Ok Individual Form

What is the ok individual?

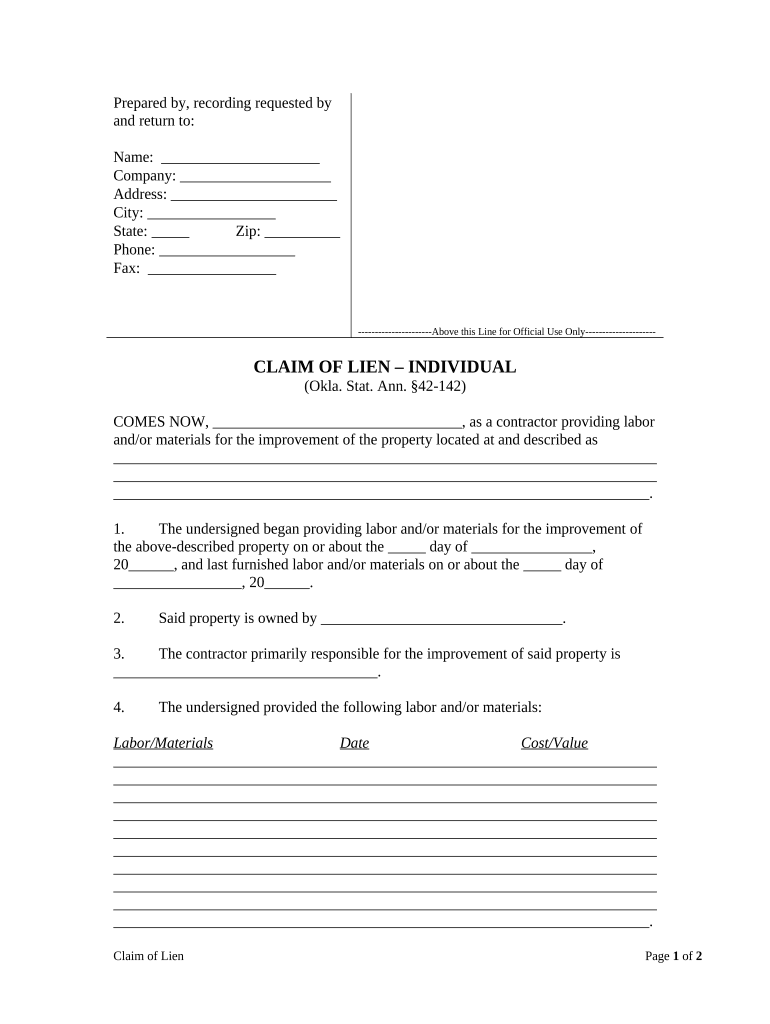

The ok individual form is a specific document utilized primarily for tax purposes in the United States. It serves as a declaration of individual taxpayer information and is essential for various financial and legal transactions. This form is often required by financial institutions and government agencies to verify the identity and tax status of individuals. Understanding the ok individual form is crucial for ensuring compliance with tax regulations and maintaining accurate records.

How to use the ok individual

Using the ok individual form involves several straightforward steps. First, gather all necessary personal information, including your Social Security number, address, and relevant financial details. Next, fill out the form accurately, ensuring that all information is complete and correct. Once completed, you can submit the form electronically or via traditional mail, depending on the requirements of the requesting agency. Utilizing a digital platform can simplify this process, allowing for easy eSigning and secure submission.

Steps to complete the ok individual

Completing the ok individual form requires careful attention to detail. Follow these steps for a smooth process:

- Collect necessary personal information, including your full name, address, and Social Security number.

- Access the form through a reliable platform that supports digital completion.

- Fill in each section of the form accurately, ensuring all required fields are completed.

- Review your entries for any errors or omissions.

- Sign the form electronically, if applicable, to ensure it is legally binding.

- Submit the form according to the specified method, whether online or by mail.

Legal use of the ok individual

The ok individual form is legally binding when completed and submitted according to established regulations. To ensure its validity, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant legal frameworks. This compliance guarantees that the form holds the same legal weight as a traditional paper document. Utilizing a trusted platform for eSigning can enhance the legal standing of the form, providing a digital certificate that verifies the authenticity of the signature.

Required Documents

When completing the ok individual form, certain documents may be required to support your application. These typically include:

- Proof of identity, such as a driver's license or passport.

- Social Security card or documentation of your Social Security number.

- Financial records that may be relevant to your tax situation.

- Any additional forms or documents specified by the requesting agency.

Examples of using the ok individual

The ok individual form can be utilized in various scenarios, such as:

- Applying for loans or credit where proof of income and tax status is required.

- Filing tax returns with the Internal Revenue Service (IRS) to ensure accurate reporting of income.

- Completing applications for government assistance programs that require verification of individual status.

Eligibility Criteria

To successfully complete the ok individual form, individuals must meet specific eligibility criteria. Generally, this includes:

- Being a legal resident or citizen of the United States.

- Possessing a valid Social Security number.

- Having the necessary documentation to support the information provided on the form.

Quick guide on how to complete ok individual

Complete Ok Individual seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ok Individual on any device using airSlate SignNow’s Android or iOS applications and simplify any document-based task today.

The easiest way to modify and electronically sign Ok Individual with ease

- Locate Ok Individual and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet signature.

- Review all details and click the Done button to save your changes.

- Choose how you prefer to share your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Edit and electronically sign Ok Individual and facilitate superior communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an ok individual in the context of airSlate SignNow?

An ok individual refers to someone who can easily use the airSlate SignNow platform for document signing and management. This solution empowers both individuals and businesses to efficiently send, eSign, and manage documents with minimal hassle.

-

How does airSlate SignNow pricing work for individuals?

The airSlate SignNow pricing for ok individuals is designed to be cost-effective and flexible. There are various subscription plans tailored to meet the needs of individual users, ensuring they get the functionality they require without breaking the bank.

-

What features does airSlate SignNow offer for ok individuals?

For ok individuals, airSlate SignNow offers features like document sharing, secure eSigning, customizable templates, and mobile access. These features ensure that individuals can manage their documents seamlessly from anywhere, making tasks easy and efficient.

-

What are the benefits of using airSlate SignNow for ok individuals?

Using airSlate SignNow benefits ok individuals by streamlining their document processes and enhancing productivity. The platform offers time-saving tools and a user-friendly interface, allowing individuals to focus on their core activities without worrying about paperwork.

-

Can ok individuals integrate airSlate SignNow with other applications?

Yes, airSlate SignNow allows ok individuals to integrate with various applications such as Google Drive, Microsoft Office, and Salesforce. These integrations enhance the user experience by enabling seamless document management across different platforms.

-

Is there a mobile app for ok individuals using airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that ok individuals can use to access and manage their documents on the go. This ensures that users can send and eSign documents anytime and anywhere, providing maximum flexibility.

-

How secure is airSlate SignNow for ok individuals?

airSlate SignNow prioritizes security for ok individuals by employing advanced encryption and compliance with industry standards. This ensures that all documents and sensitive information are protected against unauthorized access and bsignNowes.

Get more for Ok Individual

- 2005 forms w 2 magnetic media specifications handbook mass gov mass

- Georgia dol4n instructions form

- Bir 1601 c form

- Denver sales tax return quarterly form denvergov

- Acd 31098 2005 form

- Rsa alabama retirement form

- Claim for creditrefund of sales tax oklahoma tax commission tax ok form

- Health risk form

Find out other Ok Individual

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free