Living Trust Property Record Pennsylvania Form

What is the Living Trust Property Record Pennsylvania

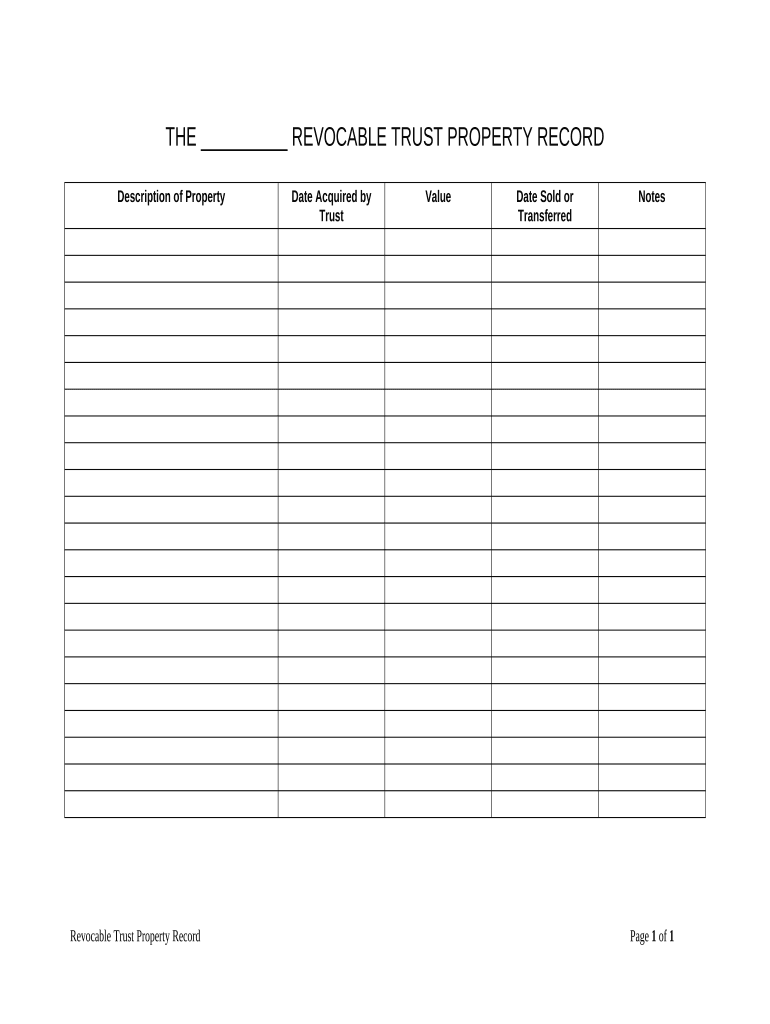

The Living Trust Property Record in Pennsylvania is a legal document that outlines the assets held within a living trust. This record serves to clarify the ownership and management of property during the grantor's lifetime and after their passing. It is essential for ensuring that the assets are distributed according to the grantor's wishes, avoiding probate, and providing a clear directive for the management of the trust. The document typically includes details about the property, the names of the trustees, and the beneficiaries involved.

How to use the Living Trust Property Record Pennsylvania

Using the Living Trust Property Record in Pennsylvania involves several steps. First, ensure that the trust is properly established by drafting a trust agreement. Next, list all assets that will be included in the trust, such as real estate, bank accounts, and investments. Once the assets are identified, complete the Living Trust Property Record form by providing detailed information about each asset, including descriptions and values. After filling out the form, it should be signed by the grantor and any required witnesses to ensure its legal validity.

Steps to complete the Living Trust Property Record Pennsylvania

Completing the Living Trust Property Record in Pennsylvania requires careful attention to detail. Follow these steps:

- Gather all necessary information about the assets to be included in the trust.

- Fill out the Living Trust Property Record form with accurate descriptions and values of each asset.

- Ensure that the form is signed by the grantor and any required witnesses.

- Store the completed form in a secure location, such as a safe or with an attorney.

- Regularly update the record as assets change or new assets are added to the trust.

Legal use of the Living Trust Property Record Pennsylvania

The Living Trust Property Record in Pennsylvania is legally binding when properly executed. It provides a framework for the management and distribution of assets according to the grantor's wishes. To ensure legal compliance, it is important to adhere to state laws regarding trusts and estate planning. This includes following specific guidelines for signing and witnessing the document, as well as keeping it updated to reflect any changes in the grantor's circumstances or asset ownership.

Key elements of the Living Trust Property Record Pennsylvania

Several key elements must be included in the Living Trust Property Record in Pennsylvania to ensure its effectiveness and legal standing:

- Grantor Information: The name and details of the person establishing the trust.

- Trustee Information: Names of individuals or entities responsible for managing the trust.

- Beneficiary Information: Names of those who will receive the assets upon the grantor's passing.

- Asset Description: Detailed information about each asset included in the trust.

- Signatures: Required signatures of the grantor and witnesses to validate the document.

State-specific rules for the Living Trust Property Record Pennsylvania

Pennsylvania has specific rules governing the creation and execution of living trusts. These rules dictate how the Living Trust Property Record should be filled out and maintained. It is crucial to comply with state laws regarding the age and mental capacity of the grantor, as well as the requirements for witnesses and notarization. Additionally, Pennsylvania law may have specific provisions related to the types of assets that can be placed in a living trust and the rights of beneficiaries.

Quick guide on how to complete living trust property record pennsylvania

Complete Living Trust Property Record Pennsylvania effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents promptly without delays. Handle Living Trust Property Record Pennsylvania on any device using the airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

How to edit and electronically sign Living Trust Property Record Pennsylvania effortlessly

- Locate Living Trust Property Record Pennsylvania and then click Get Form to initiate.

- Employ the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive data with features that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to store your updates.

- Select how you wish to share your form, by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choice. Modify and electronically sign Living Trust Property Record Pennsylvania to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in Pennsylvania?

A Living Trust Property Record in Pennsylvania is a legal document that ensures real estate assets are managed and transferred according to the trust creator's wishes. This document allows for seamless handling of property during the grantor's lifetime and after their passing, avoiding probate. Understanding this record is crucial for individuals looking to protect their assets effectively.

-

How can airSlate SignNow help with Living Trust Property Records in Pennsylvania?

airSlate SignNow provides an efficient platform to electronically sign, store, and manage Living Trust Property Records in Pennsylvania. With its user-friendly interface, users can streamline the document signing process, ensuring that all parties have immediate access to the necessary records. This enhances the security and organization of important legal documents.

-

What are the benefits of using airSlate SignNow for managing Living Trust Property Records in Pennsylvania?

Utilizing airSlate SignNow for Living Trust Property Records in Pennsylvania offers signNow benefits like cost-effectiveness, enhanced security, and ease of use. Users can quickly create, sign, and store their documents securely in the cloud, reducing the risk of loss or mismanagement. This not only saves time but also simplifies the estate planning process.

-

Is there a cost associated with using airSlate SignNow for Living Trust Property Records in Pennsylvania?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be budget-friendly. Pricing plans vary based on the features you need, allowing both individuals and businesses to choose a plan that fits their budget. Considering the time saved and efficiency gained, many find it to be a worthwhile investment for managing Living Trust Property Records in Pennsylvania.

-

Can I integrate airSlate SignNow with other software for my Living Trust Property Records?

Absolutely! AirSlate SignNow offers seamless integrations with various software platforms to enhance the management of Living Trust Property Records in Pennsylvania. This enables users to connect with other tools they already use, making the workflow more efficient. Integrations can help in tracking document updates and maintaining compliance.

-

What features does airSlate SignNow offer for processing Living Trust Property Records in Pennsylvania?

airSlate SignNow comes equipped with features such as secure eSigning, document tracking, and customizable templates specifically for Living Trust Property Records in Pennsylvania. These features facilitate quick execution and management of documents while ensuring that all interactions are secure and compliant with legal standards. Users can also automate reminders for signatories to ensure timely completion.

-

How secure is airSlate SignNow for managing Living Trust Property Records in Pennsylvania?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and complies with industry standards to protect your Living Trust Property Records in Pennsylvania. Users can be assured that their documents are secure, helping to maintain confidentiality during the signing and management process.

Get more for Living Trust Property Record Pennsylvania

Find out other Living Trust Property Record Pennsylvania

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast