Payment Workers Form

What is the Payment Workers

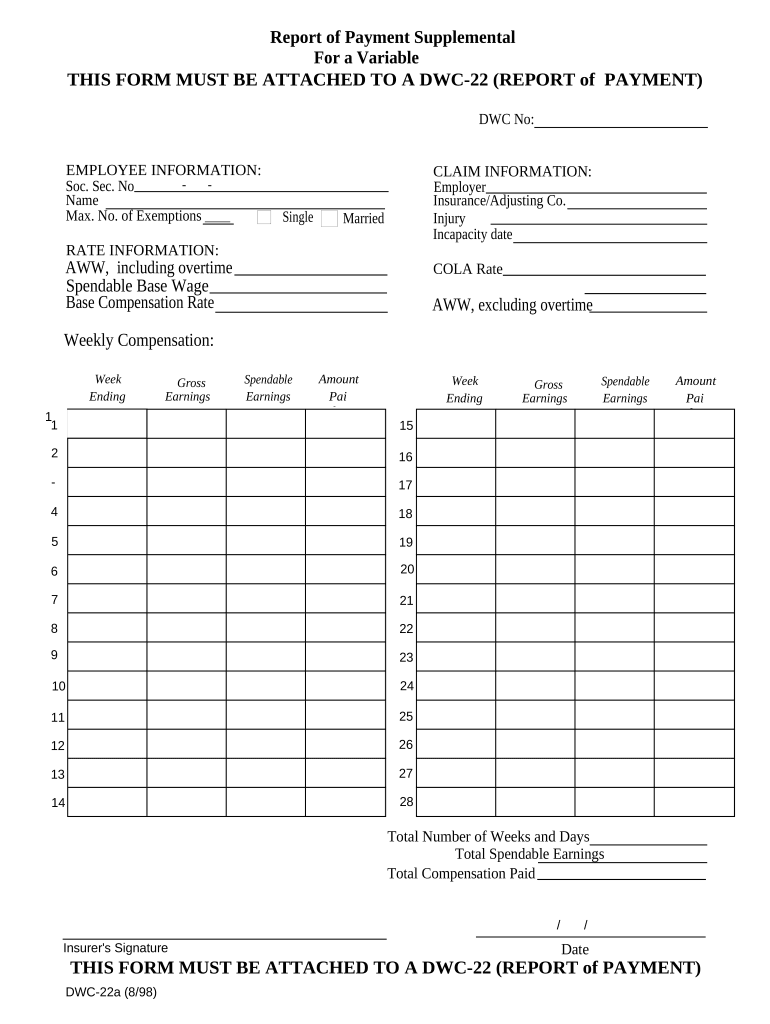

The payment workers form is a crucial document used to report income earned by individuals who provide services or labor. This form is essential for ensuring that both the worker and the employer comply with tax regulations. It typically includes details such as the worker's name, Social Security number, and the total amount paid for services rendered. Understanding this form is vital for both parties to maintain accurate records and fulfill their tax obligations.

How to use the Payment Workers

Using the payment workers form involves several straightforward steps. First, gather all necessary information about the worker, including their personal details and payment amounts. Next, accurately fill out the form, ensuring that all fields are completed correctly. Once the form is filled out, both the worker and the employer should review it for accuracy before submission. Finally, submit the form to the appropriate tax authorities, either electronically or via mail, depending on the specific requirements.

Steps to complete the Payment Workers

Completing the payment workers form requires careful attention to detail. Follow these steps to ensure accuracy:

- Collect necessary information about the worker and payment details.

- Fill out the form completely, including all required fields.

- Double-check the information for accuracy.

- Obtain signatures if required.

- Submit the form to the appropriate tax authority.

Legal use of the Payment Workers

The legal use of the payment workers form is governed by tax laws that require accurate reporting of income. This form must be filled out in compliance with the Internal Revenue Service (IRS) guidelines to ensure that it is considered valid. Failure to use the form correctly can lead to penalties for both the worker and the employer. It is essential to understand the legal implications of this form to avoid any issues with tax compliance.

Key elements of the Payment Workers

Several key elements must be included in the payment workers form to ensure its validity. These elements typically include:

- The worker's full name and address.

- The worker's Social Security number or taxpayer identification number.

- The total amount paid for services rendered.

- The date of payment.

- Signatures from both the worker and employer, if necessary.

IRS Guidelines

The IRS provides specific guidelines for completing the payment workers form. These guidelines outline the necessary information to include, the proper format for submission, and deadlines for filing. Adhering to these guidelines is essential for ensuring compliance with tax laws and avoiding potential penalties. Familiarity with IRS requirements can help streamline the process and ensure that all necessary steps are taken.

Quick guide on how to complete payment workers

Complete Payment Workers effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Payment Workers on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Payment Workers with ease

- Find Payment Workers and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then hit the Done button to save your modifications.

- Choose your preferred method to submit your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Payment Workers to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow for payment workers?

airSlate SignNow offers a variety of features tailored for payment workers, including customizable templates, bulk sending options, and a user-friendly interface. These features help streamline the document signing process, making it efficient and cost-effective for businesses. Additionally, the solution supports real-time tracking of signed documents, which enhances accountability for payment workers.

-

How does airSlate SignNow enhance the payment workers' workflow?

By integrating seamlessly into existing workflows, airSlate SignNow empowers payment workers to manage their document processes more efficiently. The platform reduces manual tasks and automates document signing, allowing payment workers to focus more on core tasks rather than paperwork. This can lead to faster transaction times and improved productivity.

-

What is the pricing structure for airSlate SignNow for payment workers?

airSlate SignNow offers flexible pricing plans to accommodate the needs of payment workers ranging from individuals to large enterprises. The plans are cost-effective, allowing businesses to choose the features they require without unnecessary expenses. Transparent pricing ensures that payment workers can budget effectively for this essential tool.

-

Can airSlate SignNow integrate with other tools used by payment workers?

Yes, airSlate SignNow offers integrations with a variety of third-party applications commonly used by payment workers, such as CRM systems, payment processing platforms, and cloud storage services. This seamless integration allows payment workers to enhance their existing workflows without having to switch tools. It ensures that all processes remain efficient and connected.

-

What benefits does airSlate SignNow provide payment workers compared to traditional methods?

airSlate SignNow offers signNow advantages over traditional document signing methods, such as reduced turnaround time and improved accuracy. Payment workers can easily send, sign, and manage documents from anywhere, eliminating the need for printing and physical signatures. This not only increases efficiency but also minimizes errors and enhances customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive documents related to payment workers?

Absolutely, airSlate SignNow employs advanced security measures to ensure that sensitive documents are protected. Payment workers can rely on features such as data encryption, secure cloud storage, and user authentication. These security features ensure that all transactions handled by payment workers are safe and compliant with industry standards.

-

How easy is it to implement airSlate SignNow for new payment workers?

Implementing airSlate SignNow is straightforward and user-friendly, making it accessible for new payment workers. The intuitive design and extensive resources provided by airSlate ensure a seamless onboarding experience. With minimal training required, payment workers can quickly adapt to the platform and start reaping its benefits almost immediately.

Get more for Payment Workers

Find out other Payment Workers

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed