Form Widower

What is the Form Widower

The form widower is a legal document used primarily in estate planning and probate processes. It is designed to help individuals who have lost their spouse navigate the complexities of managing their deceased partner's estate. This form is particularly relevant in situations where a spouse has passed away and the surviving partner needs to address matters such as inheritance, asset distribution, and other legal obligations. Understanding the purpose and implications of this form is essential for ensuring that the estate is handled according to the deceased's wishes and state laws.

How to use the Form Widower

Using the form widower involves several key steps to ensure proper completion and submission. First, gather all necessary information about the deceased spouse, including their full name, date of birth, and date of death. Next, collect details regarding the assets and liabilities of the estate. Once you have this information, fill out the form accurately, ensuring that all sections are completed. It may also be beneficial to consult with a legal professional to confirm that the form is filled out correctly and complies with state laws. After completing the form, submit it to the appropriate probate court or agency as required.

Steps to complete the Form Widower

Completing the form widower involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather Information: Collect all relevant details about the deceased spouse and their estate.

- Fill Out the Form: Accurately complete each section of the form, ensuring clarity and correctness.

- Review: Double-check the form for any errors or omissions.

- Consult a Professional: If necessary, seek legal advice to ensure compliance with local laws.

- Submit: File the completed form with the appropriate court or agency.

Legal use of the Form Widower

The legal use of the form widower is crucial for ensuring that the estate of the deceased spouse is managed according to the law. This form serves as a declaration of the surviving spouse's rights and responsibilities regarding the estate. It may be used to initiate probate proceedings or to claim assets that are part of the estate. Proper legal use of the form can help prevent disputes among heirs and ensure that the deceased's wishes are honored. It is important to understand the legal implications of the form and to comply with any state-specific requirements.

Required Documents

When preparing to complete the form widower, certain documents are typically required to support the information provided. These may include:

- Death certificate of the deceased spouse.

- Marriage certificate to establish the relationship.

- List of assets and liabilities of the estate.

- Any prior wills or estate planning documents.

Having these documents ready will streamline the process of completing the form and ensure that all necessary information is accurately represented.

State-specific rules for the Form Widower

Each state in the U.S. may have specific rules and regulations regarding the form widower and its use in estate planning and probate. It is important to familiarize yourself with the laws in your state, as they can affect how the form is completed, submitted, and processed. Some states may require additional documentation or have specific filing procedures. Consulting with a local attorney who specializes in estate law can provide valuable guidance on navigating these state-specific requirements.

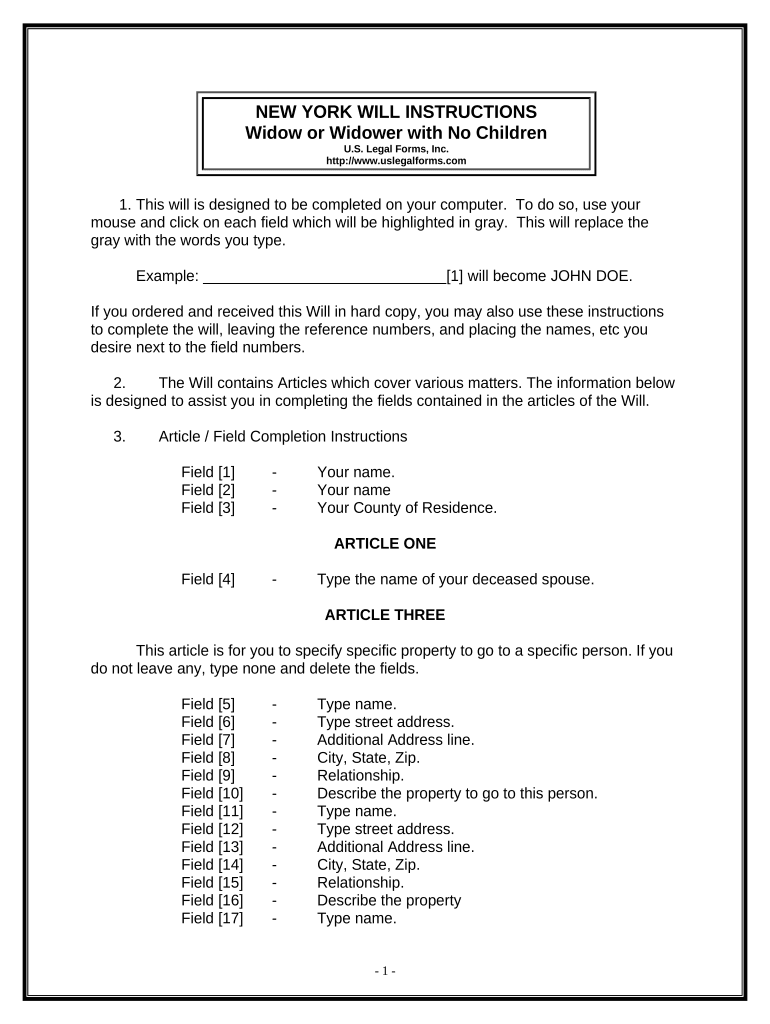

Quick guide on how to complete form widower 497322042

Effortlessly prepare Form Widower on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage Form Widower on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest way to edit and eSign Form Widower without hassle

- Locate Form Widower and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form Widower and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the form widower and how can it help me?

The form widower is a specialized document template that helps individuals manage and process necessary paperwork after the loss of a spouse. It simplifies the documentation needed for legal and financial matters, making a difficult time more manageable.

-

How much does it cost to use the form widower template?

airSlate SignNow offers competitive pricing for its document management solutions. With the form widower template, users can choose from various subscription plans that best fit their needs, ensuring efficient and cost-effective document signing at every budget level.

-

What features come with the form widower template?

The form widower template includes customizable fields, electronic signatures, and secure storage options. These features not only streamline the signing process but also ensure that your sensitive information remains safe and accessible when you need it.

-

Is the form widower template easy to use for someone unfamiliar with technology?

Absolutely! The form widower template is designed with user-friendliness in mind. Even those who are not tech-savvy can easily navigate the platform, allowing for a seamless eSigning experience that simplifies the documentation process.

-

Can I integrate the form widower template with other applications?

Yes, the form widower template integrates smoothly with various applications such as Google Drive, Dropbox, and CRM systems. This flexibility enables users to enhance their document workflow while ensuring that all necessary forms are easily accessed and managed.

-

What are the benefits of using the form widower template over traditional methods?

Using the form widower template offers signNow advantages over traditional paper methods, including time savings, reduced errors, and easy storage. By streamlining the signing process, you can focus on more important aspects of your life during a challenging time.

-

Is there customer support available for users of the form widower template?

Yes, airSlate SignNow provides comprehensive customer support for all users of the form widower template. Our dedicated support team is available through live chat, email, or phone to assist you with any questions or issues you may encounter.

Get more for Form Widower

- The standard long term disability for georgia form

- Irs 5031 form

- State farm authoirzation to pay form

- State farm personal financial statement form

- State farm authorization and direction to pay form

- Iowa first report of injury form

- V i r g i n i a form 760 resident individual 793803582

- For the calendar year or fiscal taxable year beginning form

Find out other Form Widower

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now