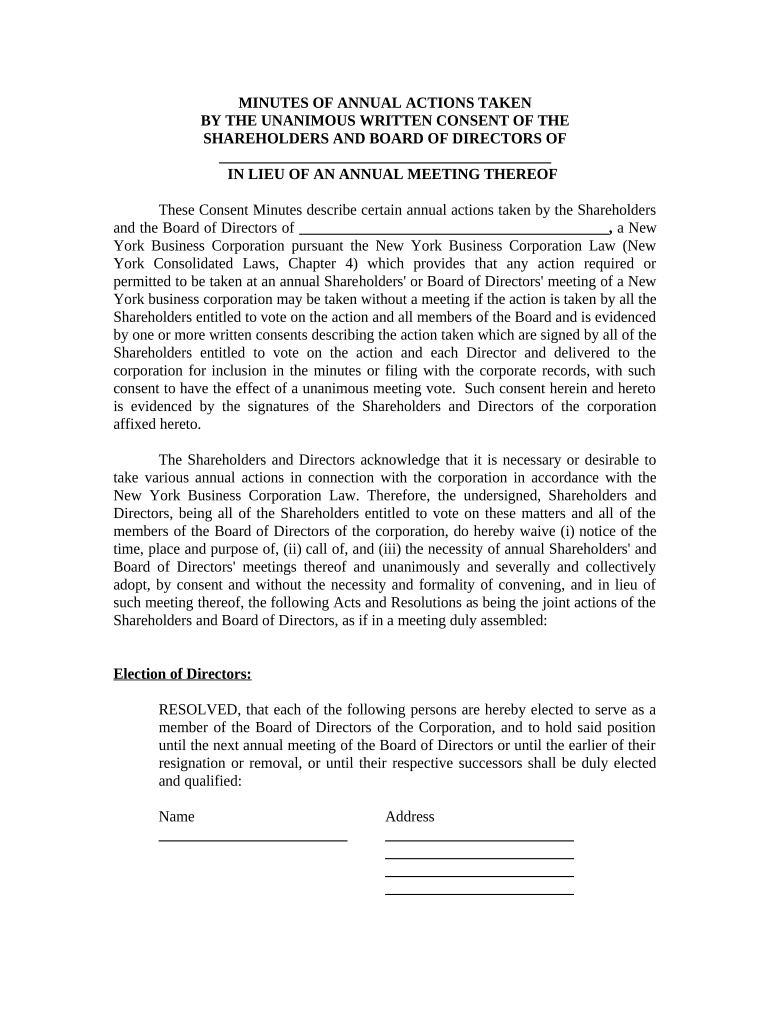

Ny Annual File Form

What is the NY Annual File

The NY Annual File is a crucial document used by businesses and individuals in New York for reporting income and other financial information to the state. It serves as a summary of a taxpayer's financial activities over the year, ensuring compliance with state tax laws. This file is essential for maintaining accurate records and fulfilling legal obligations.

How to Use the NY Annual File

Utilizing the NY Annual File involves several steps. First, gather all necessary financial documents, including income statements, expense reports, and any relevant tax forms. Next, accurately fill out the NY Annual File, ensuring that all figures are correct and reflect your financial situation. Once completed, the file can be submitted electronically or via traditional mail, depending on your preference and the requirements set by the state.

Steps to Complete the NY Annual File

Completing the NY Annual File requires careful attention to detail. Start by collecting all relevant financial information. Then, follow these steps:

- Review previous filings to ensure consistency.

- Fill out all sections of the form, including income, deductions, and credits.

- Double-check all calculations for accuracy.

- Sign and date the form to validate it.

- Submit the completed file by the designated deadline.

Legal Use of the NY Annual File

The NY Annual File must be completed in accordance with state laws to ensure its legal validity. This includes adhering to guidelines set forth by the New York State Department of Taxation and Finance. Proper use of the file helps avoid penalties and ensures that all financial activities are reported accurately and transparently.

Filing Deadlines / Important Dates

Awareness of filing deadlines is essential for compliance with New York state regulations. Typically, the NY Annual File must be submitted by April fifteenth of the following year. However, specific deadlines may vary based on individual circumstances or changes in state law. Keeping track of these dates helps prevent late fees and ensures timely processing of your file.

Required Documents

To successfully complete the NY Annual File, certain documents are necessary. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Previous year's tax returns for reference.

Having these documents ready will streamline the filing process and help ensure accuracy.

Who Issues the Form

The NY Annual File is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax compliance and ensuring that all taxpayers meet their obligations. It provides guidance on how to fill out the form and offers resources for assistance when needed.

Quick guide on how to complete ny annual file

Effortlessly Prepare Ny Annual File on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Ny Annual File on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign Ny Annual File with Ease

- Obtain Ny Annual File and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure confidential information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you would like to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tiresome form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your device of choice. Edit and electronically sign Ny Annual File to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the pricing structure for the NY annual plan with airSlate SignNow?

The NY annual plan for airSlate SignNow offers flexible pricing options that cater to businesses of all sizes. You can choose from monthly or annual billing, with signNow savings offered for the annual subscription. This plan includes unlimited eSignatures, document templates, and integration access, making it a cost-effective solution.

-

What features are included in the NY annual subscription plan?

The NY annual subscription of airSlate SignNow includes a comprehensive suite of features such as unlimited templates, advanced signing options, and automated workflows. Additionally, it provides access to robust reporting tools and integrations with popular apps, helping streamline your document management process. This makes it an excellent choice for businesses looking to enhance their efficiency.

-

How does airSlate SignNow enhance document security for NY annual users?

For users on the NY annual plan, airSlate SignNow employs advanced security measures such as encryption, two-factor authentication, and audit trails to protect sensitive documents. These security features ensure that your documents are secure during the signing process and compliance is maintained. Choosing airSlate SignNow gives you peace of mind regarding your document safety.

-

Can I integrate airSlate SignNow with other applications under the NY annual plan?

Yes, the NY annual plan offers extensive integration options with various applications like Google Drive, Salesforce, and Dropbox. This seamless integration capability allows users to manage documents more effectively and improve workflow efficiency. By using airSlate SignNow, you can centralize your document creation and sharing processes.

-

What are the benefits of choosing the NY annual plan over a monthly subscription?

Choosing the NY annual plan over a monthly subscription can save you money in the long run, as it typically comes with a discounted rate. Additionally, this plan provides uninterrupted access to all features for a year, allowing for better planning and budgeting for your business's needs. Overall, the annual plan is a convenient choice for businesses that rely on eSigning.

-

Is customer support included in the NY annual subscription?

Absolutely! The NY annual subscription includes dedicated customer support to assist you with any questions or issues. Users can access support via email, phone, or live chat, ensuring timely assistance when needed. Help is just a click away, allowing you to focus on your business operations without interruptions.

-

What types of documents can be signed using airSlate SignNow in the NY annual plan?

The airSlate SignNow NY annual plan supports a wide variety of documents, including contracts, agreements, and consent forms. You can sign any document that requires a signature, making it versatile for various industries. This flexibility empowers your business to streamline processes and improve communication with clients and partners.

Get more for Ny Annual File

Find out other Ny Annual File

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself