Living Trust for Husband and Wife with No Children Rhode Island Form

What is the Living Trust For Husband And Wife With No Children Rhode Island

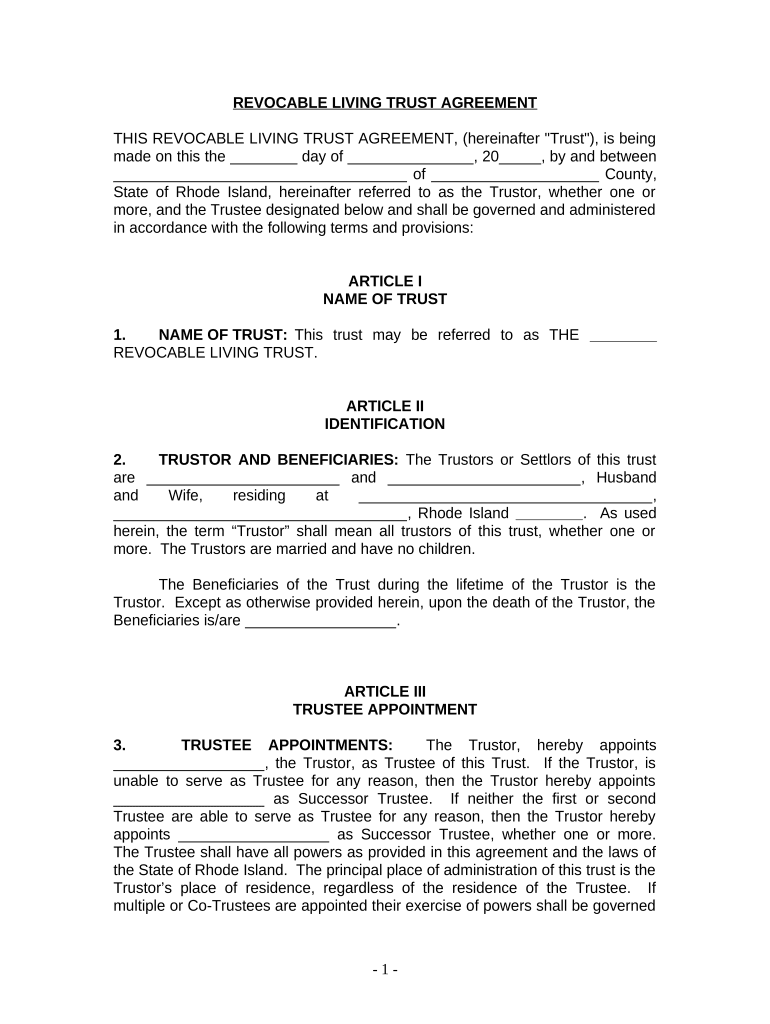

A living trust for husband and wife with no children in Rhode Island is a legal arrangement that allows couples to manage their assets during their lifetime and specify how they should be distributed after death. This type of trust is particularly beneficial for couples without children, as it provides a straightforward way to handle estate planning. The trust can hold various assets, including real estate, bank accounts, and investments, ensuring that these assets are transferred according to the couple's wishes without the need for probate.

Steps to Complete the Living Trust For Husband And Wife With No Children Rhode Island

Completing a living trust for husband and wife with no children in Rhode Island involves several key steps:

- Identify assets: List all assets that will be included in the trust, such as real estate, bank accounts, and personal property.

- Select a trustee: Choose a reliable individual or institution to manage the trust. This can be one of the spouses or a third party.

- Draft the trust document: Create the trust document that outlines the terms of the trust, including how assets will be managed and distributed.

- Sign the document: Both spouses must sign the trust document in the presence of a notary public to ensure its legal validity.

- Fund the trust: Transfer ownership of the identified assets into the trust to ensure they are managed according to the trust's terms.

Legal Use of the Living Trust For Husband And Wife With No Children Rhode Island

The legal use of a living trust for husband and wife with no children in Rhode Island allows couples to control their assets while avoiding the probate process. This trust can be used to specify how assets will be distributed upon the death of one or both spouses. It can also provide for the management of assets in case one spouse becomes incapacitated. By establishing this type of trust, couples can ensure their wishes are honored and reduce the administrative burden on surviving family members.

State-Specific Rules for the Living Trust For Husband And Wife With No Children Rhode Island

In Rhode Island, there are specific rules governing living trusts that couples should be aware of:

- Trust document requirements: The trust document must be in writing and signed by both spouses in the presence of a notary.

- Asset transfer: To be effective, assets must be formally transferred into the trust, which may require changing titles or designations.

- Revocability: Most living trusts are revocable, meaning that the couple can alter or dissolve the trust as needed during their lifetime.

- Tax considerations: Couples should consult with a tax professional to understand any tax implications associated with their living trust.

Key Elements of the Living Trust For Husband And Wife With No Children Rhode Island

Key elements of a living trust for husband and wife with no children in Rhode Island include:

- Trustee designation: The couple must designate a trustee who will manage the trust assets.

- Beneficiary designations: The trust should specify who will inherit the assets upon the death of the spouses.

- Management provisions: The trust should outline how assets will be managed during the lifetime of the spouses and in the event of incapacity.

- Distribution instructions: Clear instructions on how assets should be distributed after the death of the last surviving spouse.

How to Obtain the Living Trust For Husband And Wife With No Children Rhode Island

To obtain a living trust for husband and wife with no children in Rhode Island, couples can follow these steps:

- Consult an attorney: It is advisable to work with an estate planning attorney who is familiar with Rhode Island laws to ensure the trust is properly drafted.

- Use online resources: There are reputable online services that provide templates and guidance for creating living trusts.

- Gather necessary information: Collect information about assets, beneficiaries, and any specific wishes regarding the management and distribution of assets.

- Complete the trust document: Fill out the trust document, ensuring all required sections are completed accurately.

Quick guide on how to complete living trust for husband and wife with no children rhode island

Complete Living Trust For Husband And Wife With No Children Rhode Island effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without holdups. Manage Living Trust For Husband And Wife With No Children Rhode Island on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Living Trust For Husband And Wife With No Children Rhode Island without any hassle

- Find Living Trust For Husband And Wife With No Children Rhode Island and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Living Trust For Husband And Wife With No Children Rhode Island to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With No Children in Rhode Island?

A Living Trust For Husband And Wife With No Children in Rhode Island is a legal arrangement that allows a couple to manage and protect their assets during their lifetime and dictate how those assets will be distributed after their death. It can help avoid the probate process, ensuring a smoother transition of assets.

-

How does a Living Trust For Husband And Wife With No Children in Rhode Island differ from a Will?

Unlike a Will, which goes through the probate process, a Living Trust For Husband And Wife With No Children in Rhode Island can help bypass this lengthy process. Living trusts provide greater privacy and immediate control over asset distribution, making them a preferred choice for many couples without children.

-

What are the benefits of setting up a Living Trust For Husband And Wife With No Children in Rhode Island?

The key benefits of a Living Trust For Husband And Wife With No Children in Rhode Island include avoiding probate, maintaining privacy, and having flexibility in asset management. This arrangement can also help in case of incapacity, ensuring that trusted individuals can manage the couple's affairs.

-

What is the typical cost of establishing a Living Trust For Husband And Wife With No Children in Rhode Island?

The cost of establishing a Living Trust For Husband And Wife With No Children in Rhode Island varies depending on the complexity of the trust and the attorney's fees. Generally, costs can range from a few hundred to a couple of thousand dollars, but investing in a trust can save money in the long run by avoiding probate fees.

-

Can I integrate a Living Trust For Husband And Wife With No Children in Rhode Island with my existing estate plan?

Yes, a Living Trust For Husband And Wife With No Children in Rhode Island can seamlessly integrate with your existing estate plan. By reviewing your assets and goals, an estate planning professional can ensure that your trust complements other documents like wills and power of attorney.

-

Is it necessary to have a lawyer to create a Living Trust For Husband And Wife With No Children in Rhode Island?

While it's possible to create a Living Trust For Husband And Wife With No Children in Rhode Island without a lawyer using templates, it's generally recommended to consult an attorney for this process. A qualified legal professional can ensure that the trust is valid, meets state requirements, and effectively addresses your specific needs.

-

How can airSlate SignNow facilitate the creation of a Living Trust For Husband And Wife With No Children in Rhode Island?

airSlate SignNow provides an easy-to-use platform for eSigning and sending documents related to your Living Trust For Husband And Wife With No Children in Rhode Island. This platform streamlines the signing process, making it more efficient and accessible without the need for in-person meetings.

Get more for Living Trust For Husband And Wife With No Children Rhode Island

Find out other Living Trust For Husband And Wife With No Children Rhode Island

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed