Employment Verification Form

What is the Employment Verification Form

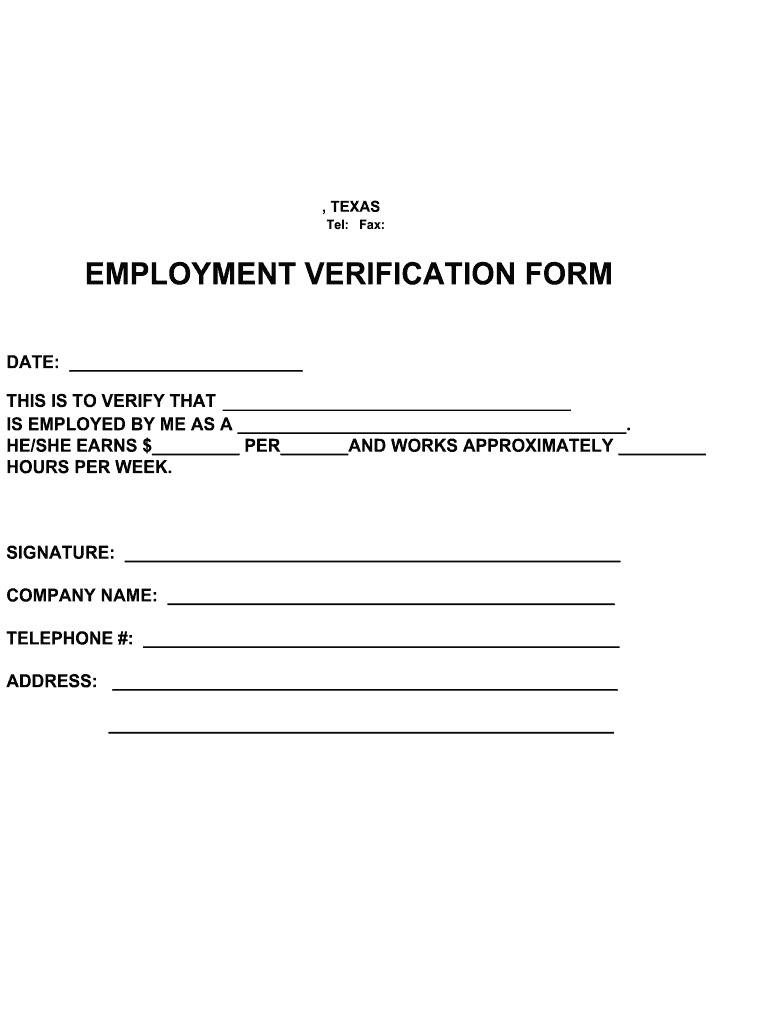

The employment verification form is a crucial document used to confirm an individual's employment status and history. It typically includes details such as the employee's job title, dates of employment, salary information, and the employer's contact information. This form is often requested by lenders, landlords, or government agencies to ensure that the individual meets specific eligibility criteria for loans, housing, or benefits. In the United States, it serves as a reliable proof of employment, helping to facilitate various processes that require verification of income and job stability.

How to use the Employment Verification Form

Using the employment verification form involves several steps to ensure accuracy and compliance with legal standards. First, the employee must fill out their personal information, including their name, address, and social security number. Next, the employer should complete the sections detailing the employee's job title, employment dates, and salary. Once filled out, the form can be provided to the requesting party, whether it be a lender, landlord, or government agency. It's essential to ensure that all information is accurate to prevent any issues during the verification process.

Steps to complete the Employment Verification Form

Completing the employment verification form requires careful attention to detail. Follow these steps for proper completion:

- Gather necessary information, including personal details and employment history.

- Fill in the employee's personal information accurately.

- Provide the employer’s details, including the company name and contact information.

- Include specific employment details such as job title, start date, and end date if applicable.

- Specify the employee's salary or hourly wage.

- Review the completed form for accuracy and completeness.

- Sign and date the form if required by the requesting party.

Key elements of the Employment Verification Form

Several key elements are essential for the employment verification form to be effective and legally binding. These include:

- Employee Information: Full name, address, and social security number.

- Employer Information: Company name, address, and contact details.

- Employment Details: Job title, employment dates, and salary information.

- Signature: Required signatures from both the employee and employer to validate the document.

Legal use of the Employment Verification Form

The employment verification form must adhere to various legal standards to be considered valid. In the U.S., it is essential that the information provided is true and accurate, as any false statements may lead to legal repercussions. Additionally, the form should comply with privacy regulations, ensuring that sensitive information is handled securely. Employers should be aware of their responsibilities under laws such as the Fair Credit Reporting Act (FCRA) when using this form for background checks or credit evaluations.

Who Issues the Employment Verification Form

The employment verification form can be issued by various entities depending on the context. Typically, it is provided by the employer's human resources department or payroll department. In some cases, employees may obtain a standardized form from online resources or through professional organizations. It is important to ensure that the form used meets the specific requirements of the requesting party to ensure a smooth verification process.

Quick guide on how to complete employment verification form

Effortlessly Prepare Employment Verification Form on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly without waiting. Manage Employment Verification Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign Employment Verification Form with Ease

- Obtain Employment Verification Form and then click Get Form to commence.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Modify and eSign Employment Verification Form while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm filling out the employment verification form online for KPMG and realized that it's not asking me for phone numbers to my previous employers. Just curious as to how they verify employment without me providing a contact number to call?

Many US employers today won’t allow individuals (coworkers, supervisors) at a company respond to any questions or write recommendations. Everything must go through HR and they will often only confirm dates of employment.I know this, so I’m not going to waste time contacting phone numbers/email lists of supposed former coworkers or managers. Fact is, if anyone answered and started responding to my questions, I’d be very suspicious. Instead, I just ask for the main number of the company — which I can look up on line and verify to be the actual number of the claimed company.Same deal with academic credentials. I’m not going to use your address for “Harvard” … the one with a PO Box in Laurel, KS. I’m going to look up the address for the registrar myself.Sorry to say, there’s far too much lying on resumes today, combined with the liability possible for a company to say anything about you. A common tactic is to lie about academic back ground while giving friends as your “former supervisor at XYZ.”

-

Is it legal for companies to charge a previous employee a fee for filling out an employment verification form?

I’m not a lawyer, but I’d say you don’t have to pay. The law, as I know it, requires former employers to confirm your dates of employment and title. If your former employer demands you pay a fee for this, ask for the demand in writing (say you need it for financial records), then send a copy of that demand to the company you applied to, and your state’s Office of the Attorney General or Labor Department. The demand on email would also work, as would a voicemail you can attach to an email.

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

Have you ever been fired on the first day of work?

Yes. Home Depot hired me to work in the Rental department.The first day I showed up for training and donned my orange Shirt and Apron.I was placed at a computer to start filling out paperwork and begin training videos and lessons.After about an hour in I was approached by an older gentleman and politely asked to come with him to be introduced to my predecessor.I was given a tour of everything, and we talked For a few minutes about what was expected of me and what to expect out of Home Depot.Back at the computer in the training room where I spent the next 3 hours doing learning center type exercises I was notified lunch time would be in a few minutes.I sat at the break room lunch table and talked it up with a few other tenured employee.come to find out the man I was replacing was about to retire from there after 10 years working in rentals.(he was well into his 70s)well the store manager and he pulled me to the side and basically told me that they didn't actually have a job for me, and my hiring was a mistake.I was livid! I passed up two other opportunities the week before.Come to find out the rental department clerk decided not to retire, and work a while longer.i was asked to turn in my uniform and exit the building immediately and to not return As I was basically fired!There was nothing I did or say to cause any issues with my job. I couldn't even start to plead for a another position before a security guard escorted me back to my locker to gather my things and then out the door.I vowed to never shop there again and to not let anyone I know to give it a thought.Shame on you Home Depot.

-

How do Indian IT companies do a background check of job candidates?

Most of the employers initiate a thorough background check on their potential employees. It comes as no surprise that a basic check would have already been done at the time of interview. (i.e, your digital footprint/social networks)It costs a bomb to verify each candidate. But then, it’s also a basic hygiene.Companies partner with third party verification firms like FADV, Jantakhoj, AuthBridge, HireRight and IDfy. The entire verification process is outsourced to these agencies.Here is a shocker - There are close to 7500 companies in India, which operate just for providing fake employment and educational certificates.The 3 major areas covered are: Employment, Education & CriminalIdeally, at the time of rolling out an offer, a company would ask you to fill out the verification forms. The forms will then be filed and forwarded to respective agencies.Agencies have access to centralized databases and also deploy field executives for physical verification. However, the verification process is not only costly but cumbersome as well. There is no single platform for non-IT/ITES companies where details of fraudulent candidates and recruiters can be found. Also, there is a lack of centralised repository of information, defined processes and procedures to conduct checks at educational institutes, police stations or courts

-

Real Estate in New York City: How can a foreigner rent an apartment in NY without a credit score?

You should provide the following, no credit score or tax returns needed:- Employment verification letter- Two recent pay stubs that verify the salary claims in the EV letter- Two most recent bank statements that show a reasonable amount of cash- Photo ID in the form of a passport or visaGenerally, the above should be plenty, but it does depend on the landlord.The landlord will likely have you fill out a W8 form, as well - common with foreign renters.You may also be able to use a corporate guarantor service like Insurent. Not all landlords accept them, due to certain constraints or preferences, but worth checking.Some landlords will accept a full year's payment up-front; however, this can only be done in free market buildings (rent stabilized buildings have some rules against this). Even in free market buildings, it's up to the landlord whether or not to accept full payment, additional security, or some form of back rent up-front.When emailing brokers / leasing offices, make sure to inquire about their international leasing policies, so you don't risk wasting any time on buildings that have strict or unreasonable policies.Good luck and welcome to New York!

-

Do American companies and startups hire Europeans with Bachelor's degree in CS for software engineering jobs?

Large companies recruit people living in Europe with BS CS degrees. Few startups do, although some transfer visas and sponsor permanent residency for foreigners already living here.Most foreign software engineers come here on H-1B visas which are awarded in an April lottery for employment beginning in October, which can mean a 15 month delay before a recruit starts work plus a year for each time the application isn’t selected.Large companies can work with that because they’re always hiring, have other people in the pipeline to handle immediate needs, and will have a use for foreigners starting every October. Many are in expensive areas like Silicon Valley, have problems hiring Americans willing to work for what they offer, and use the H1-B program. There were Europeans working at Amazon in Seattle when I was there in 2006–2007, and my wife and I regularly talk to ones working for Google when we’re dining out in Silicon Valley.Startups and other small companies hire as required, need people to start in specific roles immediately, and can’t wait for new visas that may not be granted.Small companies can transfer visas for foreigners already here allowing them to start work immediately, and sponsor permanent residency so those employees may remain although many don’t. Most Americans including startup executives aren’t familiar with immigration law. Many companies don’t want the added expense of sponsoring permanent residency which most H1-B holders expect so they can remain after their second renewal expires.A few small companies employing software engineers observe that transferring visas and sponsoring permanent residency aren’t expensive compared to total employment costs, and are willing to do those things.

-

I'm the founder of a new startup and recently I heard that when I employ someone, I need to fill out form I-9 for them. The employee needs to fill it out, but I also need to check their identity and status. Is it true that I am required to do that? Is it true that all companies, even big companies that employ thousands of people, do this?

In addition to both you and the employee filling out the form, you need to do it within a certain time period, usually the first day of work for the employee. And as mentioned, you do need to keep them on file in case of an audit. You need to examine their eligibility documents (most often their passport, or their driver's license and social security card, and the list of acceptable documents is included on the form). You just need to make sure it looks like it's the same person and that they aren't obvious fakes.You can find the forms as well as instructions on how to fill them out here: Employment Eligibility Verification | USCIS On the plus side, I-9's aren't hard or time-consuming to do. Once you get the hang of it, it only takes a few minutes.

Create this form in 5 minutes!

How to create an eSignature for the employment verification form

How to make an eSignature for your Employment Verification Form in the online mode

How to generate an electronic signature for the Employment Verification Form in Chrome

How to make an eSignature for putting it on the Employment Verification Form in Gmail

How to make an electronic signature for the Employment Verification Form from your smart phone

How to generate an electronic signature for the Employment Verification Form on iOS

How to make an electronic signature for the Employment Verification Form on Android

People also ask

-

What is an Employment Verification Form?

An Employment Verification Form is a document used by employers to confirm an employee's job title, salary, and duration of employment. This form is often required by lenders or landlords when verifying a potential tenant's income or employment status. airSlate SignNow allows you to easily create and send Employment Verification Forms for seamless verification.

-

How does airSlate SignNow simplify the Employment Verification Form process?

airSlate SignNow simplifies the Employment Verification Form process by enabling users to create, send, and eSign documents electronically. This eliminates the need for printing, scanning, or faxing, making the process faster and more efficient. With our user-friendly interface, you can complete and manage your Employment Verification Forms in minutes.

-

What features does airSlate SignNow offer for Employment Verification Forms?

airSlate SignNow offers a variety of features for Employment Verification Forms, including customizable templates, secure eSigning, and automatic reminders. Additionally, you can track the status of your forms in real-time, ensuring that all parties complete the necessary steps promptly. These features make managing Employment Verification Forms simple and effective.

-

Is there a cost associated with using airSlate SignNow for Employment Verification Forms?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that best fits your needs, whether you're sending a few Employment Verification Forms or managing a high volume of documents. Our cost-effective solution ensures that you get the best value for your money.

-

Can I integrate airSlate SignNow with other software for Employment Verification Forms?

Absolutely! airSlate SignNow seamlessly integrates with various software platforms to enhance your workflow. Whether you use CRM systems, HR software, or cloud storage services, our integration capabilities make it easy to incorporate Employment Verification Forms into your existing processes.

-

What are the benefits of using airSlate SignNow for Employment Verification Forms?

Using airSlate SignNow for Employment Verification Forms provides numerous benefits, including enhanced security, time savings, and improved accuracy. Our platform ensures that sensitive employee information is protected, while the electronic signing process reduces delays and errors associated with traditional methods.

-

How can I customize my Employment Verification Form using airSlate SignNow?

Customizing your Employment Verification Form with airSlate SignNow is straightforward. Our platform offers a range of templates that you can easily modify to include your company logo, specific fields, and tailored language to meet your requirements. This customization ensures that your Employment Verification Forms align with your brand and needs.

Get more for Employment Verification Form

- Easement for utilities streets subdivision idaho form

- Utility easement 497305731 form

- Assumption agreement of deed of trust and release of original mortgagors idaho form

- Idaho foreign judgment enrollment idaho form

- Summary administration package for small estates idaho form

- Tenant eviction form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497305736 form

- Idaho workers form

Find out other Employment Verification Form

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy