Cip Disclosure 2012-2026

What is the CIP Disclosure?

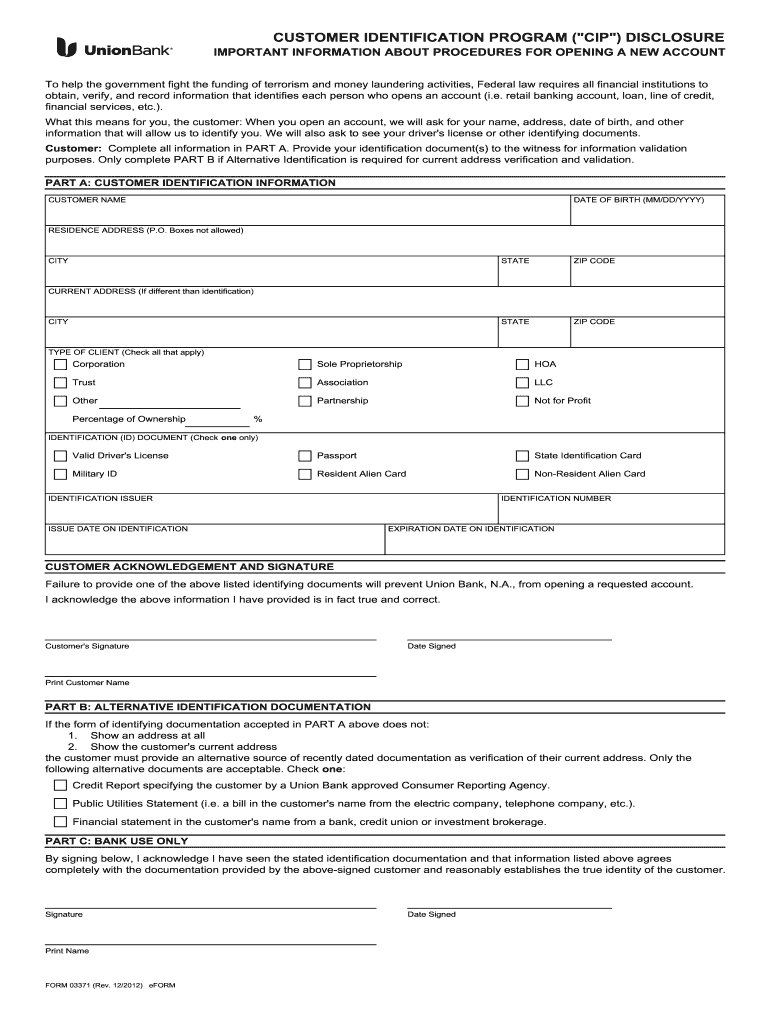

The Customer Identification Program (CIP) disclosure is a critical document that financial institutions use to verify the identity of their customers. This form is essential for compliance with the USA PATRIOT Act, which mandates that banks and other financial entities implement measures to prevent money laundering and terrorist financing. The CIP disclosure typically includes personal information such as name, address, date of birth, and Social Security number. By completing this form, customers help institutions ensure they are engaging with legitimate individuals and businesses.

Steps to Complete the CIP Disclosure

Completing the CIP disclosure involves several straightforward steps. First, gather the necessary personal information, including identification documents. Next, fill out the form with accurate details, ensuring all sections are completed. It is important to double-check for any errors or omissions, as inaccuracies can lead to delays in processing. Once the form is filled out, submit it as directed by the financial institution, either online or in person. This process helps ensure that your identity is verified promptly and securely.

Legal Use of the CIP Disclosure

The legal implications of the CIP disclosure are significant. Financial institutions must adhere to regulations set forth by the federal government to maintain compliance. This includes using the information provided in the CIP disclosure solely for the purpose of identity verification and not for any unauthorized activities. The form must be stored securely to protect customer privacy. Understanding these legal requirements is essential for both institutions and customers to ensure that the process is handled correctly and lawfully.

Key Elements of the CIP Disclosure

Several key elements define the CIP disclosure. These include:

- Customer Information: Basic personal details such as name, address, and date of birth.

- Identification Documents: Types of acceptable identification, such as a driver's license or passport.

- Signature: A declaration that the information provided is accurate and complete.

- Institution's Compliance Statement: A statement outlining the institution's commitment to safeguarding customer information.

These elements ensure that the form serves its purpose of verifying identity while protecting customer data.

How to Obtain the CIP Disclosure

Obtaining the CIP disclosure is typically straightforward. Most financial institutions provide access to this form on their official websites. Customers can also request a physical copy at their local branch. It is advisable to check with the specific institution for any additional requirements or variations in the form. Ensuring that you have the correct version of the CIP disclosure is crucial for compliance and successful submission.

Disclosure Requirements

Disclosure requirements for the CIP form are established by federal regulations and can vary by institution. Generally, customers are required to provide personal identification information and may need to present valid identification documents. Depending on the institution's policies, additional information may be requested to further verify identity. Understanding these requirements can facilitate a smoother process and help avoid any potential issues during submission.

Quick guide on how to complete customer identification program quotcipquot disclosure union bank

The optimal method to locate and endorse Cip Disclosure

Across the entire organization, unproductive workflows related to paper approvals can consume signNow working hours. Endorsing documents such as Cip Disclosure is a standard aspect of operations in every sector, which is why the effectiveness of each agreement’s lifecycle has a substantial impact on the overall productivity of the firm. With airSlate SignNow, endorsing your Cip Disclosure is as straightforward and swift as possible. You will discover on this platform the most recent version of virtually any document. Even better, you can endorse it immediately without having to download external applications to your device or printing any physical copies.

Steps to locate and endorse your Cip Disclosure

- Browse our collection by category or utilize the search bar to find the document you require.

- Inspect the document preview by clicking Learn more to confirm it’s the correct one.

- Click Get form to commence editing immediately.

- Fill out your document and input any required information using the toolbar.

- Once completed, click the Sign tool to endorse your Cip Disclosure.

- Select the endorsement method that suits you best: Draw, Generate initials, or upload a photo of your handwritten signature.

- Click Done to finalize editing and proceed to sharing options as necessary.

With airSlate SignNow, you have everything you need to handle your documents efficiently. You can find, complete, modify, and even send your Cip Disclosure in a single tab with no complications. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What are some of the best ways to learn programming?

It's been my sole focus to answer this question for the last two years, and I think a lot of the resources mentioned here are great but I've noticed there are three strategies that successful students consistently use better than anyone else regardless of what resources they use:1. Focus on habits, not goals2. Learning alone is painful3. Build thingsNote: some of this is borrowed from my answer to another Quora question: How can I prepare for Bloc?1. Focus on habits, not goalsIt seems counterintuitive that you shouldn't focus on goals, but hear me out -- it's all about leverage. Anyone who works with me knows that I dweebishly reference the R'as Al Ghul scene in Batman Begins pretty much 3-4 times a day:Our investors at Bloc are getting tired of board meetings starting with Batman clips.R'as tells Bruce: "Rub your chest, your arms will take care of themselves."If you focus on building the habit of programming for 20-30 hours a week, you will signNow your goal of being a web developer. If you focus on the goal of being a web developer in X months, you get nothing from that but stress and insecurity about how far along you are. Focus on the habit, not the goal. Rub your chest, your arms will take care of themselves.So here's what you should do right now: put 15 minutes a day on your calendar to spend time programming. Don't do more than 15, just focus on doing 15 minutes a day. If you can do it successfully with no excuses for a week, try bumping it up to 20 minutes a day. Don't try to overextend yourself by doing an hour a day right off the bat, this is going to be a 10,000 hour marathon so we're focusing on developing the habit right now. The number of minutes you put in isn't as important as you showing up each day.2. Learning alone is painfulWhen I was learning web development, the two biggest social components to my learning were having a mentor and belonging to a community.Having a mentorI worked at a small startup called merge.fm while in college. I learned more in the summer I spent working with one of their cofounders than I did in the entire previous year at my university. There's just something about working alongside an expert who knows more than you that really accelerates your learning, you're able to pick up on how they think and unveil what you don't know you don't know. There's a reason why mentorship used to be the de facto standard of learning a new trade, it's very effective.Belonging to a communityFor me, the two communities I belonged to were the Illini Entrepreneurship Network (a student organization at my university) and HackerNews (a large hacker/startup oriented online community).I didn't learn what objects and classes were from HackerNews, but I learned a different category of things. I learned that nobody likes Javascript. I learned that Rubyists are the hipsters of programming. I learned that Bret Taylor, Rich Hickey, and John Carmack are programming gods, and that software companies that are truly serious about coffee have kitchens that look like labs.In short, I learned how to talk shop. That turns out to be important when you're working with other developers, but it's also the thing that makes you feel like a developer.3. Build thingsIn the first year of learning web development, I built:A Digg Clone (from a Sitepoint book on Rails, I believe it's out of date now though)An E-Commerce App (from Agile Web Development with Rails 4)A GeekSquad-esque App (personal project)A Realtime, Online Classroom (personal project)A Foreign Language Flashcard App (class project)I think building real projects is important for many reasons, but the most important one to me is because it's fun. That's something that is tragically lost in classical education, but I think it's important enough to be on this list. Look for resources that show you how to build things, http://ruby.railstutorial.org/ is a good one.4. Be a cockroachI secretly added a 4th item for those of you who've stuck around to read this far down the page.Paul Graham once told the founders of Airbnb:"You guys won’t die, you’re like cockroaches."You'll probably want to quit learning how to code at some point. Like anything worthwhile, it's difficult and will make you feel stupid at times. This is why #1 on this list is so important -- stop worrying so much about whether you're making progress or how much longer it'll be until you feel like you've "made it." All you have to do is focus on showing up, for 10-30 hours a week. Be as mindless as a cockroach about everything else, and don't "die."I made the statement years ago which is often quoted that 80 percent of life is showing up. People used to always say to me that they wanted to write a play, they wanted to write a movie, they wanted to write a novel, and the couple of people that did it were 80 percent of the way to having something happen. All the other people struck out without ever getting that pack. They couldn’t do it, that’s why they don’t accomplish a thing, they don’t do the thing, so once you do it, if you actually write your film script, or write your novel, you are more than half way towards something good happening. So that I would say was say my biggest life lesson that has worked. All others have failed me.Woody Allen

-

How should I fill out my IAF application if I have no identification mark? Can I write NIL?

You need not to worry about it. The officer in-charge will find out the marks on your body mole, scar, marking etc on your body. He will write atleast two markings from your body.Kindly concentrate on your preparation so that you can join the defence service as early as possible. Wish you best of luck.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

Create this form in 5 minutes!

How to create an eSignature for the customer identification program quotcipquot disclosure union bank

How to create an electronic signature for your Customer Identification Program Quotcipquot Disclosure Union Bank online

How to create an electronic signature for your Customer Identification Program Quotcipquot Disclosure Union Bank in Google Chrome

How to make an eSignature for signing the Customer Identification Program Quotcipquot Disclosure Union Bank in Gmail

How to make an eSignature for the Customer Identification Program Quotcipquot Disclosure Union Bank right from your mobile device

How to make an eSignature for the Customer Identification Program Quotcipquot Disclosure Union Bank on iOS

How to create an eSignature for the Customer Identification Program Quotcipquot Disclosure Union Bank on Android devices

People also ask

-

What is a CIP form and how is it used?

A CIP form, or Customer Identification Program form, is a document used by businesses to verify the identity of their customers. It is essential in compliance with financial regulations and helps prevent identity theft. Using a CIP form within airSlate SignNow ensures that your customer verification process is efficient and secure.

-

How can I create a CIP form using airSlate SignNow?

Creating a CIP form in airSlate SignNow is simple and user-friendly. You can customize templates to fit your needs, adding necessary fields for information collection. Once your CIP form is set up, you can easily send it out for electronic signatures.

-

What are the pricing options for using airSlate SignNow to handle CIP forms?

airSlate SignNow offers various pricing plans designed to accommodate different business sizes and needs. The plans provide access to essential features for managing CIP forms and electronic signatures at an affordable cost. You can choose a plan that fits your budget while ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing CIP forms?

airSlate SignNow provides robust features for managing CIP forms, including customizable templates, secure electronic signatures, and real-time tracking. Additionally, it offers integrations with popular applications, streamlining the workflow for document management. These features help ensure that your CIP forms are managed effectively.

-

Are CIP forms created in airSlate SignNow legally binding?

Yes, CIP forms created and signed using airSlate SignNow are legally binding. The platform complies with electronic signature laws, ensuring that all signed documents, including CIP forms, hold up in court. This offers peace of mind when collecting sensitive customer information.

-

Can I integrate airSlate SignNow with other tools for handling CIP forms?

Absolutely! airSlate SignNow works seamlessly with a variety of third-party applications, allowing you to integrate your CIP forms into existing workflows. This can enhance efficiency and ensure smooth data transfer between systems, making the overall management of CIP forms easier.

-

What are the benefits of using airSlate SignNow for CIP forms?

The primary benefits of using airSlate SignNow for CIP forms include improved efficiency, enhanced security, and compliance with regulations. The platform simplifies the collection and verification process, reduces paperwork, and expedites the onboarding of customers while ensuring high data protection standards.

Get more for Cip Disclosure

- Residential rental lease application hawaii form

- Salary verification form for potential lease hawaii

- Tenant alterations 497304499 form

- Notice of default on residential lease hawaii form

- Landlord tenant lease co signer agreement hawaii form

- Application for sublease hawaii form

- Inventory and condition of leased premises for pre lease and post lease hawaii form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out hawaii form

Find out other Cip Disclosure

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure