Non Foreign Affidavit under IRC 1445 Pennsylvania Form

What is the Non Foreign Affidavit Under IRC 1445 Pennsylvania

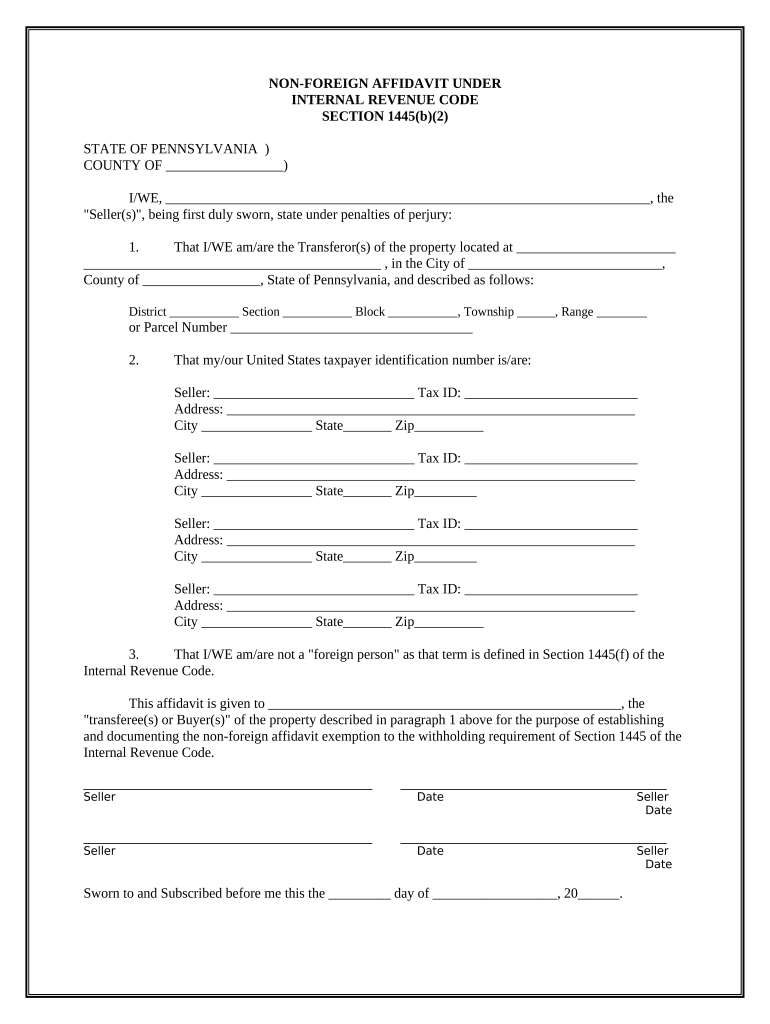

The Non Foreign Affidavit Under IRC 1445 is a legal document required in Pennsylvania for transactions involving real property where the seller is not a foreign person. This affidavit serves to certify the seller's status, ensuring compliance with federal tax regulations. It is essential for buyers to obtain this affidavit to avoid withholding taxes that may apply to foreign sellers. The form must be completed accurately to reflect the seller's identity and residency status, thereby facilitating a smoother transaction process.

How to Use the Non Foreign Affidavit Under IRC 1445 Pennsylvania

To use the Non Foreign Affidavit Under IRC 1445 in Pennsylvania, the seller must fill out the form with accurate information regarding their residency status. This includes providing their name, address, and taxpayer identification number. Once completed, the affidavit should be presented to the buyer or their representative during the closing of the real estate transaction. It is important to ensure that all information is correct to avoid any potential legal complications or tax liabilities.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 Pennsylvania

Completing the Non Foreign Affidavit Under IRC 1445 involves several key steps:

- Gather necessary information, including your name, address, and taxpayer identification number.

- Obtain the official form from a reliable source, ensuring it is the most current version.

- Fill out the form accurately, confirming that all details reflect your residency status.

- Sign and date the affidavit in the presence of a notary public to validate the document.

- Submit the completed affidavit to the buyer or their representative during the closing process.

Legal Use of the Non Foreign Affidavit Under IRC 1445 Pennsylvania

The legal use of the Non Foreign Affidavit Under IRC 1445 is crucial for ensuring compliance with federal tax laws. By providing this affidavit, sellers affirm their non-foreign status, which protects buyers from potential withholding taxes. Failure to submit this affidavit can result in significant tax liabilities for the buyer, making it a vital component of real estate transactions in Pennsylvania. It is advisable to consult with a legal professional to ensure proper completion and submission of the form.

Key Elements of the Non Foreign Affidavit Under IRC 1445 Pennsylvania

Key elements of the Non Foreign Affidavit Under IRC 1445 include:

- The seller's full legal name and address.

- The seller's taxpayer identification number, such as a Social Security number or Employer Identification Number.

- A declaration confirming the seller's status as a non-foreign person.

- The date of the affidavit and the seller's signature, witnessed by a notary public.

Filing Deadlines / Important Dates

Filing deadlines for the Non Foreign Affidavit Under IRC 1445 typically coincide with the closing date of the real estate transaction. It is essential for sellers to complete and submit the affidavit before the closing to ensure compliance and avoid any potential tax withholding issues. Buyers and sellers should communicate effectively to confirm that all necessary documents, including the affidavit, are prepared in advance of the closing date.

Quick guide on how to complete non foreign affidavit under irc 1445 pennsylvania

Complete Non Foreign Affidavit Under IRC 1445 Pennsylvania effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right format and securely keep it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your documents promptly without holdups. Manage Non Foreign Affidavit Under IRC 1445 Pennsylvania on any platform with airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and eSign Non Foreign Affidavit Under IRC 1445 Pennsylvania with ease

- Find Non Foreign Affidavit Under IRC 1445 Pennsylvania and then click Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Non Foreign Affidavit Under IRC 1445 Pennsylvania and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Pennsylvania?

A Non Foreign Affidavit Under IRC 1445 Pennsylvania is a legal document used to signNow that a seller is not a foreign person for tax purposes. This affidavit is essential when transferring real estate in Pennsylvania, as it helps ensure compliance with IRS regulations. Without this affidavit, buyers may face withholding tax issues during property transactions.

-

Why do I need a Non Foreign Affidavit Under IRC 1445 Pennsylvania?

You need a Non Foreign Affidavit Under IRC 1445 Pennsylvania to avoid potential withholding taxes on the sale of real estate. By providing this affidavit, you affirm that you are not a foreign entity, allowing for a smoother transaction process. Moreover, it helps protect buyers from unnecessary tax liabilities.

-

How does airSlate SignNow simplify the process for Non Foreign Affidavit Under IRC 1445 Pennsylvania?

AirSlate SignNow simplifies the process of completing a Non Foreign Affidavit Under IRC 1445 Pennsylvania by providing easy-to-use templates and electronic signature capabilities. With our platform, you can quickly fill out the affidavit and securely send it for signing. This reduces the time and paperwork typically associated with legal document processing.

-

What features does airSlate SignNow offer for managing Non Foreign Affidavit Under IRC 1445 Pennsylvania documents?

AirSlate SignNow offers several features tailored for managing Non Foreign Affidavit Under IRC 1445 Pennsylvania documents, including secure eSigning, customizable templates, and document tracking. These features ensure that you can efficiently handle multiple documents while maintaining compliance. Our user-friendly interface allows for a seamless signing experience.

-

Is airSlate SignNow cost-effective for managing Non Foreign Affidavit Under IRC 1445 Pennsylvania?

Yes, airSlate SignNow is a cost-effective solution for managing Non Foreign Affidavit Under IRC 1445 Pennsylvania. Our pricing plans are designed to fit various business needs, making it affordable for both small businesses and large enterprises. With unlimited eSigning, you can save money on printing and shipping costs.

-

Can I integrate airSlate SignNow with other software for Non Foreign Affidavit Under IRC 1445 Pennsylvania?

Absolutely! AirSlate SignNow integrates seamlessly with popular software such as CRM systems, cloud storage platforms, and project management tools. This connectivity allows you to manage your Non Foreign Affidavit Under IRC 1445 Pennsylvania documents alongside other critical business processes, enhancing efficiency across your operations.

-

What are the benefits of using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Pennsylvania?

Using airSlate SignNow for your Non Foreign Affidavit Under IRC 1445 Pennsylvania documents offers numerous benefits, including faster turnaround times, enhanced security, and improved compliance with legal requirements. Our platform also provides real-time updates and access to audit trails, ensuring that you can track every stage of the signing process.

Get more for Non Foreign Affidavit Under IRC 1445 Pennsylvania

Find out other Non Foreign Affidavit Under IRC 1445 Pennsylvania

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free