Pay Rate Acknowledgement Form

What is the Pay Rate Acknowledgement

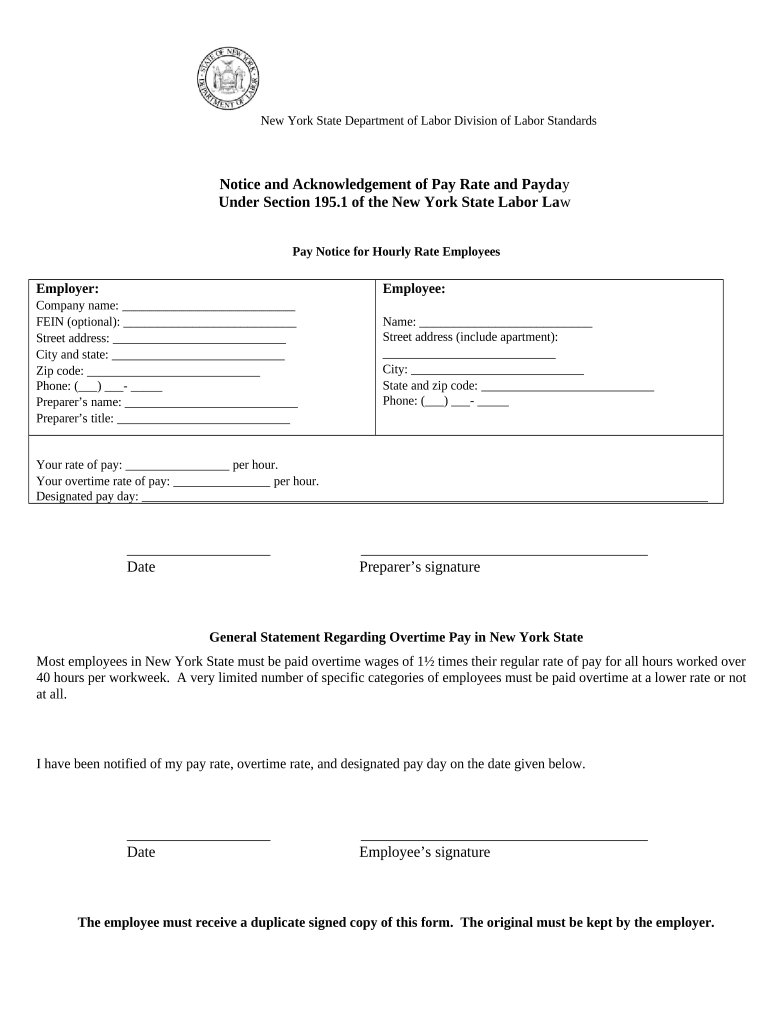

The Pay Rate Acknowledgement is a formal document that serves to confirm an employee's pay rate, ensuring both the employer and employee have a mutual understanding of compensation. This document is crucial for hourly employees, particularly in New York, as it outlines the agreed-upon pay rate, which can help prevent disputes regarding wages. It typically includes details such as the employee's name, job title, pay rate, and the effective date of this rate. By providing this acknowledgment, employers demonstrate transparency and compliance with state regulations regarding employee compensation.

Steps to complete the Pay Rate Acknowledgement

Completing the Pay Rate Acknowledgement involves several straightforward steps. First, gather the necessary information, including the employee's name, job title, and the specific pay rate. Next, fill out the form accurately, ensuring all details are correct to avoid any discrepancies. Once the form is completed, both the employer and employee should review it together to confirm that the information is accurate and understood. Finally, both parties must sign the document, which can be done electronically using a secure platform like signNow, ensuring that the acknowledgment is legally binding.

Legal use of the Pay Rate Acknowledgement

The legal use of the Pay Rate Acknowledgement is essential for maintaining compliance with labor laws. In New York, employers are required to provide written notice of pay rates to employees, which can serve as evidence in case of wage disputes. By utilizing an electronic signature solution, businesses can ensure that the acknowledgment is not only legally valid but also securely stored. This document must be retained for a specified period to comply with state regulations, providing both parties with a record of the agreed-upon terms.

Key elements of the Pay Rate Acknowledgement

Key elements of the Pay Rate Acknowledgement include the employee's name, job title, pay rate, and the effective date of the pay rate. It may also include information about overtime pay, deductions, and any applicable benefits. Clear and concise language is important to ensure that all parties understand the terms. Additionally, the document should include spaces for both the employer's and employee's signatures, which can be facilitated through electronic means to enhance convenience and security.

State-specific rules for the Pay Rate Acknowledgement

State-specific rules for the Pay Rate Acknowledgement vary, particularly in New York, where employers must adhere to strict regulations regarding pay transparency. Employers are required to provide written notice to employees about their pay rates, including any changes. This notice must be given at the time of hire and whenever there is a change in pay rate. Compliance with these regulations not only protects employees but also safeguards employers from potential legal issues related to wage disputes.

Examples of using the Pay Rate Acknowledgement

Examples of using the Pay Rate Acknowledgement can be found in various employment scenarios. For instance, when a new employee is hired, the employer provides a Pay Rate Acknowledgement outlining the agreed-upon hourly rate. Similarly, if an employee receives a pay raise, a new acknowledgment should be issued to document this change. Utilizing electronic forms for these acknowledgments can streamline the process, making it easier for both employers and employees to keep track of compensation agreements.

Quick guide on how to complete pay rate acknowledgement

Complete Pay Rate Acknowledgement effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage Pay Rate Acknowledgement on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Pay Rate Acknowledgement with ease

- Obtain Pay Rate Acknowledgement and then click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Highlight pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow provides for that specific purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Modify and eSign Pay Rate Acknowledgement and ensure superb communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the best way to rate employees in NY using airSlate SignNow?

To effectively rate employees in NY, airSlate SignNow provides customizable templates that streamline the evaluation process. By using our eSigning features, you can ensure timely feedback and create legally binding documents with ease.

-

How does airSlate SignNow help with employee evaluations in NY?

airSlate SignNow simplifies employee evaluations in NY by allowing managers to create and send evaluation forms quickly. Our platform offers robust tracking features, ensuring that all ratings are documented efficiently and securely.

-

What pricing options are available for rating employees in NY?

airSlate SignNow offers competitive pricing plans that cater to different business sizes looking to rate employees in NY. We provide a flexible subscription model, ensuring you can choose a plan that fits your budget while maximizing your evaluation capabilities.

-

Can I integrate airSlate SignNow with existing HR software to rate employees in NY?

Yes, airSlate SignNow supports integrations with various HR software, making it easier to rate employees in NY without disrupting your workflow. This seamless connectivity enhances the overall experience and boosts efficiency in managing employee evaluations.

-

What features does airSlate SignNow offer to enhance employee rating processes in NY?

Our platform includes features like customizable rating templates, eSigning capabilities, and document tracking, all designed to simplify the process of rating employees in NY. These tools help ensure accurate assessments and improve the overall employee experience.

-

Is airSlate SignNow secure for handling employee ratings in NY?

Absolutely! airSlate SignNow prioritizes security, utilizing advanced encryption to protect employee ratings in NY. Our platform complies with industry standards to ensure that your evaluation data remains confidential and secure.

-

How can airSlate SignNow streamline the feedback process in employee ratings for NY businesses?

With airSlate SignNow, businesses in NY can streamline feedback by automating the document flow for employee ratings. Our platform reduces turnaround times, allowing managers to focus on what matters most—developing their team members.

Get more for Pay Rate Acknowledgement

Find out other Pay Rate Acknowledgement

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement