New York Trust Form

What is the New York Trust

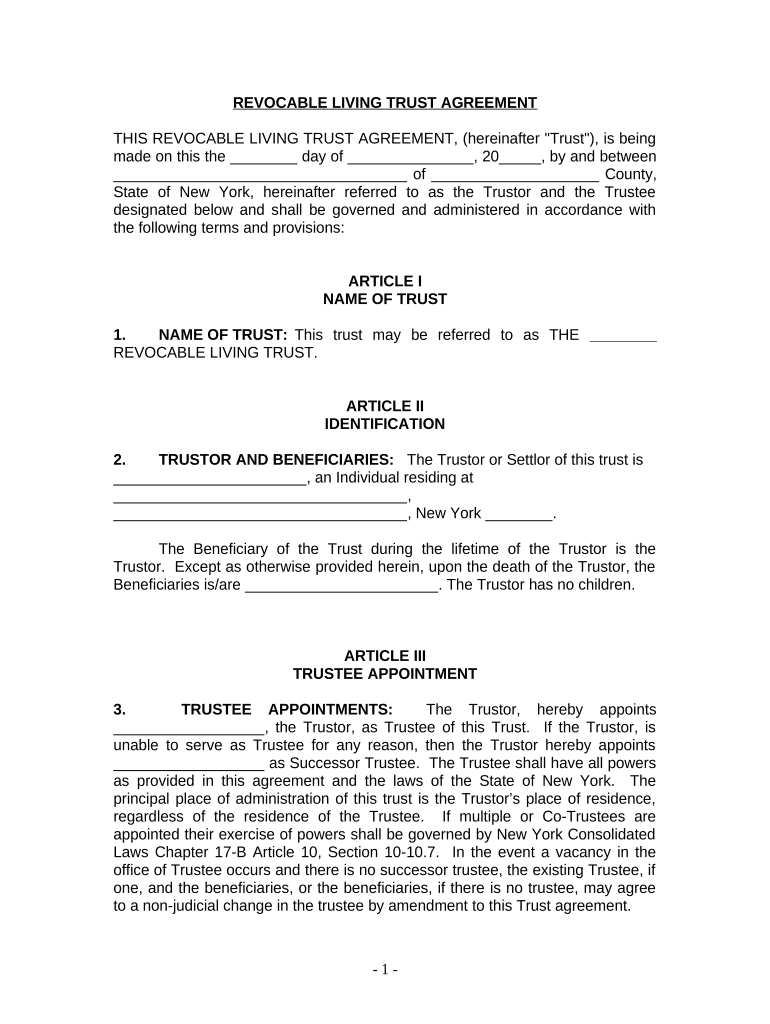

A New York Trust, often referred to as a NY Trust, is a legal arrangement that allows an individual (the grantor) to transfer assets to a trustee. The trustee manages these assets for the benefit of designated beneficiaries. This type of trust is particularly useful for estate planning, as it helps to avoid probate, ensures privacy, and can provide tax benefits. Trusts can be revocable or irrevocable, with revocable trusts allowing the grantor to retain control over the assets during their lifetime.

How to use the New York Trust

Utilizing a New York Trust involves several key steps. First, the grantor must decide on the type of trust that best suits their needs. Next, they will draft the trust document, which outlines the terms and conditions of the trust, including the identification of the trustee and beneficiaries. Once the trust is established, the grantor can transfer assets into the trust. It is important to regularly review and update the trust to reflect any changes in personal circumstances or laws.

Steps to complete the New York Trust

Completing a New York Trust involves a systematic approach:

- Determine the purpose of the trust and the assets to be included.

- Select a trustworthy trustee who will manage the assets.

- Draft the trust agreement, detailing all necessary provisions.

- Transfer ownership of the chosen assets into the trust.

- Sign the trust document in accordance with New York state laws.

- Consider consulting with an attorney to ensure compliance with legal requirements.

Legal use of the New York Trust

The legal use of a New York Trust is governed by state laws that dictate how trusts must be established and managed. Trusts must adhere to the New York Estates, Powers and Trusts Law (EPTL). This includes proper execution of the trust document, the duties of the trustee, and the rights of the beneficiaries. Understanding these legal frameworks is essential for ensuring that the trust serves its intended purpose and remains valid.

Key elements of the New York Trust

Several key elements define a New York Trust:

- Grantor: The individual who creates the trust.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or entities that benefit from the trust.

- Trust Document: The legal document that outlines the terms of the trust.

- Assets: Property or funds transferred into the trust for management.

State-specific rules for the New York Trust

New York has specific rules that govern the formation and administration of trusts. These include requirements for the trust document to be in writing, the necessity for the grantor to have the legal capacity to create a trust, and guidelines on trustee responsibilities. Additionally, New York law provides for the modification or termination of trusts under certain conditions, which can be crucial for adapting to changing circumstances.

Quick guide on how to complete new york trust 497321645

Easily Prepare New York Trust on Any Device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle New York Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign New York Trust

- Find New York Trust and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign New York Trust while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New York trust and how does it work?

A New York trust is a fiduciary arrangement allowing a third party to hold assets on behalf of beneficiaries under New York law. This legal framework provides signNow benefits, including asset protection and tax advantages, making it an essential tool for financial planning in New York.

-

How can airSlate SignNow help with New York trust documentation?

airSlate SignNow simplifies the process of creating and managing documents related to a New York trust. With our user-friendly platform, you can easily eSign and send trust agreements securely, ensuring compliance with New York regulations while saving time and reducing paperwork.

-

What are the pricing options for using airSlate SignNow for New York trust documents?

airSlate SignNow offers various pricing plans tailored to fit different business needs, making it a cost-effective solution for managing New York trust documentation. Prices depend on the features you require, but we ensure that all plans deliver outstanding value and scalability for users handling trust-related services.

-

What features make airSlate SignNow ideal for New York trusts?

With powerful features like customizable templates, secure eSigning, and real-time tracking, airSlate SignNow is perfect for managing New York trust documents. These functionalities enhance efficiency and security, ensuring that your trust agreements are handled professionally and in compliance with New York laws.

-

Can airSlate SignNow integrate with other tools for managing New York trusts?

Yes, airSlate SignNow seamlessly integrates with various tools and applications commonly used for managing New York trusts. This flexibility helps streamline your workflows, allowing you to connect with accounting, legal, and financial software to provide a comprehensive solution for trust management.

-

Are there any benefits of using airSlate SignNow for New York trust agreements?

Using airSlate SignNow for New York trust agreements offers several advantages, including enhanced security, remote accessibility, and improved document turnaround times. Our platform ensures that your sensitive trust documents are protected while providing convenience and ease of use for all parties involved.

-

How does airSlate SignNow ensure the security of New York trust documents?

airSlate SignNow prioritizes the security of your New York trust documents with advanced encryption, secure cloud storage, and strict authentication measures. Our commitment to safeguarding your data ensures that your trust-related transactions are conducted safely and compliantly.

Get more for New York Trust

Find out other New York Trust

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter