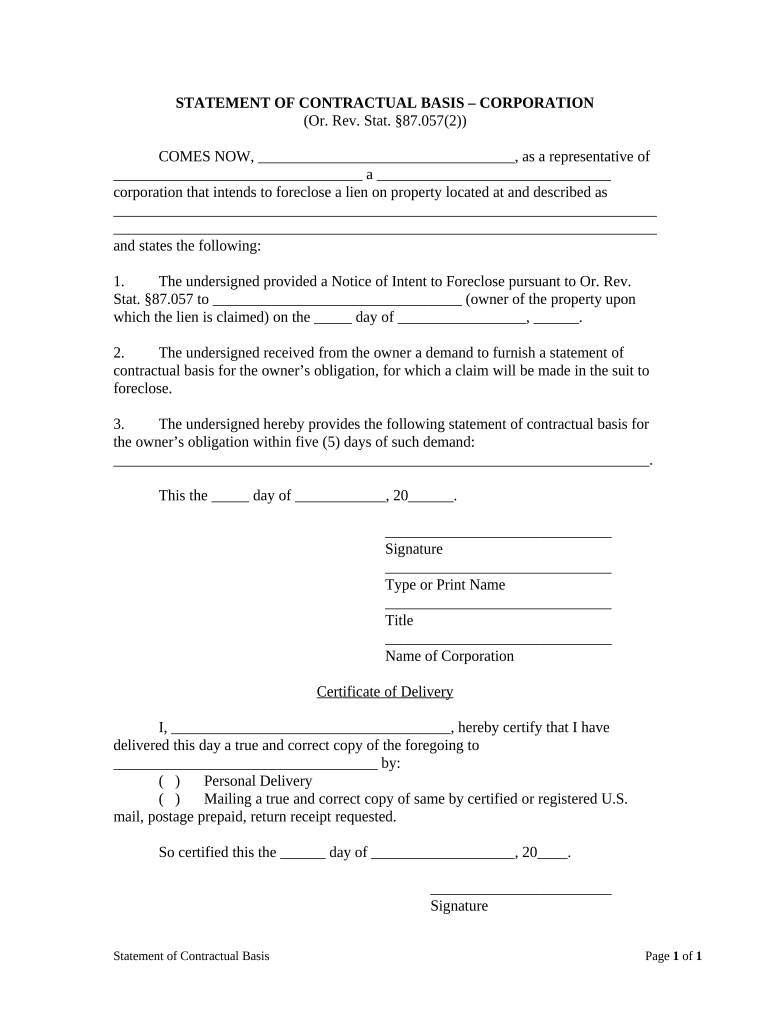

Basis Corporation Form

What is the Basis Corporation

The basis corporation is a specific type of business entity that allows for limited liability protection while enabling pass-through taxation. This structure is particularly appealing to small business owners and entrepreneurs who wish to separate their personal assets from their business liabilities. By establishing a basis corporation, owners can enjoy the benefits of a corporation without the double taxation typically associated with traditional corporate structures.

How to Use the Basis Corporation

Utilizing a basis corporation involves several steps, including formation, compliance, and operational management. Initially, business owners must file the necessary paperwork with the state to officially create the corporation. This includes submitting articles of incorporation and obtaining any required licenses or permits. Once established, the corporation must adhere to ongoing compliance requirements, such as annual reporting and tax filings. Understanding these aspects ensures that the basis corporation operates smoothly and remains in good standing with state and federal regulations.

Steps to Complete the Basis Corporation

Completing the basis corporation involves a series of essential steps:

- Choose a unique name for the corporation that complies with state regulations.

- File the articles of incorporation with the appropriate state agency.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

- Draft corporate bylaws that outline the governance structure and operational procedures.

- Hold an initial meeting with the board of directors to establish corporate policies.

- Maintain compliance by filing annual reports and tax documents as required.

Legal Use of the Basis Corporation

The legal use of the basis corporation is governed by both state and federal laws. It is crucial for business owners to understand the legal implications of operating under this structure. This includes adhering to corporate formalities, such as maintaining separate financial records and holding regular meetings. Failure to comply with these legal requirements can result in personal liability for business debts and obligations. Therefore, consulting with a legal professional can provide valuable guidance in navigating the complexities of corporate law.

Key Elements of the Basis Corporation

Several key elements define the basis corporation, including:

- Limited Liability: Protects personal assets from business debts.

- Pass-Through Taxation: Income is taxed at the individual level, avoiding double taxation.

- Formal Structure: Requires adherence to specific corporate formalities and governance.

- Ownership Flexibility: Allows for multiple shareholders and the issuance of stock.

Required Documents

To establish a basis corporation, several documents are typically required:

- Articles of Incorporation

- Bylaws of the corporation

- Employer Identification Number (EIN) application

- State-specific business licenses and permits

Having these documents prepared and filed correctly is essential for the successful formation and operation of the corporation.

Quick guide on how to complete basis corporation

Effortlessly Complete Basis Corporation on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly and without delays. Manage Basis Corporation on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Edit and Electronically Sign Basis Corporation

- Obtain Basis Corporation and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Basis Corporation to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit a basis corporation?

airSlate SignNow is an electronic signature solution designed to streamline the document signing process for businesses like basis corporations. It enhances efficiency by allowing users to send and eSign documents quickly, ensuring a smooth workflow and faster transactions.

-

How much does airSlate SignNow cost for a basis corporation?

Pricing for airSlate SignNow varies based on the plan chosen, making it suitable for basis corporations of all sizes. We offer flexible pricing that caters to different business needs, ensuring that every basis corporation can access our cost-effective eSignature solutions.

-

What features does airSlate SignNow offer for basis corporations?

airSlate SignNow provides a range of features perfect for basis corporations, including document templates, customizable workflows, and real-time tracking. These features help organizations simplify contract management and ensure compliance while enhancing collaboration.

-

Can airSlate SignNow integrate with other software used by basis corporations?

Yes, airSlate SignNow seamlessly integrates with a variety of applications commonly used by basis corporations, such as CRM and project management tools. This ensures that you can enhance your existing workflows and maximize productivity without any disruptions.

-

Is airSlate SignNow secure for use within a basis corporation?

Security is a top priority for airSlate SignNow, especially for basis corporations handling sensitive documents. We utilize industry-leading encryption and compliance measures to protect your data, allowing you to eSign documents with confidence.

-

How can using airSlate SignNow improve the efficiency of a basis corporation?

By utilizing airSlate SignNow, basis corporations can signNowly reduce the time spent on document management and signing processes. This leads to improved operational efficiency, as employees can focus more on core tasks rather than paperwork.

-

What types of documents can be signed using airSlate SignNow in a basis corporation?

airSlate SignNow allows basis corporations to eSign a wide range of documents, including contracts, agreements, and internal forms. This versatility ensures that any document requiring signatures can be handled swiftly and securely.

Get more for Basis Corporation

Find out other Basis Corporation

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien