Financial Account Transfer to Living Trust South Dakota Form

What is the Financial Account Transfer To Living Trust South Dakota

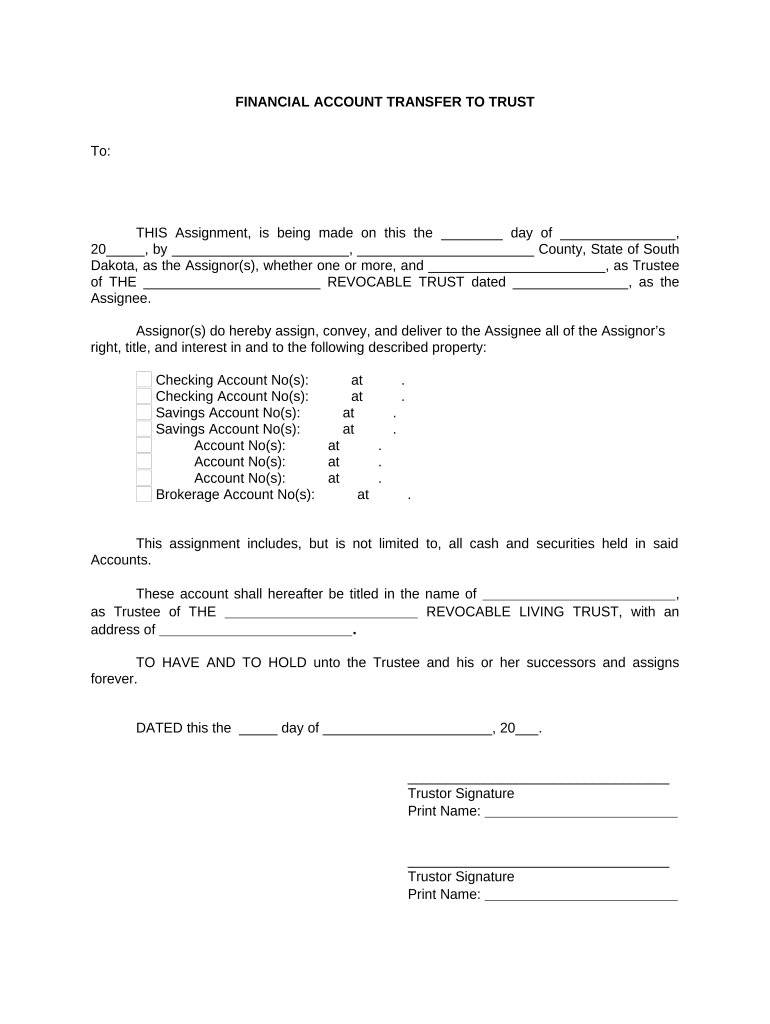

The Financial Account Transfer To Living Trust South Dakota is a legal document that facilitates the transfer of financial assets into a living trust. This process helps individuals manage their assets during their lifetime and ensures a smooth transition of those assets to beneficiaries after their passing. By placing financial accounts into a living trust, individuals can avoid probate, which can be a lengthy and costly process. This form is essential for anyone looking to ensure their financial affairs are handled according to their wishes.

Steps to complete the Financial Account Transfer To Living Trust South Dakota

Completing the Financial Account Transfer To Living Trust South Dakota involves several key steps:

- Identify the financial accounts you wish to transfer into the living trust.

- Gather necessary documentation, including the trust document and account information.

- Fill out the Financial Account Transfer To Living Trust South Dakota form accurately.

- Sign the form in accordance with state laws, ensuring all required signatures are included.

- Submit the completed form to the financial institution managing your accounts.

- Confirm the transfer with the institution to ensure the accounts are now held in the name of the trust.

Legal use of the Financial Account Transfer To Living Trust South Dakota

The Financial Account Transfer To Living Trust South Dakota is legally binding when executed properly. It must comply with state laws regarding trusts and the transfer of assets. This includes ensuring that the trust is valid and that all necessary parties have signed the document. Proper execution protects the interests of both the trust creator and the beneficiaries, ensuring that the assets are managed according to the trust's terms.

Required Documents

To complete the Financial Account Transfer To Living Trust South Dakota, several documents are typically required:

- The original living trust document.

- Identification documents, such as a driver's license or passport.

- Account statements or information from the financial institutions.

- The completed Financial Account Transfer To Living Trust South Dakota form.

State-specific rules for the Financial Account Transfer To Living Trust South Dakota

South Dakota has specific regulations governing the creation and management of living trusts. It is essential to understand these rules to ensure compliance. For instance, the trust must be properly funded for it to be effective, and the trust document must meet state requirements. Additionally, South Dakota has no state income tax, which can be beneficial for trust management.

How to use the Financial Account Transfer To Living Trust South Dakota

Using the Financial Account Transfer To Living Trust South Dakota involves filling out the form with accurate information regarding the financial accounts being transferred. This includes providing details about the account holder, the trust, and the specific accounts. After completing the form, it should be submitted to the respective financial institution for processing. It is advisable to keep copies of all submitted documents for personal records.

Quick guide on how to complete financial account transfer to living trust south dakota

Effortlessly Set Up Financial Account Transfer To Living Trust South Dakota on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools needed to generate, revise, and electronically sign your documents quickly without interruptions. Manage Financial Account Transfer To Living Trust South Dakota on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

How to Alter and eSign Financial Account Transfer To Living Trust South Dakota with Ease

- Locate Financial Account Transfer To Living Trust South Dakota and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark signNow sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Financial Account Transfer To Living Trust South Dakota while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Financial Account Transfer To Living Trust South Dakota?

The process for Financial Account Transfer To Living Trust South Dakota involves a few essential steps. First, ensure that your living trust is properly established and funded. Next, complete the required forms to transfer your financial accounts into the trust. Finally, submit these documents to your financial institutions and keep records for your files.

-

What are the benefits of Financial Account Transfer To Living Trust South Dakota?

Transferring your financial accounts to a living trust can provide numerous benefits. It can help avoid probate, ensure a smooth transition of assets upon your passing, and provide privacy since trusts are not public records. Additionally, it offers greater control over how assets are managed and distributed.

-

Are there any costs associated with Financial Account Transfer To Living Trust South Dakota?

Yes, there can be costs associated with Financial Account Transfer To Living Trust South Dakota. Typical expenses may include attorney fees for trust setup, fees for filing documents with financial institutions, and potential taxes. It's advisable to consult with a professional to understand all potential costs involved.

-

How do I choose a trustee for my living trust in South Dakota?

Choosing a trustee for your living trust in South Dakota is a crucial decision. Consider someone trustworthy and responsible, whether it's a family member, friend, or professional. Ensure the person understands their duties related to managing the Financial Account Transfer To Living Trust South Dakota efficiently.

-

Can I change my living trust after the Financial Account Transfer To Living Trust South Dakota is complete?

Yes, you can change your living trust after the Financial Account Transfer To Living Trust South Dakota is complete. Living trusts are revocable, meaning you can modify them at any time if your circumstances or wishes change. It's essential to keep the changes documented to avoid confusion later.

-

What types of accounts can be transferred to a living trust in South Dakota?

Typically, various types of accounts can be included in the Financial Account Transfer To Living Trust South Dakota. This can range from bank accounts, investment accounts, and retirement accounts to real estate holdings. It's important to verify with your financial institution regarding their specific requirements for such transfers.

-

Do I need an attorney for Financial Account Transfer To Living Trust South Dakota?

While it's possible to handle a Financial Account Transfer To Living Trust South Dakota yourself, hiring an attorney is highly recommended. An attorney can help ensure that all documents are correctly prepared and compliant with state laws, minimizing the risk of errors that could complicate the process.

Get more for Financial Account Transfer To Living Trust South Dakota

- Personal history statement f 3 alaska department of public form

- Oskar and the ls final theatreworks theatreworks form

- Sro duties form 6a transactions treated as sub sales of land statutory declaration sro vic gov

- Doctoral degree application muscogee creek nation form

- Texas hotel tax exempt form 2014

- Consent agenda policy of highlands ranch bb hrcaonline form

- Dishwasher high temperature log september bcnpbrorgb form

- Usda extends application deadline for acer fsmip form

Find out other Financial Account Transfer To Living Trust South Dakota

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF