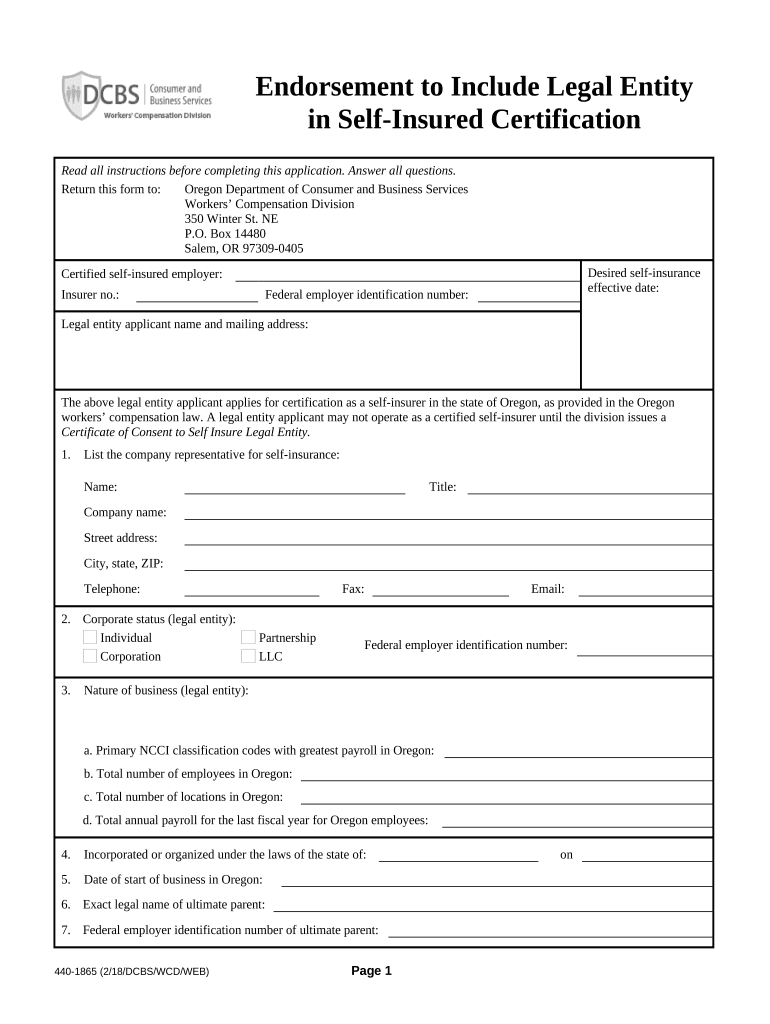

Oregon Entity Form

What is the Oregon Entity?

The Oregon entity refers to a legal structure recognized by the state of Oregon for businesses. This can include various forms such as Limited Liability Companies (LLCs), Corporations, and Partnerships. Each type of entity has its own legal implications, tax obligations, and operational requirements. Understanding the characteristics of the Oregon entity is crucial for business owners to ensure compliance with state regulations and to leverage the benefits associated with their chosen structure.

Key Elements of the Oregon Entity

When establishing an Oregon entity, several key elements must be considered:

- Business Name: The name must be unique and comply with Oregon naming regulations.

- Registered Agent: An individual or business designated to receive legal documents on behalf of the entity.

- Formation Documents: Required documents such as Articles of Incorporation or Organization must be filed with the state.

- Operating Agreement: While not mandatory for all entities, it is advisable to have an agreement outlining management and operational procedures.

- Tax Identification: Obtaining an Employer Identification Number (EIN) from the IRS is essential for tax purposes.

How to Obtain the Oregon Entity

To obtain an Oregon entity, follow these steps:

- Choose a business structure that fits your needs.

- Conduct a name search to ensure your desired business name is available.

- Prepare the necessary formation documents, such as Articles of Incorporation or Organization.

- File the documents with the Oregon Secretary of State, either online or by mail.

- Pay the required filing fees.

- Obtain any necessary licenses or permits specific to your business type.

Legal Use of the Oregon Entity

The legal use of the Oregon entity encompasses various activities, including conducting business operations, entering contracts, and protecting personal assets from business liabilities. Each entity type offers different levels of liability protection and tax treatment. It is essential for business owners to understand these legal implications to ensure compliance with state and federal laws.

Eligibility Criteria

Eligibility criteria for forming an Oregon entity typically include:

- Age: Owners must be at least eighteen years old.

- Residency: While non-residents can form entities in Oregon, having a registered agent with a physical address in the state is required.

- Compliance: All entities must comply with Oregon state laws and regulations.

Application Process & Approval Time

The application process for establishing an Oregon entity involves submitting the required formation documents to the Oregon Secretary of State. The approval time can vary based on the volume of applications but typically ranges from a few days to several weeks. Expedited processing options may be available for those needing faster approval.

Quick guide on how to complete oregon entity

Complete Oregon Entity seamlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Oregon Entity on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Oregon Entity with ease

- Obtain Oregon Entity and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or mask sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or a shared link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Oregon Entity and facilitate exceptional communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is endorsement legal in relation to eSignatures?

Endorsement legal refers to the legal acceptance of digital signatures for endorsing documents. With airSlate SignNow, you can create, send, and eSign documents securely while ensuring compliance with endorsement legal standards. This makes it a reliable choice for businesses looking to streamline their document workflow.

-

How does airSlate SignNow ensure compliance with endorsement legal requirements?

airSlate SignNow employs advanced security features including AES-256 bit encryption and audit trails to ensure that all eSignatures meet endorsement legal requirements. Our platform is designed to adhere to various laws and regulations, giving you confidence in the legality of your signed documents.

-

What features does airSlate SignNow offer for endorsement legal documents?

Our platform offers features specifically designed for endorsement legal needs, such as customizable templates, multi-party signing, and document tracking. These tools allow you to manage the endorsement workflow efficiently, ensuring that all legal aspects are covered.

-

Is airSlate SignNow cost-effective for businesses needing endorsement legal solutions?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to manage endorsement legal processes. With flexible pricing plans, you can choose an option that fits your budget while still gaining access to robust features designed for legal document signing.

-

Can airSlate SignNow integrate with other applications for endorsement legal needs?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications, including CRM and project management software, to enhance your endorsement legal processes. This integration capability allows for streamlined workflows and better document management across your operations.

-

What industries benefit most from using airSlate SignNow for endorsement legal matters?

Various industries, including real estate, finance, and legal services, benefit greatly from using airSlate SignNow for endorsement legal matters. Our platform provides the flexibility and features needed to cater to diverse sector requirements while ensuring compliance with all legal standards.

-

How fast can I get documents signed and endorsed using airSlate SignNow?

With airSlate SignNow, you can get documents signed and endorsed in minutes instead of days. Our user-friendly interface facilitates quick sending and signing, helping your business maintain efficiency in handling endorsement legal documents.

Get more for Oregon Entity

Find out other Oregon Entity

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement