Living Trust for Individual as Single, Divorced or Widow or Widower with Children Oklahoma Form

What is the Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma

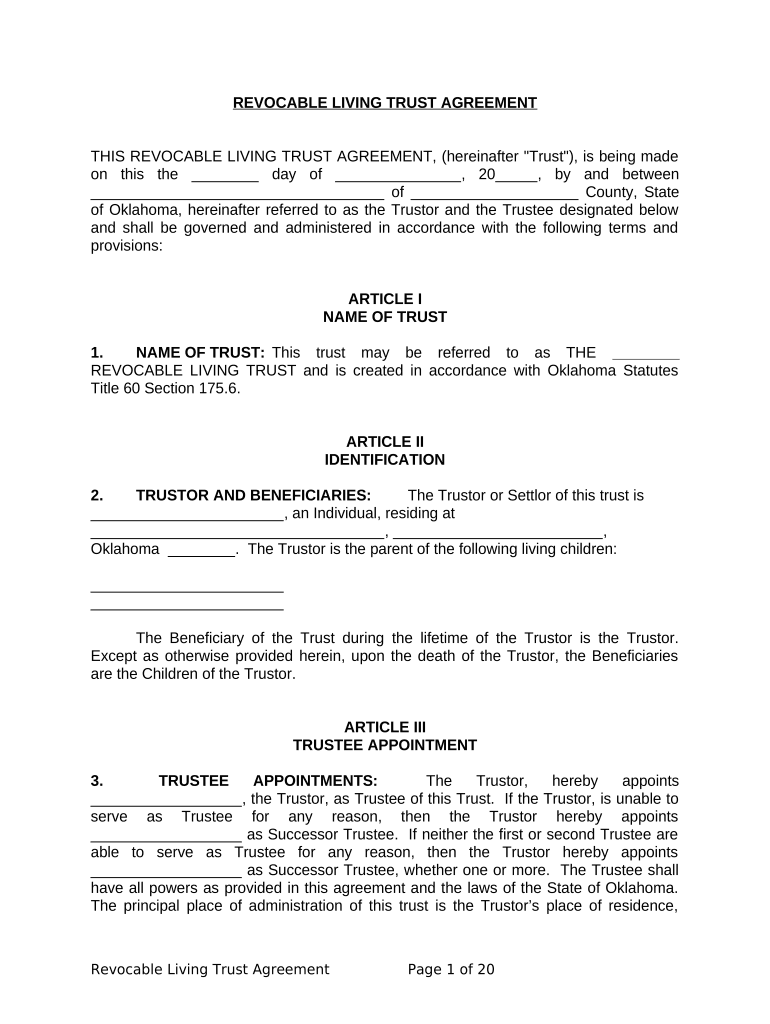

A living trust for individuals who are single, divorced, or widowed with children in Oklahoma is a legal arrangement that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust is particularly beneficial for individuals with children, as it provides a structured way to ensure that their assets are passed on according to their wishes. Unlike a will, a living trust can help avoid probate, which can be a lengthy and costly process.

Steps to complete the Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma

Completing a living trust involves several important steps:

- Identify your assets: List all assets you wish to include in the trust, such as real estate, bank accounts, and investments.

- Choose a trustee: Select a trusted individual or institution to manage the trust.

- Draft the trust document: Create a legal document that outlines the terms of the trust, including how assets will be managed and distributed.

- Sign the document: Execute the trust document in accordance with Oklahoma laws, ensuring all necessary signatures are obtained.

- Fund the trust: Transfer ownership of your assets into the trust to ensure they are managed according to your wishes.

Legal use of the Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma

The legal use of a living trust in Oklahoma is governed by state laws that outline the requirements for creating and managing trusts. A living trust must be properly executed to be considered valid, which includes having the trust document signed and notarized. It is essential to comply with Oklahoma's specific legal requirements to ensure that the trust is enforceable and that your wishes regarding asset distribution are honored.

State-specific rules for the Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma

Oklahoma has specific rules regarding living trusts that individuals must follow. These include:

- The trust must be in writing and signed by the grantor.

- It must clearly state the grantor's intentions regarding the management and distribution of assets.

- Oklahoma law requires that the trust be funded with assets to be effective.

- Trusts can be revocable or irrevocable, with revocable trusts being more common for individuals who wish to retain control over their assets.

How to use the Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma

Using a living trust effectively involves understanding its purpose and how it operates. Once established, the trust allows the grantor to manage their assets during their lifetime. Upon the grantor's death, the trustee is responsible for distributing the assets according to the trust's terms. This can simplify the process for heirs and provide peace of mind, knowing that the grantor's wishes will be followed without the need for probate.

Key elements of the Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma

Key elements of a living trust in Oklahoma include:

- Grantor: The individual creating the trust.

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: Individuals or entities designated to receive the trust assets.

- Trust terms: Specific instructions on how assets should be managed and distributed.

Quick guide on how to complete living trust for individual as single divorced or widow or widower with children oklahoma

Complete Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma with ease

- Find Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential parts of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious document searches, or errors necessitating new printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma to ensure seamless communication at all stages of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual As Single, Divorced Or Widow or Widower With Children in Oklahoma?

A Living Trust For Individual As Single, Divorced Or Widow or Widower With Children in Oklahoma is a legal arrangement that allows individuals to manage their assets while ensuring that their children are provided for after their passing. This type of trust can help avoid probate, facilitate asset distribution, and provide peace of mind for parents.

-

How does a Living Trust differ from a will for individuals in Oklahoma?

Unlike a will, a Living Trust For Individual As Single, Divorced Or Widow or Widower With Children in Oklahoma takes effect during your lifetime and allows for the direct transfer of assets upon death. This can streamline the process of asset distribution and helps prevent probate litigation, which is essential for protecting your children's inheritance.

-

What are the benefits of setting up a Living Trust in Oklahoma?

Setting up a Living Trust For Individual As Single, Divorced Or Widow or Widower With Children in Oklahoma provides several benefits, including avoiding probate, maintaining privacy, and ensuring a smoother transition of assets for your children. Additionally, it allows for more control over how and when your assets are distributed.

-

What is the cost associated with creating a Living Trust in Oklahoma?

The cost of establishing a Living Trust For Individual As Single, Divorced Or Widow or Widower With Children in Oklahoma can vary based on factors like complexity and professional fees. However, it is generally considered a cost-effective solution in comparison to the potential expenses involved in probate, making it a wise investment for your family's future.

-

Can I modify my Living Trust in Oklahoma once it is established?

Yes, a Living Trust For Individual As Single, Divorced Or Widow or Widower With Children in Oklahoma is revocable, meaning you can make changes as your circumstances evolve. This flexibility allows you to update beneficiaries, modify asset distribution, and adapt to changes in your life or family situation.

-

How can airSlate SignNow help with creating a Living Trust?

airSlate SignNow provides an easy-to-use, cost-effective solution for drafting and eSigning the necessary documents for a Living Trust For Individual As Single, Divorced Or Widow or Widower With Children in Oklahoma. Our platform simplifies the legal process, ensuring that everything is completed efficiently and accurately.

-

What assets can I include in my Oklahoma Living Trust?

You can include a variety of assets in your Living Trust For Individual As Single, Divorced Or Widow or Widower With Children in Oklahoma, such as real estate, bank accounts, investments, and personal property. This comprehensive inclusion helps ensure that all of your assets are managed according to your wishes and benefit your children.

Get more for Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma

Find out other Living Trust For Individual As Single, Divorced Or Widow or Widower With Children Oklahoma

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement