Business Credit Application Pennsylvania Form

What is the Business Credit Application Pennsylvania

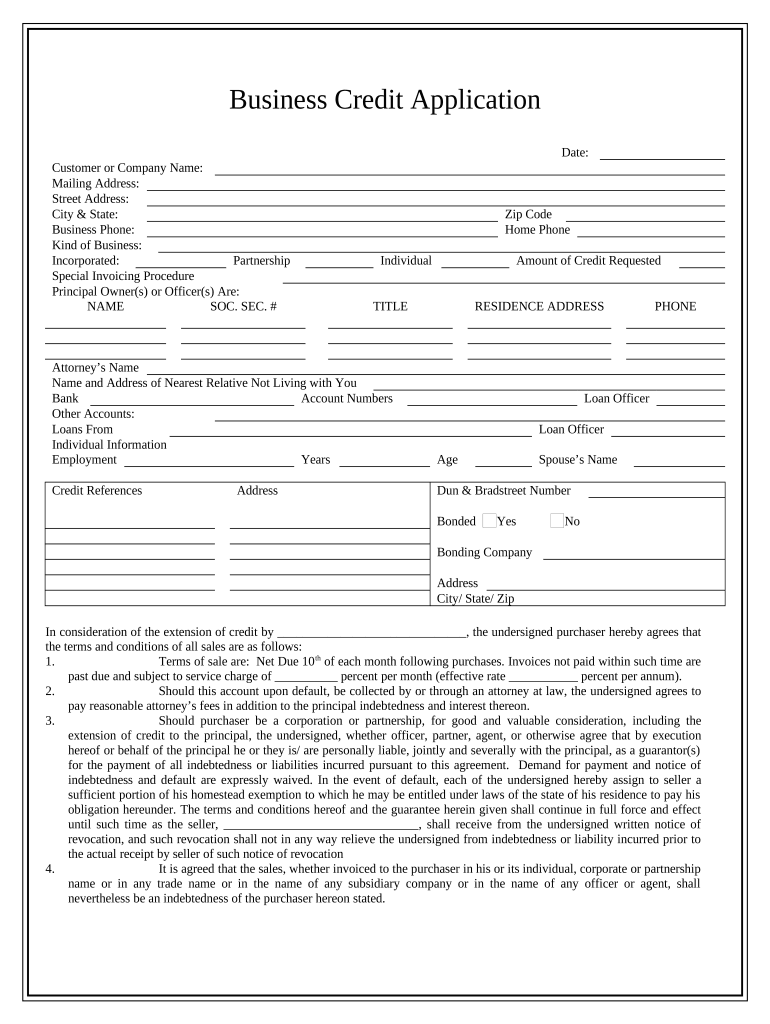

The Business Credit Application Pennsylvania is a formal document that businesses in Pennsylvania use to apply for credit from lenders or suppliers. This application typically includes essential information about the business, such as its legal name, address, ownership structure, and financial details. By submitting this form, businesses seek to establish creditworthiness and facilitate transactions with vendors or financial institutions.

How to use the Business Credit Application Pennsylvania

Using the Business Credit Application Pennsylvania involves several straightforward steps. First, gather all necessary information about your business, including financial statements and ownership details. Next, fill out the application accurately, ensuring that all fields are completed. Once the form is filled out, review it for any errors or omissions before submitting it to the intended lender or supplier. Utilizing electronic signature solutions can streamline this process, making it easier to send and sign the document securely.

Steps to complete the Business Credit Application Pennsylvania

Completing the Business Credit Application Pennsylvania involves a systematic approach:

- Gather necessary documents, including financial statements and identification.

- Provide basic business information, such as the business name and address.

- Detail the ownership structure, including names and contact information for owners.

- Include financial information, such as annual revenue and existing debts.

- Review the application for accuracy and completeness.

- Submit the application electronically or via traditional mail, depending on the lender's requirements.

Legal use of the Business Credit Application Pennsylvania

The legal use of the Business Credit Application Pennsylvania is paramount for ensuring compliance with state and federal regulations. This form must be filled out truthfully, as providing false information can lead to legal consequences, including denial of credit or potential fraud charges. Additionally, the use of electronic signatures on this form is legally recognized, provided that the signing process adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Key elements of the Business Credit Application Pennsylvania

Several key elements are essential for the Business Credit Application Pennsylvania to be complete and effective:

- Business Information: Legal name, address, and type of business entity.

- Ownership Details: Names and contact information of owners or partners.

- Financial Information: Revenue, expenses, and existing debts.

- Credit History: Any previous credit relationships or outstanding obligations.

- Signature: An authorized signature to validate the application.

Eligibility Criteria

Eligibility for submitting the Business Credit Application Pennsylvania typically depends on several factors, including:

- The legal structure of the business (e.g., LLC, corporation, partnership).

- The business's credit history and financial stability.

- Compliance with state and federal regulations.

- The purpose of the credit being sought, such as for inventory purchases or operational expenses.

Quick guide on how to complete business credit application pennsylvania

Effortlessly Prepare Business Credit Application Pennsylvania on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without any holdups. Manage Business Credit Application Pennsylvania on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to Edit and Electronically Sign Business Credit Application Pennsylvania with Ease

- Obtain Business Credit Application Pennsylvania and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Business Credit Application Pennsylvania to guarantee smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application Pennsylvania, and how can it benefit my business?

A Business Credit Application Pennsylvania is a formal document used by businesses to apply for credit or financing. It streamlines the application process, allowing lenders to assess your business's creditworthiness efficiently. By using this application, businesses can improve their chances of securing favorable credit terms and funding opportunities.

-

How do I complete a Business Credit Application Pennsylvania through airSlate SignNow?

To complete a Business Credit Application Pennsylvania using airSlate SignNow, simply upload the required documents to our platform. Follow the guided steps to fill out the application fields electronically and add your eSignature. Our user-friendly interface makes the entire process quick and hassle-free.

-

Are there any costs associated with using airSlate SignNow for my Business Credit Application Pennsylvania?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of different businesses. You can choose a plan that best fits your budget and requirements, allowing you to manage your Business Credit Application Pennsylvania effectively without breaking the bank.

-

What features of airSlate SignNow enhance the Business Credit Application Pennsylvania process?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking that enhance the Business Credit Application Pennsylvania process. These tools ensure that your application is completed accurately and efficiently, reducing the risk of errors and improving turnaround times.

-

Can I integrate airSlate SignNow with other tools for my Business Credit Application Pennsylvania?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications and platforms like CRM systems and cloud storage services. This compatibility allows you to streamline your Business Credit Application Pennsylvania process, ensuring that all your documents and data are readily accessible.

-

Is my information secure when using airSlate SignNow for Business Credit Applications Pennsylvania?

Yes, airSlate SignNow prioritizes your data security. We implement advanced encryption practices and comply with industry standards to protect your sensitive information during the Business Credit Application Pennsylvania process. You can trust that your data is in safe hands.

-

How quickly can I get a response after submitting a Business Credit Application Pennsylvania?

Response times may vary depending on the lender’s review process. However, using airSlate SignNow can signNowly reduce processing times as it organizes and streamlines Business Credit Application Pennsylvania submissions. Many businesses report quicker response rates compared to traditional methods.

Get more for Business Credit Application Pennsylvania

Find out other Business Credit Application Pennsylvania

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now