South Dakota Living Trust Form

What is the South Dakota Living Trust

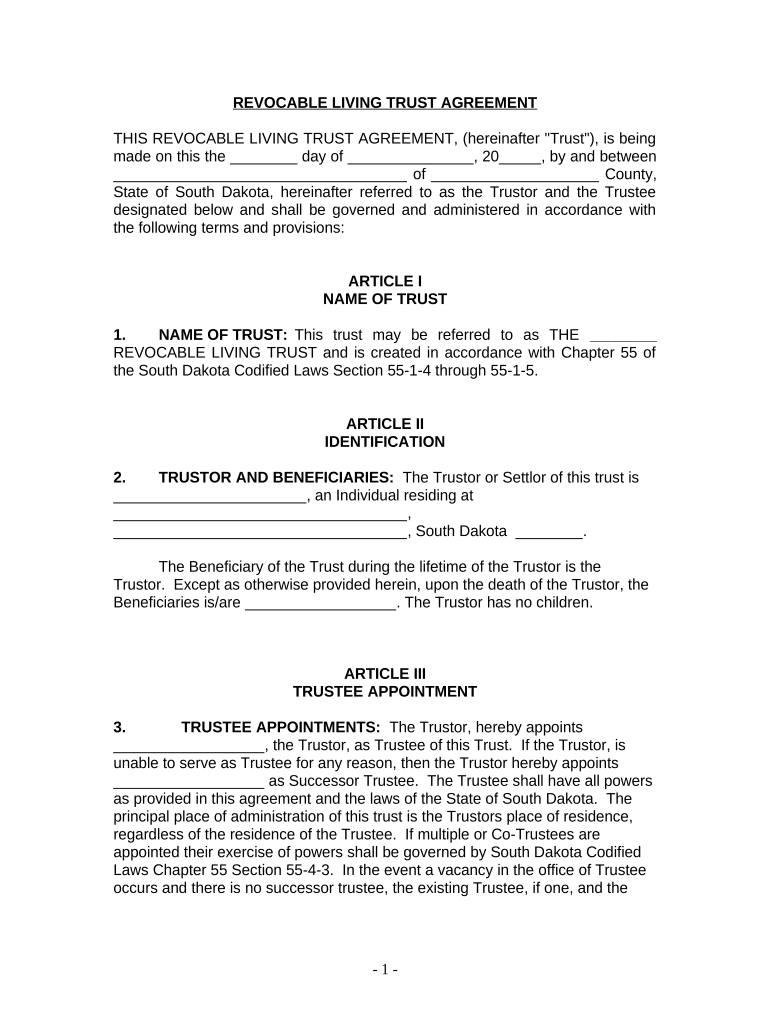

The South Dakota Living Trust is a legal arrangement that allows individuals to manage their assets during their lifetime and dictate how those assets will be distributed after their death. This type of trust is created while the individual is alive, providing flexibility and control over their estate. It can help avoid probate, which is the legal process of distributing a deceased person's assets, making the transition smoother for beneficiaries.

How to use the South Dakota Living Trust

Using a South Dakota Living Trust involves several steps. First, individuals need to identify the assets they want to place in the trust, which can include real estate, bank accounts, and personal property. Next, they must draft the trust document, specifying the terms of the trust, including the trustee and beneficiaries. Once the trust is established, assets should be transferred into the trust to ensure they are managed according to the trust's terms. Regular reviews of the trust may also be necessary to accommodate changes in personal circumstances or state laws.

Steps to complete the South Dakota Living Trust

Completing a South Dakota Living Trust involves a systematic approach:

- Gather necessary information about your assets and beneficiaries.

- Consult with a legal professional to draft the trust document, ensuring it complies with South Dakota laws.

- Sign the trust document in the presence of a notary public to validate it.

- Transfer ownership of your assets into the trust, which may require additional paperwork for real estate and financial accounts.

- Review and update the trust periodically to reflect any changes in your situation or intentions.

Key elements of the South Dakota Living Trust

Several key elements define a South Dakota Living Trust:

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or organizations designated to receive the trust assets upon the grantor's death.

- Trust Document: A legal document outlining the terms and conditions of the trust.

- Revocability: Many living trusts are revocable, allowing the grantor to make changes or dissolve the trust at any time.

State-specific rules for the South Dakota Living Trust

South Dakota has specific regulations governing living trusts. These rules dictate how trusts must be created, managed, and terminated. It is essential to adhere to state laws to ensure the trust is valid and enforceable. For instance, South Dakota allows for the creation of both revocable and irrevocable trusts, each with distinct implications for asset management and tax treatment. Consulting with a legal expert familiar with South Dakota trust laws can help navigate these requirements effectively.

Legal use of the South Dakota Living Trust

The legal use of a South Dakota Living Trust encompasses various aspects, including asset protection, estate planning, and tax considerations. By establishing a living trust, individuals can manage their assets during their lifetime while ensuring a smooth transfer to beneficiaries upon death. Additionally, living trusts can provide privacy, as they do not go through probate, which is a public process. It is crucial to follow legal guidelines to maintain the trust's validity and ensure compliance with state regulations.

Quick guide on how to complete south dakota living trust

Prepare South Dakota Living Trust effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without any delays. Manage South Dakota Living Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign South Dakota Living Trust with ease

- Find South Dakota Living Trust and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark important sections of your documents or obscure confidential information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign South Dakota Living Trust and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Dakota living trust?

A South Dakota living trust is a legal arrangement that allows you to manage your assets during your lifetime and specify how they will be distributed after your death. It can help you avoid probate, reduce estate taxes, and provide privacy for your estate. By establishing a living trust, you can ensure that your assets are managed according to your wishes.

-

How does a South Dakota living trust work?

A South Dakota living trust works by transferring ownership of your assets into the trust, which you manage as the trustee. You can change the terms, add or remove assets, and specify beneficiaries at any time while you're alive. After your death, the trust assets are distributed to your beneficiaries without going through the probate process.

-

What are the benefits of setting up a South Dakota living trust?

Setting up a South Dakota living trust provides several benefits, including avoiding probate, maintaining privacy, and ensuring a smooth asset transfer to your heirs. Additionally, it allows for more control over your assets and can help reduce estate taxes. A living trust can provide peace of mind knowing that your wishes will be honored.

-

How much does a South Dakota living trust cost?

The cost of establishing a South Dakota living trust can vary based on several factors, including complexity and the attorney's fees. Generally, you can expect to pay anywhere from $1,000 to $3,000 for a well-drafted trust. It's important to compare services and consult with professionals to find a cost-effective solution.

-

Can I customize my South Dakota living trust?

Yes, you can customize your South Dakota living trust according to your specific needs and wishes. You can choose your beneficiaries, determine how assets are distributed, and even set conditions for distribution. Working with legal experts can help ensure that your trust aligns perfectly with your goals.

-

What types of assets can be placed in a South Dakota living trust?

A variety of assets can be placed in a South Dakota living trust, including real estate, bank accounts, stocks, and personal property. This flexibility allows you to manage and distribute much of your estate according to your wishes. It's important to work with a professional to ensure all assets are properly transferred.

-

Does a South Dakota living trust provide asset protection?

While a South Dakota living trust can help you manage your assets and provide a smoother transfer upon death, it does not offer protection from creditors during your lifetime. For asset protection, you may need to explore other legal tools. Consulting with an attorney can help clarify your options.

Get more for South Dakota Living Trust

- Ergonomic assessment checklist occupational safety and health osha form

- Form 8974 january 2017 quarterly small business payroll tax credit for increasing research activities irs

- Amd 23e form

- Nutrition of the north american porcupine erethizon glenoakzoo form

- Mkbhavunieduin form

- Cms 855r form 2016 2019

- Vaccine administration record var for children and teens public health oregon form

- Imm5533 form

Find out other South Dakota Living Trust

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease