signing process is seamless and secure.

-

Can NY individuals integrate airSlate SignNow with other applications?

Yes, airSlate SignNow allows NY individuals to integrate seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. This flexibility helps users streamline their workflow, making document management more efficient.

-

What are the benefits of using airSlate SignNow for NY individuals?

Using airSlate SignNow provides NY individuals with a host of benefits including time savings, reduced paper waste, and enhanced security for document handling. It empowers users to focus on what matters most, as eSigning becomes fast and efficient.

-

Is airSlate SignNow legally compliant for NY individuals?

Absolutely, airSlate SignNow is legally compliant with eSignature laws, including the ESIGN Act and UETA, making it a suitable choice for NY individuals. This compliance ensures that your signed documents are recognized as legally binding.

-

How does airSlate SignNow enhance productivity for NY individuals?

airSlate SignNow enhances productivity for NY individuals by allowing them to send documents for signing in just a few clicks. This speed and efficiency reduce turnaround times, enabling users to manage their documents more effectively and focus on other important tasks.

Get more for Ny Individual

- Dows can he open vs simulationresearch lbl form

- Prwgzgings pampquotlamp39amp39iampquot b ncbi nlm nih form

- Patient safety statement lakeside behavioral health system form

- Wilderness volunteer fire department inc company profile form

- Cplr 2105 form

- Dance studio contract template form

- Plumb work contract template form

- Plumber contract template form

Find out other Ny Individual

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document