Insurers Report Oregon Form

What is the Insurers Report Oregon

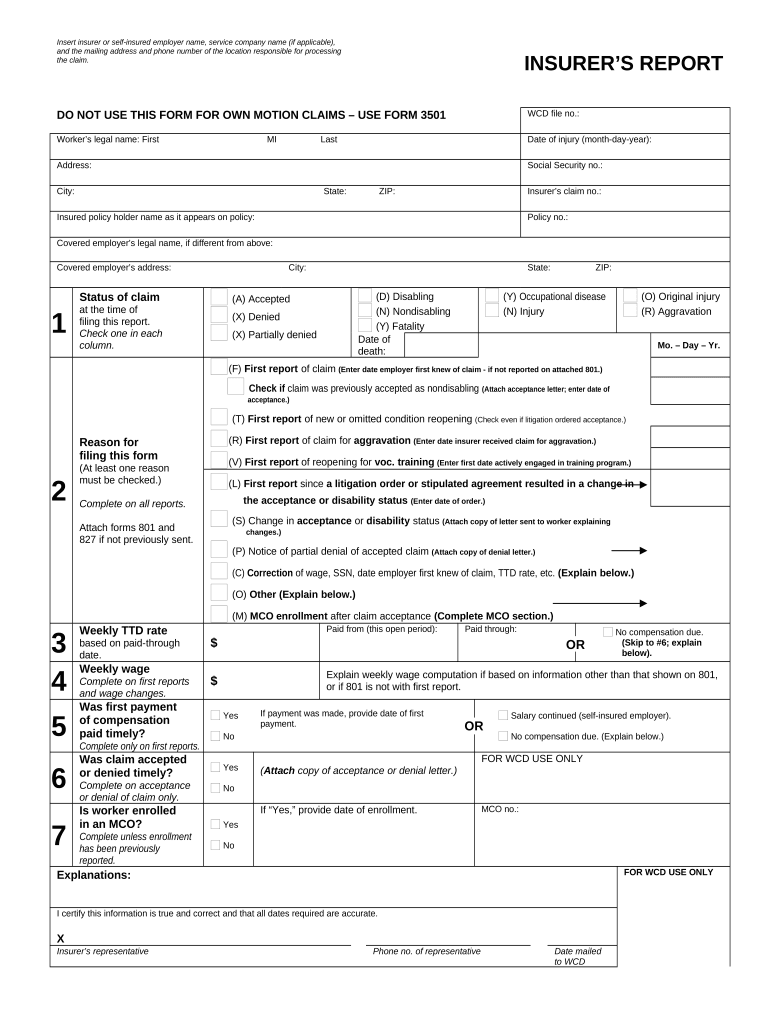

The Insurers Report Oregon is a formal document that provides essential information regarding insurance claims and policies within the state. This report is typically used by insurance companies to report losses, claims, and other relevant data to regulatory bodies. It serves as a key resource for understanding the insurance landscape in Oregon, helping stakeholders assess risks and make informed decisions.

How to obtain the Insurers Report Oregon

To obtain the Insurers Report Oregon, individuals or entities can request the report through the Oregon Department of Consumer and Business Services (DCBS). The process usually involves submitting a formal request, which may require specific identifying information and the purpose of the request. It is advisable to check the DCBS website for any forms or additional documentation that may be required.

Steps to complete the Insurers Report Oregon

Completing the Insurers Report Oregon involves several key steps:

- Gather necessary information, including details about the insurance policy, claims history, and any relevant loss data.

- Access the official form through the Oregon DCBS website or other authorized sources.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the completed form as directed, either electronically or via mail, depending on the submission guidelines.

Legal use of the Insurers Report Oregon

The Insurers Report Oregon is legally recognized as a vital document in the insurance industry. It must be completed in accordance with state regulations to ensure its validity. The report is used for regulatory compliance, helping to maintain transparency and accountability within the insurance sector. Properly completed reports can protect against legal liabilities and support claims processing.

Key elements of the Insurers Report Oregon

Key elements of the Insurers Report Oregon include:

- Policyholder information, including name and contact details.

- Details of the insurance policy, such as policy number and coverage type.

- Claims history, including dates, amounts, and descriptions of claims.

- Loss data, which may include the nature of the loss and any related documentation.

- Signatures of authorized representatives to validate the report.

State-specific rules for the Insurers Report Oregon

Oregon has specific rules governing the completion and submission of the Insurers Report. These rules are designed to ensure accuracy and compliance with state regulations. Insurers must adhere to deadlines for submission and maintain records of submitted reports. Familiarity with these rules is essential for insurance companies operating in Oregon to avoid penalties and ensure smooth operations.

Quick guide on how to complete insurers report oregon

Execute Insurers Report Oregon effortlessly on any gadget

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle Insurers Report Oregon on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The ideal method to modify and eSign Insurers Report Oregon effortlessly

- Obtain Insurers Report Oregon and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to deliver your form, via email, SMS, invite link, or download it to your PC.

Eliminate concerns about missing or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Insurers Report Oregon to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Insurers Report Oregon and how can it benefit my business?

The Insurers Report Oregon provides critical information related to insurance claims and coverage in the state. By utilizing this report, businesses can make informed decisions about risk management and insurance policies, ultimately leading to better financial planning and protection.

-

How does airSlate SignNow facilitate the process of obtaining the Insurers Report Oregon?

With airSlate SignNow, obtaining the Insurers Report Oregon is seamless. Our platform allows you to electronically sign and send documents, ensuring that you can quickly access the reports without delays or complicated processes, enhancing your efficiency in managing insurance needs.

-

What are the pricing options for accessing the Insurers Report Oregon through airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet diverse business needs. By subscribing, you can access the Insurers Report Oregon and other essential features at competitive rates, ensuring your investment provides the best value for your organization.

-

Is there any integration available for accessing the Insurers Report Oregon?

Yes, airSlate SignNow integrates with various software solutions to streamline your access to the Insurers Report Oregon. Our integrations with popular CRM and document management systems ensure that your workflow remains efficient and organized, saving you time and effort.

-

What security measures does airSlate SignNow implement while handling the Insurers Report Oregon?

Security is a top priority for airSlate SignNow. We use advanced encryption protocols and compliance measures to protect all documents, including the Insurers Report Oregon, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

Can I customize my Insurers Report Oregon documents using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your documents related to the Insurers Report Oregon. You can add fields, templates, and branding elements, making it easier to create tailored reports that meet your specific business needs.

-

How can I track my Insurers Report Oregon documents with airSlate SignNow?

Tracking your documents related to the Insurers Report Oregon is straightforward with airSlate SignNow. Our platform provides real-time updates and notifications on document statuses, so you always know when your reports are signed, sent, or viewed.

Get more for Insurers Report Oregon

Find out other Insurers Report Oregon

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter