Living Trust for Husband and Wife with One Child Oklahoma Form

Understanding the Living Trust for Husband and Wife with One Child in Oklahoma

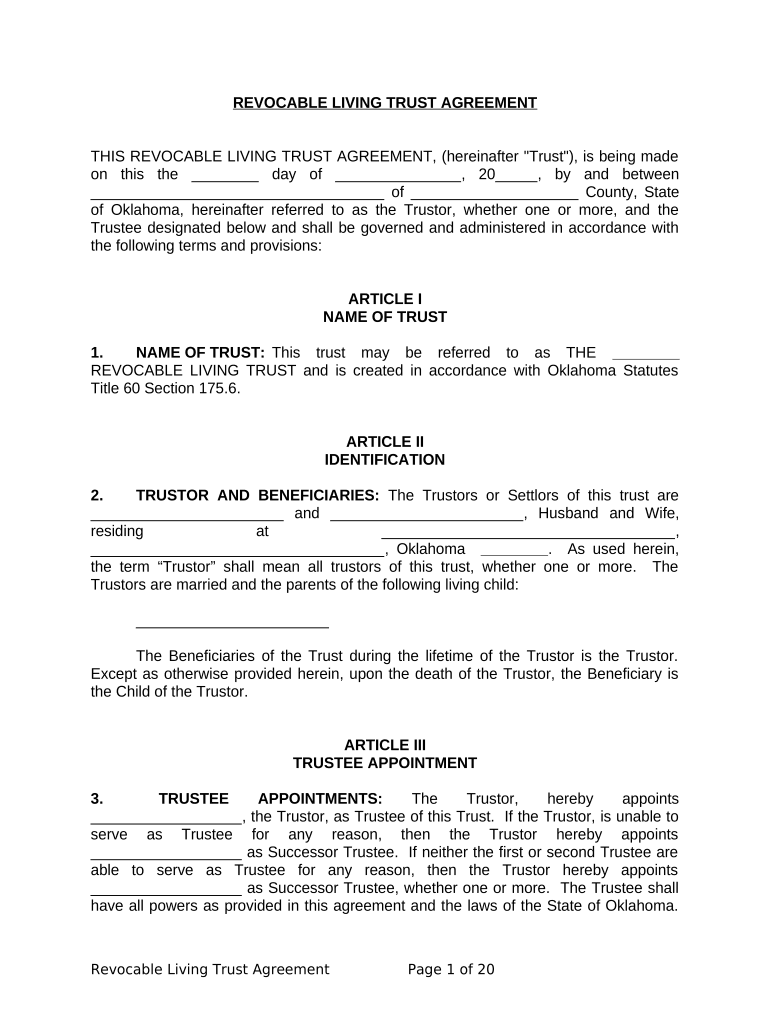

A living trust for husband and wife with one child in Oklahoma is a legal document that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust can help avoid probate, ensuring a smoother transition of assets to the surviving spouse and child. It offers flexibility in managing assets and can be amended or revoked as needed. Establishing a living trust can provide peace of mind, knowing that your family is taken care of according to your wishes.

Steps to Complete the Living Trust for Husband and Wife with One Child in Oklahoma

Completing a living trust involves several key steps:

- Determine the assets to be included in the trust.

- Choose a trustee, who will manage the trust.

- Draft the trust document, specifying the terms and conditions.

- Sign the document in the presence of a notary public.

- Fund the trust by transferring ownership of assets into it.

Each step is crucial to ensure that the trust is valid and meets your family's needs.

Key Elements of the Living Trust for Husband and Wife with One Child in Oklahoma

Several key elements are essential when creating a living trust:

- Trustees: Designate who will manage the trust, typically one or both spouses.

- Beneficiaries: Clearly identify the child as the primary beneficiary.

- Distribution Terms: Specify how and when assets will be distributed to the beneficiaries.

- Revocation Clause: Include terms that allow the trust to be amended or revoked if necessary.

These elements ensure that the trust aligns with your family's financial goals and wishes.

Legal Use of the Living Trust for Husband and Wife with One Child in Oklahoma

The living trust is legally recognized in Oklahoma, provided it meets state requirements. It must be properly executed, including signatures and notarization. The trust document should clearly outline the intentions of the grantors, and it must comply with Oklahoma laws regarding trusts. This legal standing offers protection and ensures that the trust's terms are enforceable in court.

State-Specific Rules for the Living Trust for Husband and Wife with One Child in Oklahoma

Oklahoma has specific rules governing living trusts. It is essential to adhere to state laws, which include:

- The trust must be in writing and signed by the grantors.

- It must be notarized to be legally binding.

- Oklahoma does not require the trust to be recorded, but doing so may provide additional legal protection.

Understanding these rules helps ensure that the trust is valid and enforceable.

How to Use the Living Trust for Husband and Wife with One Child in Oklahoma

Using a living trust involves managing the assets placed within it. The trustees are responsible for overseeing the trust, making decisions about asset management, and ensuring that distributions are made according to the trust's terms. During the grantors' lifetime, they can amend the trust as circumstances change. After the passing of the grantors, the trust becomes irrevocable, and the trustee must follow the outlined distribution plan for the beneficiaries.

Quick guide on how to complete living trust for husband and wife with one child oklahoma

Effortlessly Prepare Living Trust For Husband And Wife With One Child Oklahoma on Any Device

Online document management has increasingly become favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Living Trust For Husband And Wife With One Child Oklahoma on any device with the airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to Modify and eSign Living Trust For Husband And Wife With One Child Oklahoma with Ease

- Obtain Living Trust For Husband And Wife With One Child Oklahoma and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Living Trust For Husband And Wife With One Child Oklahoma and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with One Child in Oklahoma?

A Living Trust for Husband and Wife with One Child in Oklahoma is a legal arrangement that allows you to manage and distribute your assets during your lifetime and after your death. It ensures that your child receives the intended inheritance while potentially avoiding probate. This trust offers flexibility, allowing both spouses to act as trustees and manage the trust's assets together.

-

How does a Living Trust for Husband and Wife with One Child in Oklahoma benefit families?

A Living Trust for Husband and Wife with One Child in Oklahoma provides numerous benefits, such as maintaining privacy regarding your assets and simplifying the process of transferring property upon death. It also allows for immediate access to funds for your child without the delays often associated with probate. This can provide peace of mind for families concerned about their children's financial future.

-

What are the costs associated with setting up a Living Trust for Husband and Wife with One Child in Oklahoma?

The costs of establishing a Living Trust for Husband and Wife with One Child in Oklahoma can vary based on the complexity of the trust and the fees of the attorney or service provider. Typically, you can expect to pay between $1,000 to $3,000 for legal services to draft the trust. Using online platforms may offer more cost-effective options to help you create a trust at a lower price.

-

Can I modify a Living Trust for Husband and Wife with One Child in Oklahoma?

Yes, a Living Trust for Husband and Wife with One Child in Oklahoma is revocable, meaning that you can modify its terms as your circumstances change. This includes adjusting beneficiaries, changing trustees, or adding or removing assets. It's essential to review and update your trust regularly to reflect your current wishes and financial situation.

-

What happens to the Living Trust for Husband and Wife with One Child in Oklahoma if one spouse passes away?

If one spouse passes away, the Living Trust for Husband and Wife with One Child in Oklahoma typically remains revocable, allowing the surviving spouse to manage the trust. The assets can continue to be distributed according to the trust's terms without necessitating the probate process, ensuring a smooth transition for your child. It's important to review the trust after the death of a spouse to make necessary adjustments.

-

How does a Living Trust for Husband and Wife with One Child in Oklahoma ensure asset protection?

A Living Trust for Husband and Wife with One Child in Oklahoma can provide asset protection by keeping assets out of probate and safeguarding them from creditors. While it does not offer complete protection from lawsuits, it can help shield your child's inheritance from certain legal claims. Consulting with a legal professional can further clarify how to structure your trust for optimal asset protection.

-

Are there any tax benefits to setting up a Living Trust for Husband and Wife with One Child in Oklahoma?

Establishing a Living Trust for Husband and Wife with One Child in Oklahoma generally does not offer direct tax benefits, as assets in the trust are still considered part of your estate for tax purposes. However, it can aid in estate tax planning and help avoid probate taxes. Consulting a tax advisor can help you understand potential tax implications related to trusts.

Get more for Living Trust For Husband And Wife With One Child Oklahoma

Find out other Living Trust For Husband And Wife With One Child Oklahoma

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile