Assignment to Living Trust Oregon Form

What is the Assignment To Living Trust Oregon

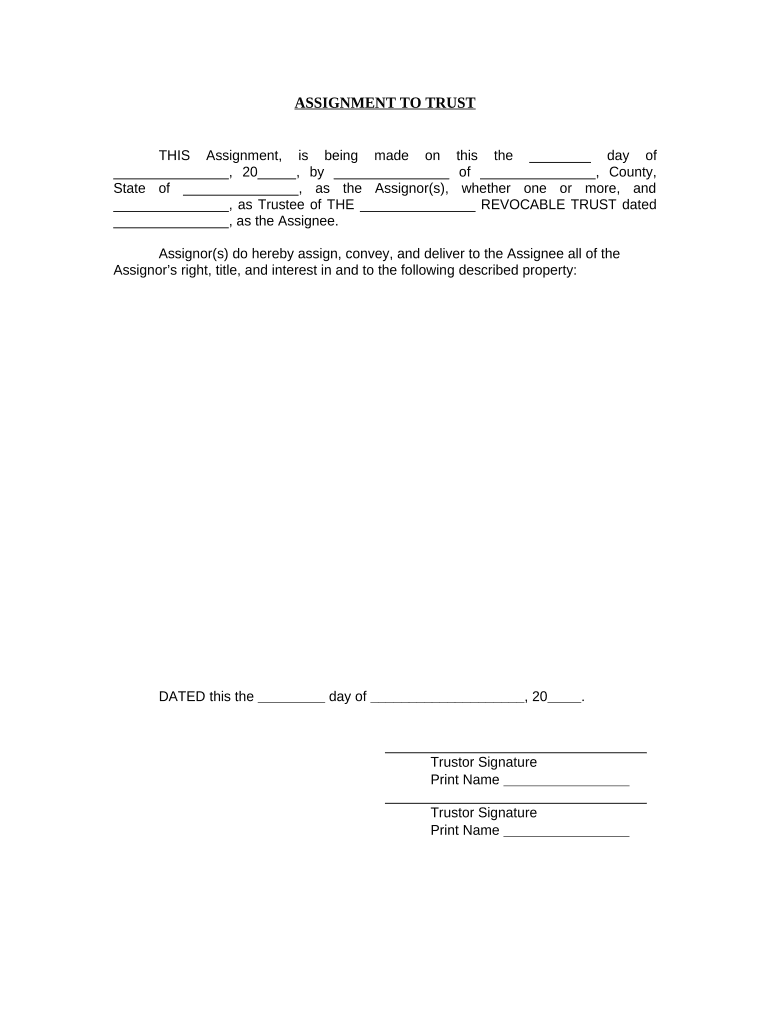

The Assignment To Living Trust Oregon is a legal document used to transfer ownership of assets into a living trust in the state of Oregon. This form is essential for individuals who wish to manage their assets during their lifetime and ensure a smooth transition of those assets upon their passing. By assigning property to a living trust, individuals can avoid probate, maintain privacy, and streamline the distribution process for their beneficiaries. This document typically includes details about the grantor, the trustee, and the specific assets being assigned to the trust.

Steps to Complete the Assignment To Living Trust Oregon

Completing the Assignment To Living Trust Oregon involves several key steps to ensure its validity and effectiveness. First, gather all relevant information about the assets you wish to assign, including property deeds, bank account details, and any other pertinent documentation. Next, fill out the form accurately, providing the necessary details about the grantor, trustee, and the assets being transferred. After completing the form, it is crucial to sign it in front of a notary public to validate the assignment. Finally, keep a copy of the signed document for your records and provide copies to the trustee and any relevant parties.

Legal Use of the Assignment To Living Trust Oregon

The Assignment To Living Trust Oregon is legally binding when executed according to Oregon state laws. To ensure its legal standing, the document must be signed by the grantor and notarized. Additionally, it is important to comply with any specific state requirements regarding the transfer of certain types of assets, such as real estate or financial accounts. Understanding these legal parameters helps prevent disputes and ensures that the trust operates as intended.

State-Specific Rules for the Assignment To Living Trust Oregon

Oregon has specific rules governing the creation and execution of living trusts, including the Assignment To Living Trust Oregon. These rules dictate how assets can be transferred, the rights of the grantor and trustee, and the necessary documentation for various asset types. For instance, real estate transfers may require additional forms, such as a deed, to be filed with the county recorder. Familiarizing yourself with these state-specific regulations is crucial for ensuring compliance and protecting your interests.

Required Documents for the Assignment To Living Trust Oregon

To complete the Assignment To Living Trust Oregon, several documents may be required. These typically include the trust document itself, proof of ownership for the assets being assigned, and identification for the grantor and trustee. Depending on the assets, additional documentation, such as property deeds or account statements, may also be necessary. Having all required documents prepared in advance can facilitate a smoother process.

Examples of Using the Assignment To Living Trust Oregon

There are various scenarios in which the Assignment To Living Trust Oregon can be utilized. For example, a homeowner may wish to transfer their property into a living trust to avoid probate and ensure that their beneficiaries receive the home without complications. Similarly, individuals with investment accounts may assign these assets to a trust for better management and distribution upon their passing. Each example highlights the flexibility and benefits of using this legal document to manage assets effectively.

Quick guide on how to complete assignment to living trust oregon

Effortlessly Prepare Assignment To Living Trust Oregon on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Assignment To Living Trust Oregon on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Alter and eSign Assignment To Living Trust Oregon with Ease

- Find Assignment To Living Trust Oregon and click Get Form to initiate the process.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method of delivering your document, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Edit and eSign Assignment To Living Trust Oregon and guarantee exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Assignment To Living Trust Oregon?

An Assignment To Living Trust Oregon is a legal document that transfers ownership of an individual's assets into a trust. This process helps ensure that your assets are managed according to your wishes while avoiding probate. Utilizing this feature can provide peace of mind and financial security for your beneficiaries.

-

How much does the Assignment To Living Trust Oregon service cost?

The pricing for the Assignment To Living Trust Oregon services can vary depending on the complexity of your trust and the assets involved. airSlate SignNow offers competitive rates for eSigning documents safely and securely online. For a detailed quote, you can contact our support team or check our pricing page.

-

What features does airSlate SignNow offer for Assignment To Living Trust Oregon?

airSlate SignNow provides a range of features including eSignature capabilities, document templates, and secure cloud storage. These tools simplify the process of creating and managing your Assignment To Living Trust Oregon. Additionally, our user-friendly interface ensures that the entire process is efficient and quick without compromising on security.

-

Can I customize my Assignment To Living Trust Oregon with airSlate SignNow?

Yes, you can fully customize your Assignment To Living Trust Oregon using airSlate SignNow’s document editor. The platform allows you to add specific clauses or terms that are important to your trust. This flexibility helps tailor the document to your unique needs.

-

Is it easy to integrate airSlate SignNow with other tools for Assignment To Living Trust Oregon?

Absolutely! airSlate SignNow offers seamless integrations with various tools and software to enhance your workflow. This means you can easily incorporate your Assignment To Living Trust Oregon process into existing systems for improved efficiency and convenience.

-

What are the benefits of using airSlate SignNow for Assignment To Living Trust Oregon?

Using airSlate SignNow for your Assignment To Living Trust Oregon brings numerous benefits, including cost-effectiveness, ease of use, and enhanced security. This enables users to streamline the document signing process, protecting sensitive information while ensuring compliance with legal requirements.

-

How long does it take to complete an Assignment To Living Trust Oregon with airSlate SignNow?

The time taken to complete an Assignment To Living Trust Oregon using airSlate SignNow varies based on your preparation. However, our platform allows for quick eSigning and document management, making the entire process efficient. Most users can finalize their documents within hours, rather than days.

Get more for Assignment To Living Trust Oregon

- Ssa 1372 bkpdffillercom form

- City of homestead application for utilities form

- Volunteer application piedmont casa pcasa form

- Restoring urban neighborhoods llc new york ny form

- Small business dvbe certification application std 812 rev 042011 form

- Transcript request form registraramp39s office sweet briar college registrar sbc

- Professional paralegal recertification form nals nals

- Leak allowance form

Find out other Assignment To Living Trust Oregon

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word