Revocation of Living Trust Pennsylvania Form

What is the Revocation Of Living Trust Pennsylvania

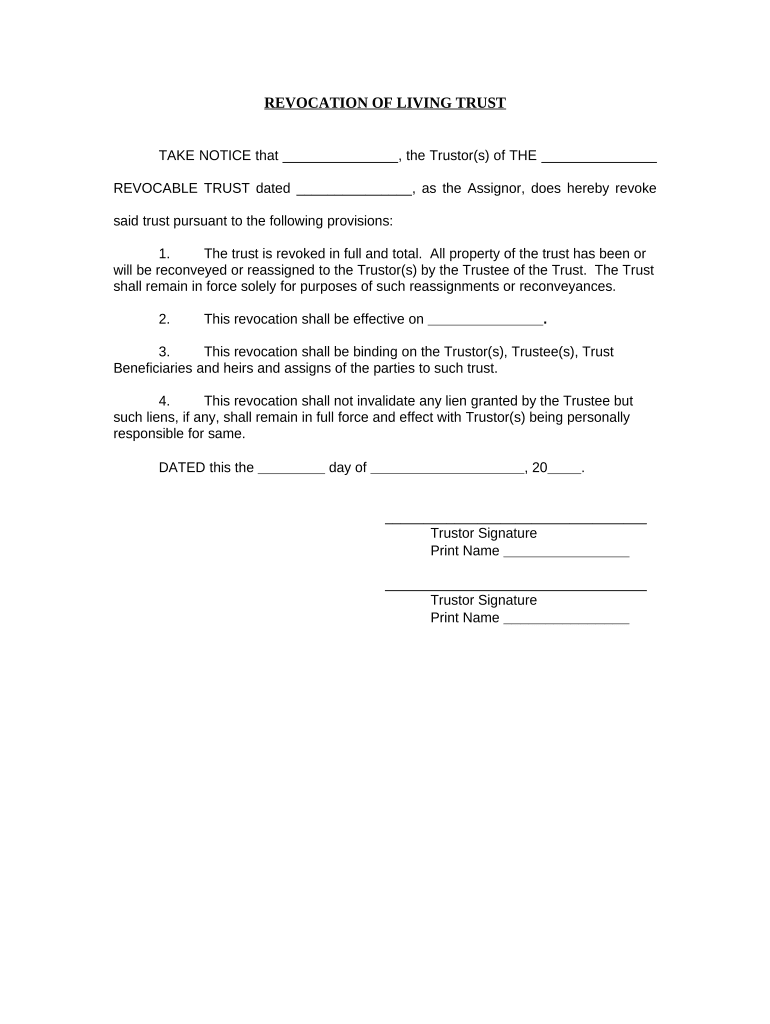

The Revocation of Living Trust in Pennsylvania is a legal document that allows an individual to nullify a previously established living trust. This process is essential for individuals who wish to change their estate planning arrangements or eliminate a trust that is no longer needed. The revocation document must clearly state the intent to revoke the trust and typically requires the signature of the trust creator, also known as the grantor. It is important to ensure that the revocation is executed in accordance with Pennsylvania state laws to maintain its legal validity.

Steps to complete the Revocation Of Living Trust Pennsylvania

Completing the Revocation of Living Trust in Pennsylvania involves several key steps:

- Review the original trust document: Understand the terms and conditions of the existing trust to ensure proper revocation.

- Draft the revocation document: Clearly state the intention to revoke the trust, including the trust's name and date.

- Sign the document: The grantor must sign the revocation in the presence of a notary public to ensure its legal standing.

- Notify relevant parties: Inform beneficiaries and any institutions involved with the trust about the revocation.

- Store the document securely: Keep the signed revocation document in a safe place, along with other important estate planning documents.

Legal use of the Revocation Of Living Trust Pennsylvania

The legal use of the Revocation of Living Trust in Pennsylvania is governed by state laws surrounding trusts and estates. This document serves to formally cancel the trust, ensuring that the assets held within it are no longer subject to the terms of the original trust agreement. It is crucial to follow the legal requirements for execution, including notarization, to prevent any disputes or challenges in the future. Proper legal use ensures that the grantor's intentions are respected and upheld.

Key elements of the Revocation Of Living Trust Pennsylvania

When drafting a Revocation of Living Trust in Pennsylvania, several key elements must be included to ensure its effectiveness:

- Identification of the trust: Clearly state the name and date of the original trust being revoked.

- Grantor's information: Include the full name and address of the individual revoking the trust.

- Statement of revocation: A clear declaration indicating the intent to revoke the trust.

- Signature and notarization: The document must be signed by the grantor and notarized to be legally binding.

State-specific rules for the Revocation Of Living Trust Pennsylvania

Pennsylvania has specific rules governing the revocation of living trusts. The revocation must comply with the state's Uniform Trust Act, which outlines the procedures for modifying or revoking trusts. It is essential to ensure that the revocation document adheres to the formalities required by Pennsylvania law, including proper execution and witnessing. Additionally, if the trust holds real estate, further steps may be necessary to ensure the revocation is recognized by the county recorder of deeds.

How to use the Revocation Of Living Trust Pennsylvania

Using the Revocation of Living Trust in Pennsylvania involves several practical steps. First, ensure that the revocation document is properly executed and signed. Once completed, distribute copies to all relevant parties, including beneficiaries and financial institutions that may have held assets under the trust. It is also advisable to review any estate planning documents to ensure consistency with the revocation. If there are any changes to the distribution of assets, consider drafting a new trust or will to reflect the updated intentions.

Quick guide on how to complete revocation of living trust pennsylvania

Effortlessly Prepare Revocation Of Living Trust Pennsylvania on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage Revocation Of Living Trust Pennsylvania on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to Edit and eSign Revocation Of Living Trust Pennsylvania with Ease

- Locate Revocation Of Living Trust Pennsylvania and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all information and then click the Done button to save your modifications.

- Select your preferred method to send your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Revocation Of Living Trust Pennsylvania to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Revocation of Living Trust in Pennsylvania?

A Revocation of Living Trust in Pennsylvania is a legal process that terminates an existing living trust. This document officially dissolves the trust and redistributes the assets according to the grantor's wishes. It's important for individuals to understand the implications of revoking a trust and ensure proper documentation.

-

What are the costs associated with revoking a living trust in Pennsylvania?

The costs to revoke a living trust in Pennsylvania can vary based on legal fees, document preparation, and filing fees if necessary. Typically, using a service like airSlate SignNow can signNowly reduce costs as it offers an affordable solution for document management. It's advisable to consult with a legal expert for precise cost estimation.

-

How can airSlate SignNow help with the Revocation of Living Trust in Pennsylvania?

airSlate SignNow provides an efficient platform to create, manage, and execute the Revocation of Living Trust in Pennsylvania electronically. With its user-friendly interface, individuals can easily customize their documents, secure electronic signatures, and ensure compliance with state regulations. This enhances convenience and speeds up the process.

-

Is electronic signing valid for a Revocation of Living Trust in Pennsylvania?

Yes, electronic signing is valid for a Revocation of Living Trust in Pennsylvania as long as it meets the specific requirements set forth by state law. airSlate SignNow ensures that all electronic signatures are legally compliant, making the process seamless and trustworthy. This means you can confidently revoke your living trust using their platform.

-

What features does airSlate SignNow offer for managing trust documents?

airSlate SignNow offers a plethora of features for managing trust documents, including easy drafting, automated workflows, and template options specifically for the Revocation of Living Trust in Pennsylvania. Furthermore, it integrates with various applications for enhanced productivity. This makes it an ideal choice for those looking to efficiently handle their trust documentation.

-

Are there any integrations available with airSlate SignNow for revocation processes?

Yes, airSlate SignNow offers multiple integrations with popular tools such as Google Drive, Dropbox, and eCommerce platforms. These integrations facilitate a smoother workflow when dealing with the Revocation of Living Trust in Pennsylvania. Users can easily access and manage their documents across different applications.

-

What benefits does using airSlate SignNow offer for revoking a living trust?

Using airSlate SignNow for revocation of a living trust offers numerous benefits, including saving time, reducing costs, and enhancing document security. The platform provides a streamlined approach to preparing and managing legal documents, ensuring that the Revocation of Living Trust in Pennsylvania is handled efficiently. Additionally, users receive support and guidance throughout the process.

Get more for Revocation Of Living Trust Pennsylvania

- Dcps s55so5 form

- 670 147 cdp enhancement plan instructions and form doh wa

- 30 day rental notice editable document download form

- Verifiable training form texas department of agriculture texasagriculture

- Ncdva9 form

- Bid sheet amp contract terms amp conditions acceptance form co iredell nc

- Denver county zoning department compliance letter 2008 form

- Disability parking sign removal form city and county of denver denvergov

Find out other Revocation Of Living Trust Pennsylvania

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now