Notice of Assignment to Living Trust Oregon Form

What is the Notice Of Assignment To Living Trust Oregon

The Notice of Assignment to Living Trust in Oregon is a legal document that formally assigns assets to a living trust. This document serves to notify relevant parties, including beneficiaries and financial institutions, that certain assets are now held in trust. By doing so, it helps in the management and distribution of assets according to the terms outlined in the trust agreement. This notice is essential for ensuring that the trust operates effectively and that all parties are informed of the trust's existence and its terms.

How to use the Notice Of Assignment To Living Trust Oregon

Utilizing the Notice of Assignment to Living Trust in Oregon involves several steps to ensure proper execution. First, gather all necessary information about the assets being assigned to the trust, including descriptions and titles. Next, complete the notice form with accurate details about the trust and the assets. Once filled out, the document must be signed by the grantor and possibly notarized, depending on specific requirements. After execution, distribute copies of the notice to all relevant parties, such as beneficiaries and financial institutions, to inform them of the asset assignment.

Steps to complete the Notice Of Assignment To Living Trust Oregon

Completing the Notice of Assignment to Living Trust in Oregon requires careful attention to detail. Follow these steps:

- Gather information about the assets you wish to assign to the trust.

- Obtain the official Notice of Assignment form, which can be found through legal resources or state websites.

- Fill out the form, ensuring all information is accurate and complete.

- Sign the document in the presence of a notary, if required.

- Make copies of the signed notice for your records and for distribution.

- Distribute the notice to all relevant parties, including beneficiaries and financial institutions.

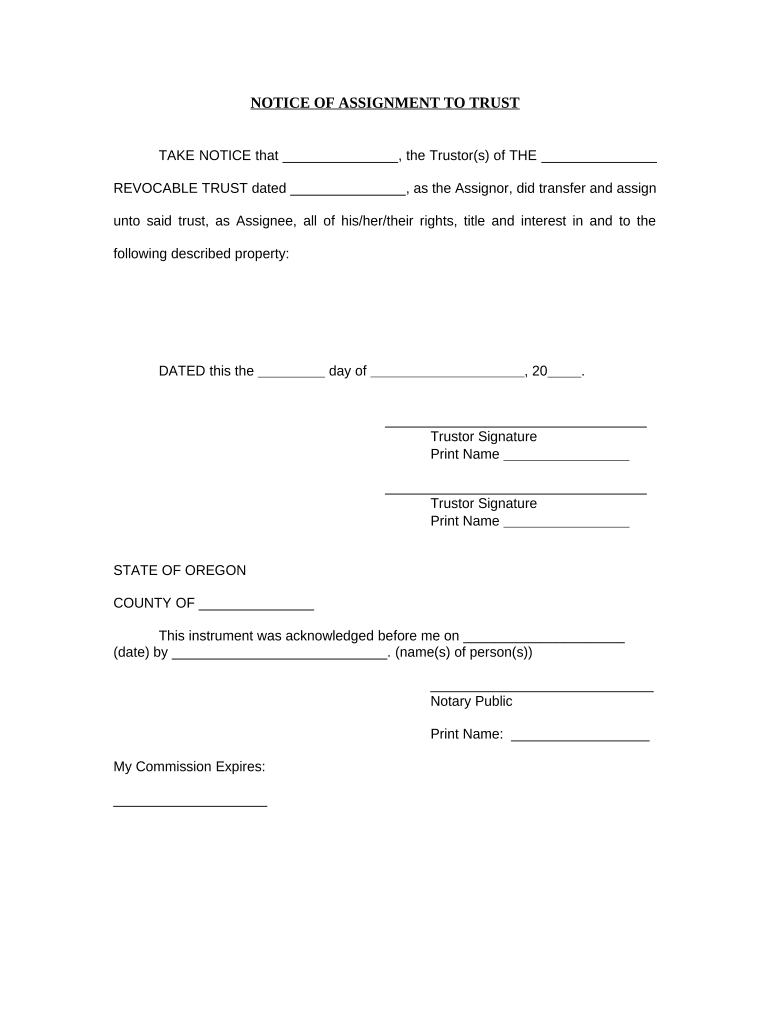

Key elements of the Notice Of Assignment To Living Trust Oregon

The Notice of Assignment to Living Trust in Oregon includes several key elements that must be clearly outlined. These elements typically consist of:

- The name of the trust and the date it was established.

- The name of the grantor or individual assigning the assets.

- A detailed description of the assets being assigned.

- The signatures of the grantor and any witnesses or notaries, if applicable.

- Any relevant legal citations or references to Oregon state law regarding trusts.

Legal use of the Notice Of Assignment To Living Trust Oregon

The legal use of the Notice of Assignment to Living Trust in Oregon is governed by state laws regarding trusts and estate planning. This document is crucial for establishing the legal framework within which the trust operates. It ensures that the assets are recognized as part of the trust, thereby providing legal protection against claims from creditors or disputes among beneficiaries. Proper execution and distribution of the notice are vital to uphold its legal standing and to ensure compliance with Oregon state regulations.

State-specific rules for the Notice Of Assignment To Living Trust Oregon

In Oregon, the Notice of Assignment to Living Trust is subject to specific state laws that dictate its use and requirements. It is important to be aware of the following rules:

- The document must be signed by the grantor and may require notarization.

- All asset descriptions must be clear and specific to avoid ambiguity.

- The notice must be distributed to all relevant parties to ensure transparency.

- Oregon law may require certain disclosures or additional documentation depending on the type of assets involved.

Quick guide on how to complete notice of assignment to living trust oregon

Effortlessly Prepare Notice Of Assignment To Living Trust Oregon on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Notice Of Assignment To Living Trust Oregon on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Edit and eSign Notice Of Assignment To Living Trust Oregon with Ease

- Find Notice Of Assignment To Living Trust Oregon and click Get Form to start.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Notice Of Assignment To Living Trust Oregon to ensure excellent communication at any point in the document preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Notice Of Assignment To Living Trust in Oregon?

A Notice Of Assignment To Living Trust in Oregon is a formal statement that notifies relevant parties of the transfer of assets into a living trust. This legal document helps to manage, protect, and distribute your assets according to your wishes during your lifetime and after your death. Understanding this process is crucial for effective estate planning.

-

How does airSlate SignNow facilitate creating a Notice Of Assignment To Living Trust in Oregon?

airSlate SignNow provides an intuitive platform that allows users to easily create, edit, and eSign a Notice Of Assignment To Living Trust in Oregon. With customizable templates and straightforward document management features, you can efficiently prepare this essential legal document without any hassle.

-

What are the benefits of using airSlate SignNow for estate planning documents like a Notice Of Assignment To Living Trust in Oregon?

Using airSlate SignNow for your estate planning documents, such as a Notice Of Assignment To Living Trust in Oregon, streamlines the signing process, saves time, and ensures document security. The platform allows for quick collaboration with legal advisors and beneficiaries, making important decisions easier and more efficient.

-

Does airSlate SignNow offer templates for the Notice Of Assignment To Living Trust in Oregon?

Yes, airSlate SignNow offers a variety of templates, including the Notice Of Assignment To Living Trust in Oregon. These templates are designed to meet Oregon's legal requirements, allowing you to fill in your details quickly while ensuring compliance with state regulations.

-

What is the pricing for using airSlate SignNow to create a Notice Of Assignment To Living Trust in Oregon?

airSlate SignNow offers flexible pricing plans tailored to various business needs, making it a cost-effective solution for creating a Notice Of Assignment To Living Trust in Oregon. Pricing typically includes access to all features, including template customization and eSigning, which can help you save on legal fees.

-

Is it easy to integrate airSlate SignNow with my existing document management systems for a Notice Of Assignment To Living Trust in Oregon?

Absolutely! airSlate SignNow offers seamless integrations with numerous document management systems and cloud storage services. This means you can efficiently manage your Notice Of Assignment To Living Trust in Oregon alongside your other important documents, ensuring a smooth workflow.

-

Can I share my completed Notice Of Assignment To Living Trust in Oregon with relevant parties using airSlate SignNow?

Yes, airSlate SignNow allows you to share your completed Notice Of Assignment To Living Trust in Oregon securely with relevant parties. You can invite others to review or eSign the document, ensuring that all necessary stakeholders are informed and involved in the estate planning process.

Get more for Notice Of Assignment To Living Trust Oregon

- Meal voucher request form dineoncampuscom

- Il driver education verification form top driver

- Breath alcohol technician training handbook form

- Hpd supplement application the huntsville police department form

- Fuel safe washington files gsx us appeal sqwalk form

- Wa162 form

- Cheerleading waiver release form

- Acp small job form res electrical safety authority

Find out other Notice Of Assignment To Living Trust Oregon

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe