Individual Credit Application New York Form

What is the Individual Credit Application New York

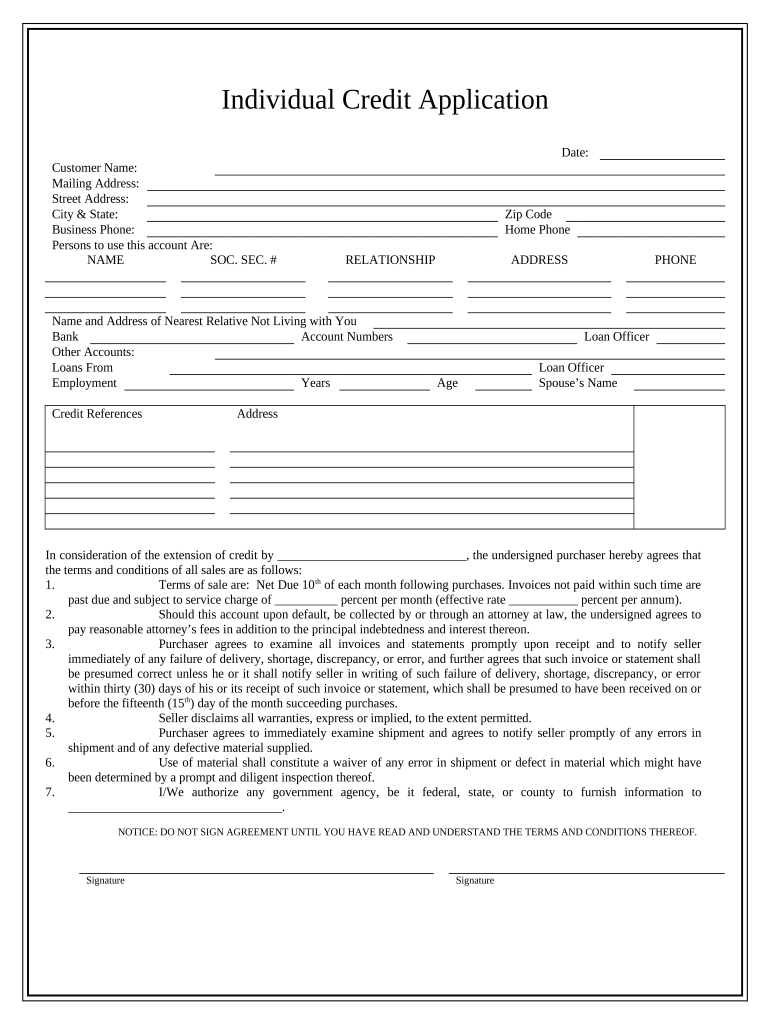

The Individual Credit Application New York is a formal document used by individuals seeking to obtain credit from financial institutions. This application collects essential personal and financial information to assess the applicant's creditworthiness. It typically includes details such as the applicant's name, address, social security number, income, employment history, and existing debts. The information provided helps lenders make informed decisions regarding loan approvals and credit limits.

Steps to complete the Individual Credit Application New York

Completing the Individual Credit Application New York involves several straightforward steps. First, gather all necessary personal and financial documents, including proof of income and identification. Next, fill out the application form accurately, ensuring that all information is current and truthful. It is crucial to review the completed application for any errors or omissions before submission. Finally, submit the application either electronically or via traditional mail, depending on the lender's requirements.

Key elements of the Individual Credit Application New York

Several key elements are essential to the Individual Credit Application New York. These include:

- Personal Information: Name, address, date of birth, and social security number.

- Employment Details: Current employer, job title, and length of employment.

- Financial Information: Monthly income, existing debts, and assets.

- Credit History: Previous credit accounts and payment history.

Each of these components plays a critical role in determining credit eligibility and terms.

Legal use of the Individual Credit Application New York

The Individual Credit Application New York is legally binding when completed and signed by the applicant. It must comply with federal and state regulations governing credit applications. This includes adherence to the Fair Credit Reporting Act (FCRA), which mandates that lenders inform applicants about the use of their credit information. Additionally, applicants should be aware of their rights regarding the accuracy of the information provided and the lender's obligations to protect personal data.

Eligibility Criteria

Eligibility for the Individual Credit Application New York typically requires applicants to meet specific criteria. These may include:

- Being at least eighteen years old.

- Having a valid social security number.

- Demonstrating a stable source of income.

- Maintaining a reasonable credit history.

Meeting these criteria does not guarantee approval but is essential for consideration by lenders.

Form Submission Methods

The Individual Credit Application New York can be submitted through various methods to accommodate different preferences. Applicants may choose to:

- Online Submission: Many lenders offer digital platforms for completing and submitting the application.

- Mail: Applicants can print the completed form and send it via postal service.

- In-Person: Some financial institutions allow applicants to submit the form directly at their branches.

Each method has its advantages, with online submission often being the fastest and most convenient.

Quick guide on how to complete individual credit application new york

Complete Individual Credit Application New York effortlessly on any device

Online document management has become prevalent among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Individual Credit Application New York on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Individual Credit Application New York effortlessly

- Obtain Individual Credit Application New York and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to store your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Modify and eSign Individual Credit Application New York and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Credit Application in New York?

An Individual Credit Application in New York is a formal request for credit or financing made by an individual. It typically includes personal information, financial details, and the purpose of the credit. Using airSlate SignNow, applicants can easily complete and submit their Individual Credit Application online for convenience and efficiency.

-

How does airSlate SignNow streamline the Individual Credit Application process in New York?

airSlate SignNow streamlines the Individual Credit Application process in New York by allowing users to fill out, sign, and send documents electronically. This eliminates the need for physical paperwork, reducing errors and saving time. The platform also provides secure storage for your signed applications, ensuring that your information is safe and accessible.

-

What are the costs associated with using airSlate SignNow for an Individual Credit Application in New York?

The cost of using airSlate SignNow for an Individual Credit Application in New York varies depending on the subscription plan. We offer competitive pricing models that cater to different business sizes and needs. Additionally, users benefit from our cost-effective solution that reduces printing and mailing expenses.

-

Can I customize my Individual Credit Application in New York with airSlate SignNow?

Yes, you can customize your Individual Credit Application in New York with airSlate SignNow. The platform allows users to create and modify templates to suit their specific requirements. This flexibility ensures that your application meets all regulatory standards and organizational preferences.

-

What are the key features of airSlate SignNow for handling Individual Credit Applications in New York?

Key features of airSlate SignNow for handling Individual Credit Applications in New York include electronic signatures, document templates, and automated workflows. These features enhance productivity and improve accuracy in processing applications. Additionally, users can track the status of their applications in real time.

-

Is airSlate SignNow compliant with legal regulations for Individual Credit Applications in New York?

Absolutely, airSlate SignNow is compliant with all relevant legal regulations for Individual Credit Applications in New York. Our platform adheres to e-signature laws and security standards, providing users with peace of mind when submitting sensitive information. This compliance ensures that your electronic documents are legally binding.

-

How secure is my information when submitting an Individual Credit Application in New York with airSlate SignNow?

When submitting an Individual Credit Application in New York with airSlate SignNow, your information is highly secure. We utilize industry-standard encryption to protect your data both in transit and at rest. Additionally, our platform employs robust security practices to ensure that your sensitive information remains confidential.

Get more for Individual Credit Application New York

- Authorization for release of health informationpl

- Surgery daily progress note form

- Lifeline systems inc form

- As 100 medical necessity short form all inclusive usedoc

- Aota fieldwork data form introduction my spalding

- Attending physicians statement lc 7135 form

- California hospital association advance directive 520012679 form

- Sc town business license form

Find out other Individual Credit Application New York

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed