Pay Rate Form

What is the Pay Rate Form

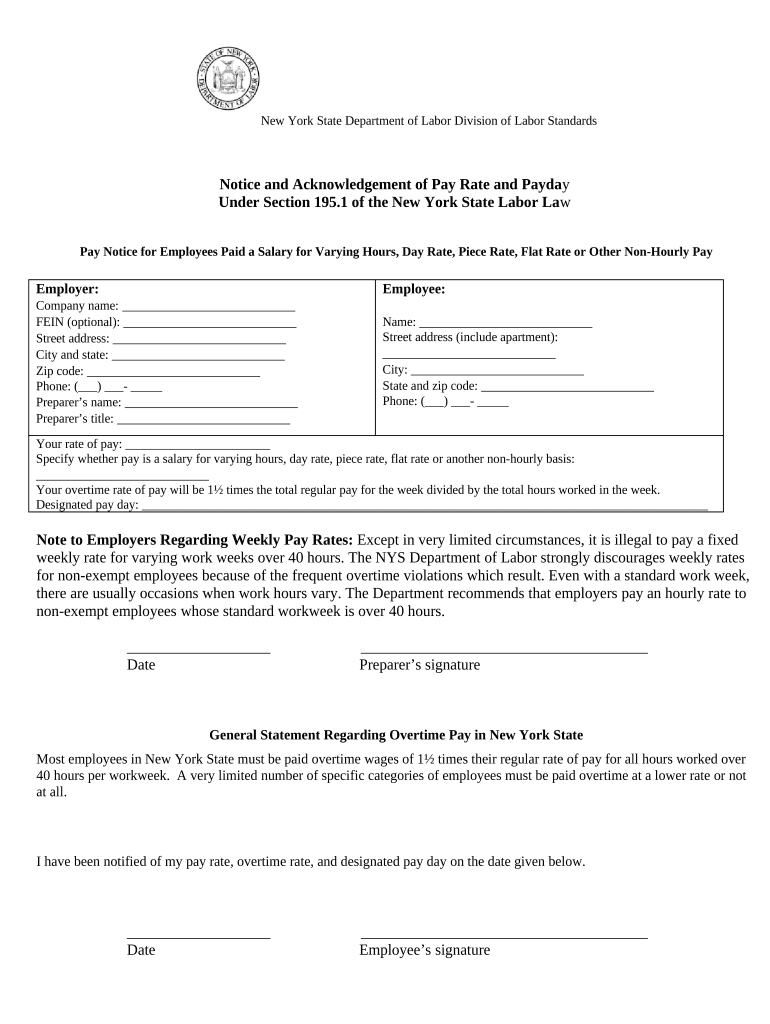

The Pay Rate Form, often referred to as the New York LS-54, is a document that employers in New York State must provide to employees. This form outlines the pay rate, including salary, hourly wages, and any additional compensation details. It serves as a formal notice to employees regarding their earnings and is essential for maintaining transparency in employer-employee relationships. Understanding this form is crucial for both employers and employees to ensure compliance with state wage laws.

How to use the Pay Rate Form

Utilizing the Pay Rate Form involves several steps to ensure it is filled out correctly and comprehensively. Employers should start by gathering all necessary information, including the employee's name, job title, and specific pay details. Once the form is completed, it should be distributed to the employee, who must acknowledge receipt. This acknowledgment can be done electronically or in writing, depending on the employer's preference. Proper use of the form helps protect both parties by providing clear documentation of pay agreements.

Steps to complete the Pay Rate Form

Completing the Pay Rate Form involves a systematic approach to ensure accuracy. Here are the key steps:

- Gather employee information, including full name and job title.

- Determine the pay rate, specifying whether it is hourly or salaried.

- Include any additional compensation details, such as bonuses or overtime rates.

- Review the form for completeness and accuracy.

- Distribute the form to the employee and obtain their acknowledgment.

Following these steps ensures that the form is filled out correctly and meets legal requirements.

Legal use of the Pay Rate Form

The legal use of the Pay Rate Form is governed by New York State labor laws. Employers are required to provide this form to employees at the time of hire and whenever there are changes to the pay rate. This legal obligation helps ensure that employees are informed about their earnings and protects them from potential wage disputes. Compliance with these regulations is essential for employers to avoid penalties and maintain a positive workplace environment.

Key elements of the Pay Rate Form

Several key elements must be included in the Pay Rate Form to ensure it serves its intended purpose. These elements include:

- The employee's full name and job title.

- The specific pay rate, indicating whether it is hourly or salary.

- Details about any additional compensation, such as overtime or bonuses.

- The effective date of the pay rate.

- Employer's name and contact information.

Including these elements helps ensure clarity and compliance with state regulations.

Examples of using the Pay Rate Form

There are various scenarios in which the Pay Rate Form is utilized. For instance, when a new employee is hired, the employer must provide this form to outline their pay structure. Additionally, if an employee receives a raise or changes positions, a new Pay Rate Form should be issued to reflect these changes. These examples highlight the form's importance in maintaining clear communication regarding employee compensation.

Quick guide on how to complete pay rate form

Prepare Pay Rate Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Pay Rate Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Pay Rate Form effortlessly

- Locate Pay Rate Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal weight as an authentic wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Pay Rate Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the pay rate ls for using airSlate SignNow?

The pay rate ls for airSlate SignNow is designed to be competitive and cost-effective, making it accessible for businesses of all sizes. You can choose from different pricing plans that cater to various needs, ensuring you only pay for the features you utilize. We encourage you to visit our pricing page for detailed insights on the pay rate ls options available.

-

How does airSlate SignNow benefit my business?

airSlate SignNow offers numerous benefits, including streamlined document signing and enhanced workflow efficiencies at a reasonable pay rate ls. By using our platform, businesses can save time and reduce operational costs, allowing them to focus on core activities. The ease of use and robust features provide a high return on investment.

-

Are there any hidden fees associated with the pay rate ls?

At airSlate SignNow, we believe in transparent pricing with no hidden fees associated with the pay rate ls. All costs are clearly outlined in our subscription plans, so you know exactly what you're paying for. This transparency helps businesses budget effectively and avoid surprises.

-

What features are included in the pay rate ls?

The pay rate ls includes a comprehensive suite of features such as document templates, workflow automation, and advanced signing options. Users can also enjoy integrations with other software tools to enhance productivity further. Each plan is tailored to provide maximum value based on your business needs.

-

Can I customize my plan based on the pay rate ls?

Yes, airSlate SignNow allows you to customize your plan according to your unique requirements, ensuring that the pay rate ls aligns with the specific features you need. This flexibility enables businesses to scale their e-signature solutions as they grow without paying for unnecessary features. signNow out to our sales team for personalized options.

-

Is there a free trial available to test the pay rate ls?

Absolutely! airSlate SignNow offers a free trial that allows you to explore our features and understand the value of our services before committing to a pay rate ls. This trial is an excellent opportunity for businesses to evaluate how our platform can enhance their document signing processes without any upfront costs.

-

How does airSlate SignNow integrate with other tools while maintaining the pay rate ls?

airSlate SignNow integrates seamlessly with various applications like Google Workspace, Salesforce, and more, without affecting the pay rate ls you choose. These integrations enhance usability and streamline workflows, allowing users to send and manage documents efficiently. Our platform is designed to work alongside your existing tools for a smooth user experience.

Get more for Pay Rate Form

Find out other Pay Rate Form

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure