Mortgage Short Pennsylvania Form

What is the Mortgage Short Pennsylvania?

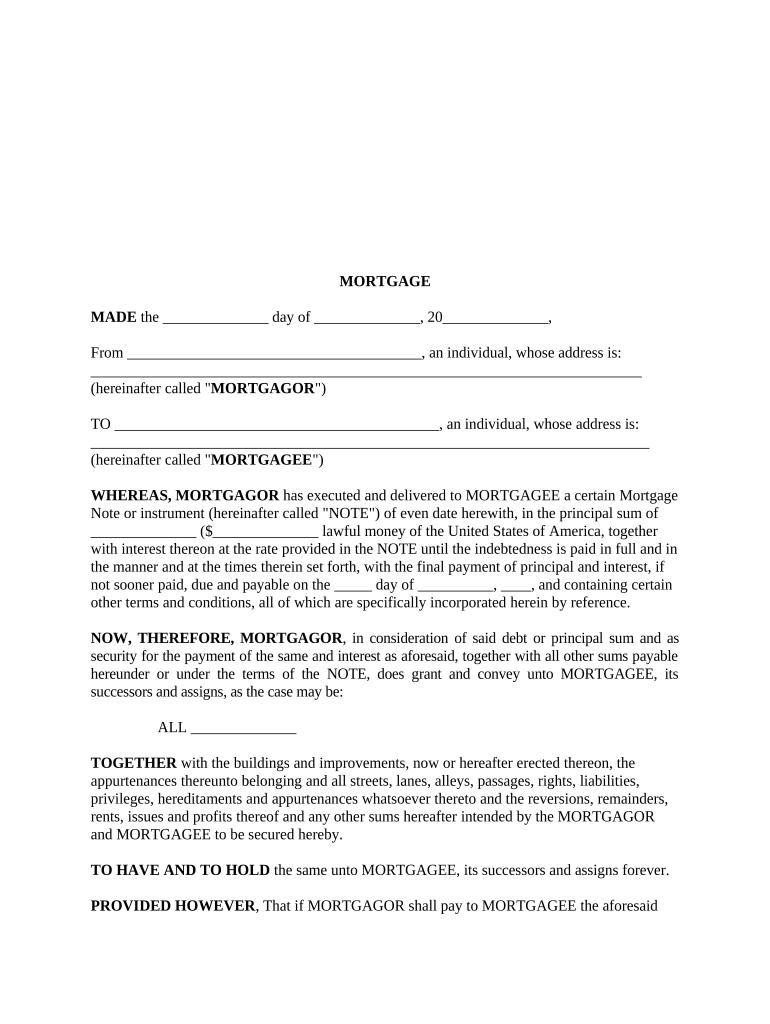

The Mortgage Short Pennsylvania form is a legal document used in the state of Pennsylvania to facilitate a short sale of a property. A short sale occurs when a homeowner sells their property for less than the amount owed on the mortgage, typically due to financial hardship. This form is essential for notifying the lender of the homeowner's intent to sell the property under these circumstances. It outlines the details of the mortgage, the property, and the reasons for the short sale, ensuring that all parties are aware of the situation and can proceed accordingly.

How to use the Mortgage Short Pennsylvania

Using the Mortgage Short Pennsylvania form involves several key steps. First, homeowners must gather necessary documentation, including financial statements and a hardship letter explaining their situation. Once these documents are ready, the homeowner completes the Mortgage Short Pennsylvania form, providing accurate information about the property and the mortgage. After filling out the form, it should be submitted to the lender for review. The lender will then assess the request and determine whether to approve the short sale based on the provided information.

Steps to complete the Mortgage Short Pennsylvania

Completing the Mortgage Short Pennsylvania form involves a systematic approach:

- Gather all required documents, such as your mortgage statement, proof of income, and a hardship letter.

- Fill out the Mortgage Short Pennsylvania form with accurate and detailed information regarding your mortgage and property.

- Review the form for any errors or omissions to ensure completeness.

- Submit the completed form along with the supporting documents to your lender.

- Follow up with the lender to confirm receipt and inquire about the review process.

Legal use of the Mortgage Short Pennsylvania

The Mortgage Short Pennsylvania form must be used in compliance with state and federal laws governing short sales. It is important to ensure that the form is filled out accurately and submitted in a timely manner to avoid any legal complications. The form serves as a formal request to the lender, and its proper use can help facilitate a smoother transaction. Legal advice may be beneficial to navigate the complexities of short sales and ensure that all requirements are met.

Key elements of the Mortgage Short Pennsylvania

The Mortgage Short Pennsylvania form contains several key elements that are crucial for its validity:

- Property Information: Details about the property being sold, including the address and current market value.

- Mortgage Details: Information about the existing mortgage, including the lender's name and the outstanding balance.

- Homeowner's Financial Information: A summary of the homeowner's financial situation, including income, expenses, and reasons for the short sale.

- Signatures: Required signatures from all parties involved, including the homeowner and any co-borrowers.

State-specific rules for the Mortgage Short Pennsylvania

Pennsylvania has specific regulations that govern short sales, which must be adhered to when using the Mortgage Short Pennsylvania form. These rules may include requirements for notifying the lender, timelines for submitting the form, and obligations for the homeowner to provide accurate information. Familiarity with these state-specific rules is essential to ensure compliance and to facilitate a successful short sale process.

Quick guide on how to complete mortgage short pennsylvania

Prepare Mortgage Short Pennsylvania effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Mortgage Short Pennsylvania on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

The easiest way to modify and electronically sign Mortgage Short Pennsylvania without hassle

- Obtain Mortgage Short Pennsylvania and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or redact confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Mortgage Short Pennsylvania and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mortgage Short in Pennsylvania?

A Mortgage Short in Pennsylvania refers to a situation where a homeowner sells their property for less than the amount owed on their mortgage. This process can be complex, but it may help homeowners avoid foreclosure. Understanding the implications and benefits of a Mortgage Short in Pennsylvania is crucial for making informed decisions.

-

How does airSlate SignNow help with Mortgage Shorts in Pennsylvania?

airSlate SignNow provides an efficient and secure way to handle the documentation associated with Mortgage Shorts in Pennsylvania. The platform allows users to eSign necessary documents quickly and effortlessly, ensuring a smooth transaction process. This can save time and reduce the stress involved in handling mortgage-related paperwork.

-

What are the costs associated with using airSlate SignNow for Mortgage Shorts in Pennsylvania?

airSlate SignNow offers cost-effective pricing plans tailored to fit various needs, including those related to Mortgage Shorts in Pennsylvania. Our subscription model allows users to choose between different plans based on their document needs, ensuring you only pay for what you use. This affordability is especially beneficial for individuals navigating the complexities of Mortgage Shorts.

-

What features does airSlate SignNow offer for managing Mortgage Shorts in Pennsylvania?

airSlate SignNow includes features like customizable templates, real-time collaboration, and secure cloud storage that are ideal for managing Mortgage Shorts in Pennsylvania. Users can create and send documents easily, track status updates, and ensure security with legally binding eSignatures. These functionalities streamline the document handling process signNowly.

-

Are there any integrations available with airSlate SignNow for Mortgage Shorts in Pennsylvania?

Yes, airSlate SignNow supports multiple integrations with popular platforms, making it an excellent choice for managing Mortgage Shorts in Pennsylvania. Whether you're using CRM software or other document management tools, our integrations enhance productivity. This compatibility supports seamless workflows and ensures you can work with your existing tools.

-

What are the benefits of using airSlate SignNow for mortgage documents?

Using airSlate SignNow for mortgage documents, including those related to Mortgage Shorts in Pennsylvania, offers several benefits. The platform is user-friendly, helping users navigate the signing process easily. Additionally, its efficiency reduces turnaround time signNowly, allowing for faster closings and enhanced customer satisfaction.

-

Is airSlate SignNow suitable for real estate professionals dealing with Mortgage Shorts in Pennsylvania?

Absolutely! airSlate SignNow is designed to cater to real estate professionals dealing with various transactions, including Mortgage Shorts in Pennsylvania. The platform's features facilitate efficient document management, helping agents quickly prepare, send, and sign necessary paperwork. This capability can signNowly enhance the service offered to clients experiencing mortgage challenges.

Get more for Mortgage Short Pennsylvania

- Intent to lien form

- North carolina final notice of forfeiture and request to vacate property under contract for deed form

- Promissory note form

- Maryland general power of attorney for care and custody of child or children form

- New mexico fiduciary deed form

- Last will and testament texas fill in the blank form

- Utah special or limited power of attorney for real estate sales transaction by seller form

- Arizona quitclaim deed by two individuals to husband and wife form

Find out other Mortgage Short Pennsylvania

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History