Form it 216Claim for Child and Dependent Care CreditIT216 Tax Ny

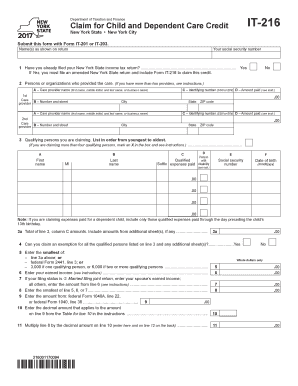

What is the Form IT 216?

The Form IT 216 is a tax form used in New York State for claiming the Child and Dependent Care Credit. This credit is designed to assist taxpayers who incur expenses for the care of their children or dependents while they work or look for work. The form allows eligible taxpayers to reduce their tax liability based on the amount spent on care services. Understanding the purpose of this form is essential for maximizing potential tax benefits and ensuring compliance with state tax regulations.

Steps to Complete the Form IT 216

Completing the Form IT 216 involves several key steps to ensure accurate submission and eligibility for the credit. Start by gathering all necessary information, including your personal details, income, and the total amount spent on child and dependent care. Follow these steps:

- Enter your personal information, including name, address, and Social Security number.

- Provide details about your qualifying dependents, including their names and ages.

- Report your total qualifying expenses for child and dependent care services.

- Calculate the credit amount based on your expenses and applicable percentage.

- Review the form for accuracy before submission.

It is important to ensure that all information is correct to avoid delays or issues with your tax return.

Eligibility Criteria for the Form IT 216

To qualify for the Child and Dependent Care Credit using Form IT 216, certain eligibility criteria must be met. Taxpayers must:

- Have earned income from employment or self-employment.

- Pay for care services for a child under the age of thirteen or a dependent who is physically or mentally incapable of self-care.

- Provide the care services to enable the taxpayer to work or look for work.

Meeting these criteria is crucial for successfully claiming the credit and receiving the associated tax benefits.

Required Documents for Form IT 216

When completing Form IT 216, certain documents are necessary to substantiate your claim. These may include:

- Receipts or invoices for child and dependent care expenses.

- Tax identification numbers for care providers.

- Proof of income, such as W-2 forms or pay stubs.

Having these documents ready can streamline the process and ensure that your claim is valid and complete.

Filing Deadlines for Form IT 216

It is essential to be aware of the filing deadlines associated with Form IT 216 to avoid penalties and ensure timely processing. Generally, the form must be filed by the same deadline as your New York State income tax return. This typically falls on April fifteenth of each year, unless extended. Keeping track of these dates is vital for maintaining compliance with state tax laws.

Form Submission Methods

Form IT 216 can be submitted through various methods, allowing flexibility for taxpayers. The submission options include:

- Filing electronically through tax preparation software that supports New York State forms.

- Mailing a paper copy of the completed form to the appropriate state tax office.

- In-person submission at designated tax offices, if available.

Choosing the right submission method can enhance the efficiency of your filing process and ensure that your form is received promptly.

Quick guide on how to complete child and dependent care credit form

Effortlessly Prepare child and dependent care credit form on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers a perfect environmentally friendly option to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage it 216 instructions on any device with the airSlate SignNow Android or iOS applications and ease any document-related process today.

How to Edit and eSign it 216 with Ease

- Obtain form it 216 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or disorganized files, tedious form searches, or errors that require reprinting new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign it 216 form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs it216

-

Is it better to pay for child-care expenses using a flexible spending account or to claim the dependent-care credit on my tax return?

The IRS Tax Code provides for a "Dependent Care Tax Credit" for those paying for dependent care of a child under age 13.The credit can also be used for a spouse or dependent (such as an elder) who cannot care for themselves and requires care. The expense must be absolutely medically necessary in such cases to allow the taxpayer (and spouse, if applicable) to work, seek work, or attend school.To determine any available credit, you might consider up to $3000 annually of child care expenses for a single dependent, and a maximum of $6000 annually for 2 or 2+ dependents. Depending on the your AGI or adjusted gross income, the maximum credit (dollar-for-dollar offset of tax liability) is: 30% ($720 annually for 1 child) IF you less than $10,000 per year.It decreases by 1% for each $2000 of additional annual income to 20% ($480 annually for 1 child) for you if your annual earning is over $28,000.The higher your earnings, the lower your tax credit. If your income is more than $43k annually, you'll qualify for the 20% break.The IRS Section 129 Dependent Care Assistance Plans (DCAP), are a form of employer-provided assistance for dependent care needs of employees. The most popular: Dependent Care Flexible Spending Account usually offered through a flexible benefit plan. Employees with this benefit may salary reduce on a pre-tax basis up to $5000 annually into a flexible spending account (FSA) for dependent care. Again, the care must be for a child under age 13 or a disabled dependent meeting certain other requirements. Not all employers offer a flexible spending option.These types of salary reduction contributions are exempt from federal income tax, state income tax, and social security tax. Once you've covered such an expense, you are required to submit an reasonable receipt in order to gain a reimbursement. Upon approval of the expense, a tax-free reimbursement is made to the employee. Not all employees are offered such benefits by the employer and the third party receipt usually cannot be as simple as a handwritten note from say, a family member you asked to babysit. Ask your employer about this and find a professional in your area as it is contingent on your specific tax situation.Say you have $5,000 in child-care expenses, you will get a tax break of only 1000.00. You can set aside up to $5,000 in pretax money in your FSA, and claim the dependent-care credit for up to $1,000 in additional expenses. (sources: IRS; Kiplinger's Tax Education; ProBenefits)Obviously some of these little known benefits are rarely provided by employers and it can be rather complicated if you're not doing financial planning or using unlicensed care vendors.So I would recommend you locate a licensed professional in your area and schedule an appointment if your benefits package has such an option and you're keeping your care providers at a corporate facility for example or an at home care medical professional.Usually if you'd like to take advantage of such credits you would have to hire an qualified Enrolled Agent, CPA, or tax professional with the type of software needed to reflect more intricate tax credits on your return. In other words, don't expect Turbo Tax or your local church free return preparation weekend to know about how to help you take advantage as it does require some financial planning and cooperation from your employer.If you're on a 1099 or work several jobs resulting in many W2s per year obviously such a solution would very difficult especially if you have a friend or family member who is not licensed providing cash basis care. In that case you're probably better off keeping your taxes simple rather than taking credits you might not qualify for and sticking with the general EITC refundable credit if you qualify.Not all tax credits are refundable meaning it will only offset the tax you owe by that amount and cause a nominal, if any change in your refund or owed amount. Complicating your return in some scenarios will only cost you more at filing time and it may well offset any benefit.

Related searches to it216 form 2012

Create this form in 5 minutes!

How to create an eSignature for the it216 instructions

How to generate an electronic signature for your Form It 2162012claim For Child And Dependent Care Creditit216 Tax Ny in the online mode

How to create an electronic signature for the Form It 2162012claim For Child And Dependent Care Creditit216 Tax Ny in Google Chrome

How to create an eSignature for putting it on the Form It 2162012claim For Child And Dependent Care Creditit216 Tax Ny in Gmail

How to make an electronic signature for the Form It 2162012claim For Child And Dependent Care Creditit216 Tax Ny from your smartphone

How to generate an electronic signature for the Form It 2162012claim For Child And Dependent Care Creditit216 Tax Ny on iOS devices

How to make an electronic signature for the Form It 2162012claim For Child And Dependent Care Creditit216 Tax Ny on Android devices

People also ask ny it 216

-

What are the key features of airSlate SignNow related to IT 216 instructions?

airSlate SignNow offers a variety of features including customizable templates, advanced security measures, and seamless eSigning workflows, all of which can help you effectively manage your IT 216 instructions. These features ensure that your documents are signed quickly and securely, optimizing your overall efficiency.

-

How can airSlate SignNow help streamline the IT 216 instructions process?

By utilizing airSlate SignNow, businesses can automate the sending and signing of IT 216 instructions, reducing time spent on manual processes. With easy-to-use templates and intuitive tools, you can manage your document workflows more efficiently, allowing you to focus on core business functions.

-

Is there a free trial available for airSlate SignNow to test IT 216 instructions?

Yes, airSlate SignNow provides a free trial that allows you to explore its features for handling IT 216 instructions without any commitment. This trial enables you to experience firsthand how the platform can enhance your document management processes before deciding on a subscription.

-

What pricing options does airSlate SignNow offer for managing IT 216 instructions?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes when managing IT 216 instructions. You can choose from various subscription tiers, ensuring that you select a plan that fits your budget and organizational requirements.

-

Can airSlate SignNow integrate with other applications for managing IT 216 instructions?

Absolutely! airSlate SignNow supports integrations with numerous applications, enhancing your ability to manage IT 216 instructions alongside other business tools. This integration capability ensures that you can maintain a streamlined workflow and improve collaboration across different platforms.

-

What security features does airSlate SignNow provide for IT 216 instructions?

airSlate SignNow prioritizes security by employing advanced encryption and compliance with various regulations to protect your IT 216 instructions. This ensures that all your documents are secure, providing peace of mind whether you are sending, signing, or storing sensitive information.

-

How does airSlate SignNow enhance the eSign experience for IT 216 instructions?

airSlate SignNow simplifies the eSigning experience for IT 216 instructions through its user-friendly interface and robust functionalities. Users can sign documents from any device conveniently, making the process not only efficient but also accessible for all parties involved.

Get more for ny it 216 instructions

- Oregon marine board bill of sale form

- Notice of appeal form oregon

- Oregon petition for review administrative child support order form

- Pennsylvania gaming control board institutional investor notice of ownership form

- Pa certified gaming service provider form

- Pgcb sgspr 1111 form

- Renewal instructions for alarm business license dlt ri form

- Ri dem water resources freshwater wetlands application and dem ri form

Find out other it 216 instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors