Nebraska Form 6

What is the Nebraska Form 6

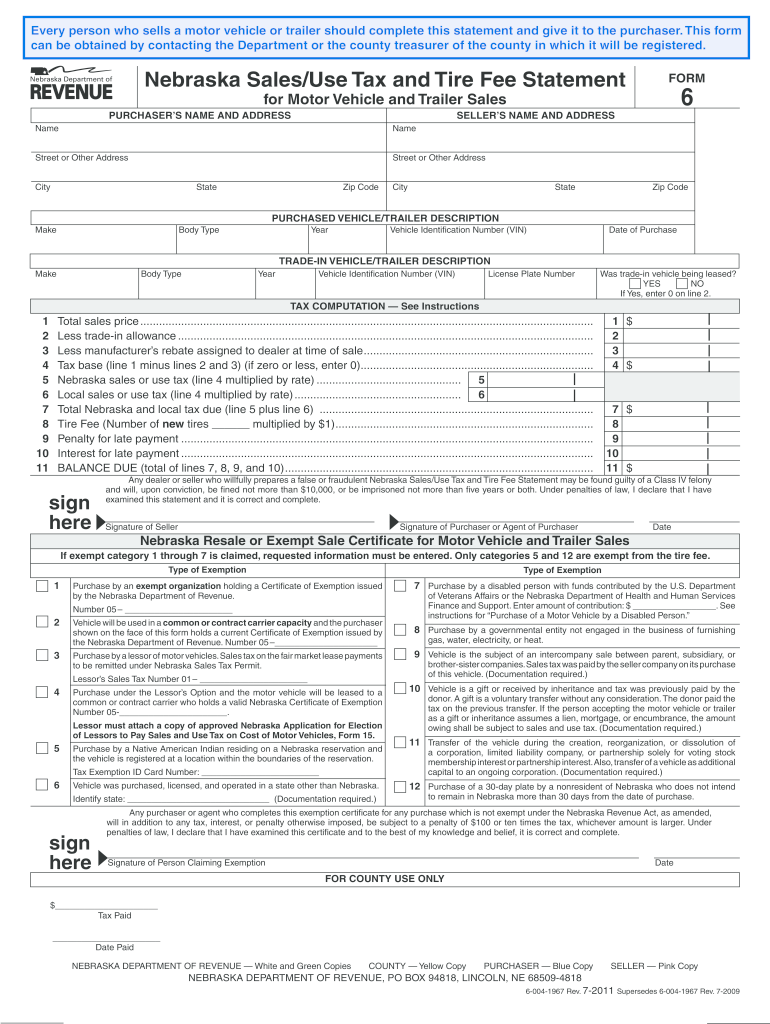

The Nebraska Form 6, also known as the Nebraska Vehicle Sales Tax Form, is a document used to report and pay sales tax on vehicles purchased in Nebraska. This form is essential for individuals and businesses that acquire vehicles, trailers, or other taxable items within the state. It ensures compliance with Nebraska's sales tax regulations and helps in the proper assessment of the sales tax owed based on the purchase price of the vehicle.

How to use the Nebraska Form 6

Using the Nebraska Form 6 involves several steps to ensure accurate completion and submission. First, gather all necessary information related to the vehicle purchase, including the purchase price, vehicle identification number (VIN), and any applicable exemptions. Next, fill out the form with this information, ensuring that all sections are completed accurately. Once the form is filled, it can be submitted electronically or by mail, depending on your preference and the options available. It is important to retain a copy of the completed form for your records.

Steps to complete the Nebraska Form 6

Completing the Nebraska Form 6 requires careful attention to detail. Follow these steps:

- Obtain the Nebraska Form 6 from an official source or online.

- Provide your personal information, including name, address, and contact details.

- Enter the vehicle details, including make, model, year, and VIN.

- Indicate the purchase price and any trade-in value, if applicable.

- Calculate the total sales tax due based on the provided information.

- Sign and date the form to certify that the information is accurate.

Legal use of the Nebraska Form 6

The Nebraska Form 6 is legally binding when completed and submitted according to state regulations. It serves as an official record of the sales tax paid on a vehicle purchase. To ensure its legal standing, the form must be filled out accurately, and any required signatures must be provided. Additionally, the form must be submitted within the designated time frame to avoid penalties or additional fees.

Required Documents

When completing the Nebraska Form 6, certain documents may be required to support your submission. These documents typically include:

- Proof of purchase, such as a bill of sale or invoice.

- Identification documents, such as a driver's license or state ID.

- Any documentation related to exemptions, if applicable.

Form Submission Methods

The Nebraska Form 6 can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online submission through the Nebraska Department of Revenue's website.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated state offices or tax centers.

Penalties for Non-Compliance

Failure to complete and submit the Nebraska Form 6 accurately and on time can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to adhere to all deadlines and ensure that the information provided is correct to avoid these consequences.

Quick guide on how to complete nebraska sales tax for motor vehicle and trailer sales form

Effortlessly prepare Nebraska Form 6 on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily access the correct format and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly and without delays. Handle Nebraska Form 6 on any platform using the airSlate SignNow apps for Android or iOS and enhance your document-based processes today.

How to edit and eSign Nebraska Form 6 with ease

- Find Nebraska Form 6 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure private information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your updates.

- Select your preferred method for sharing your document, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs within a few clicks from your chosen device. Edit and eSign Nebraska Form 6 and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Who should I charge sales tax to for my online store? How do I figure out how much?

The first thing you need to know is whether you have a nexus in a state, otherwise you don’t need to worry about charging sales tax in it. Bear in mind that after the Wayfair decision, physical presence is not the only criteria to have a nexus in some states, but also the amount of sales and the number of transactions.In case you have nexus then you’ll need to check if your product is taxable in that state.Regarding how much to charge, you should know that some states also have local tax so you need to check with the revenue office which tax you need to charge.You will get more information here: The Ultimate Guide to US Economic Nexus

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

Create this form in 5 minutes!

How to create an eSignature for the nebraska sales tax for motor vehicle and trailer sales form

How to create an eSignature for the Nebraska Sales Tax For Motor Vehicle And Trailer Sales Form in the online mode

How to generate an eSignature for your Nebraska Sales Tax For Motor Vehicle And Trailer Sales Form in Google Chrome

How to make an eSignature for putting it on the Nebraska Sales Tax For Motor Vehicle And Trailer Sales Form in Gmail

How to make an eSignature for the Nebraska Sales Tax For Motor Vehicle And Trailer Sales Form from your smart phone

How to create an electronic signature for the Nebraska Sales Tax For Motor Vehicle And Trailer Sales Form on iOS

How to make an eSignature for the Nebraska Sales Tax For Motor Vehicle And Trailer Sales Form on Android OS

People also ask

-

What is the Nebraska Form 6 and why is it important?

The Nebraska Form 6 is a vital document used in various business and legal contexts within Nebraska. It serves to formalize agreements or permissions in a legally binding manner. Understanding its significance ensures compliance and smooth operations, making airSlate SignNow a valuable tool for managing the Nebraska Form 6.

-

How can airSlate SignNow streamline the process of filling out and submitting Nebraska Form 6?

airSlate SignNow simplifies the entire process of filling out and submitting the Nebraska Form 6 by allowing users to create, edit, and eSign documents effortlessly. Its intuitive interface enables quick access to templates and previous forms, reducing time spent on paperwork and increasing productivity.

-

What are the pricing options for using airSlate SignNow for the Nebraska Form 6?

airSlate SignNow offers a variety of pricing plans to accommodate different needs and budgets for managing the Nebraska Form 6. Whether you're a small business or a larger enterprise, you'll find a plan that suits your requirements, ensuring a cost-effective solution for document signing.

-

Can I integrate airSlate SignNow with other software to manage Nebraska Form 6 efficiently?

Yes, airSlate SignNow seamlessly integrates with various software platforms, making it easy to manage the Nebraska Form 6 alongside your existing tools. This integration enhances workflow efficiency by allowing you to import data directly from other applications, minimizing manual entry errors.

-

What are the key features of airSlate SignNow that help in handling Nebraska Form 6?

Key features of airSlate SignNow that assist with the Nebraska Form 6 include eSignature capabilities, document templates, and real-time collaboration. These features make it easy to create, send, and track forms, ensuring that all necessary parties can sign quickly and securely.

-

Is airSlate SignNow legally compliant for using Nebraska Form 6?

Absolutely! airSlate SignNow is designed to comply with all relevant laws and regulations governing digital signatures, ensuring that the Nebraska Form 6 is legally binding. This compliance offers peace of mind that your documents are secure and recognized under the law.

-

How does airSlate SignNow enhance the security of my Nebraska Form 6?

airSlate SignNow prioritizes the security of your Nebraska Form 6 with advanced encryption and secure authentication protocols. This ensures that all document exchanges are protected from unauthorized access, maintaining the integrity and confidentiality of your sensitive information.

Get more for Nebraska Form 6

- Idaho small claims form

- Letter from landlord to tenant as notice to remove wild animals in premises idaho form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises idaho form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497305496 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair idaho form

- Letter from tenant to landlord containing notice that doors are broken and demand repair idaho form

- Letter with demand 497305499 form

- Letter from tenant to landlord with demand that landlord repair plumbing problem idaho form

Find out other Nebraska Form 6

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template