Tennessee Transfer Form

What is the Tennessee Transfer Form

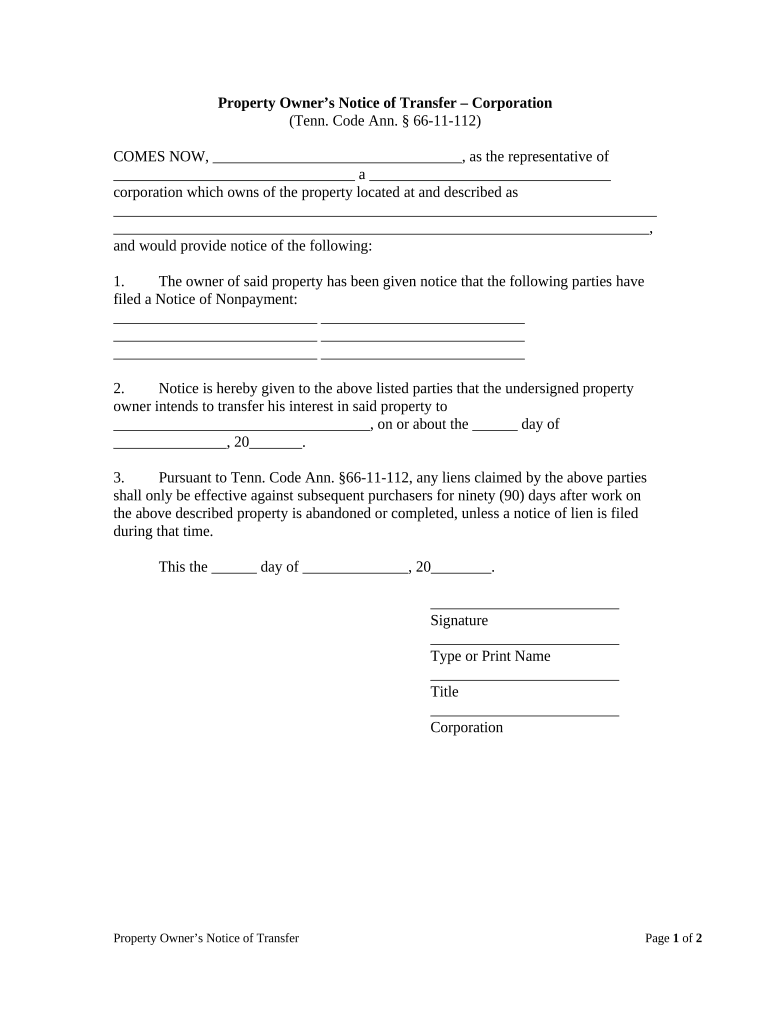

The Tennessee Transfer Form is a legal document used to facilitate the transfer of ownership of a limited liability company (LLC) in Tennessee. This form is essential for documenting changes in ownership and ensuring that the state records reflect the current owners of the LLC. It serves as an official notice to the Tennessee Secretary of State about the changes in ownership, which is crucial for maintaining compliance with state regulations.

Steps to Complete the Tennessee Transfer Form

Completing the Tennessee Transfer Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the current owner's details, the new owner's information, and the LLC's name. Next, fill out the form with accurate data, ensuring that all sections are completed. After filling out the form, both the current and new owners must sign it, indicating their agreement to the transfer. Finally, submit the completed form to the appropriate state office, either online or via mail, depending on your preference.

Legal Use of the Tennessee Transfer Form

The Tennessee Transfer Form is legally binding once it is properly completed and submitted. It must comply with state laws regarding the transfer of ownership in an LLC. This means that all parties involved must understand their rights and obligations under Tennessee law. Using this form correctly helps protect the interests of both the current and new owners and ensures that the transfer is recognized by the state, preventing any potential disputes in the future.

Required Documents

When completing the Tennessee Transfer Form, certain documents may be required to support the transfer of ownership. These may include the original Articles of Organization for the LLC, any amendments made to the LLC's operating agreement, and identification for both the current and new owners. Having these documents ready can streamline the process and ensure that all necessary information is provided to the state.

Form Submission Methods

The Tennessee Transfer Form can be submitted through various methods, providing flexibility for owners. The form can be filed online through the Tennessee Secretary of State's website, which is often the quickest method. Alternatively, owners can choose to mail the completed form to the appropriate office. In-person submissions are also an option for those who prefer direct interaction with state officials. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

State-Specific Rules for the Tennessee Transfer Form

Tennessee has specific rules governing the use of the Transfer Form that must be adhered to for the transfer to be valid. These rules include requirements for signatures, the necessity of notifying all members of the LLC about the transfer, and deadlines for submission. Understanding these state-specific regulations is crucial to ensure that the transfer process goes smoothly and that the new ownership is legally recognized.

Quick guide on how to complete tennessee transfer form

Complete Tennessee Transfer Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle Tennessee Transfer Form on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Tennessee Transfer Form without stress

- Find Tennessee Transfer Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Tennessee Transfer Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Tennessee owner LLC and how does it work?

A Tennessee owner LLC, or Limited Liability Company, is a business structure that provides liability protection and tax benefits to individual owners. It allows for personal asset protection while enabling flexible management and operational structures. By forming a Tennessee owner LLC, you can enjoy a simpler tax process compared to corporations.

-

What are the benefits of forming a Tennessee owner LLC?

Forming a Tennessee owner LLC offers various benefits, including limited liability protection, pass-through taxation, and enhanced credibility with clients. It allows owners to separate personal and business assets, reducing personal risk. Additionally, a Tennessee owner LLC can help streamline business operations and simplify tax filing.

-

How much does it cost to establish a Tennessee owner LLC?

The cost of establishing a Tennessee owner LLC generally includes state filing fees, which are typically around $300. Additional costs may arise from obtaining necessary licenses and permits depending on your business type. Investing in professional services for formation can also add to your overall expenses but may provide valuable assistance.

-

What features should I look for in eSignature solutions for my Tennessee owner LLC?

When selecting an eSignature solution for your Tennessee owner LLC, prioritize features such as compliance with regulations, user-friendly interface, and integration capabilities with other business tools. Look for a provider that offers robust security measures and audit trails to protect your documents. Additionally, consider the pricing plans to find a cost-effective solution.

-

Can I integrate eSigning solutions with my Tennessee owner LLC software?

Yes, many eSigning solutions can seamlessly integrate with the software used by your Tennessee owner LLC, enhancing overall efficiency. Look for platforms that support integrations with common business applications like CRM, cloud storage, and project management tools. This allows you to streamline workflows and reduce manual tasks.

-

How does a Tennessee owner LLC benefit from using airSlate SignNow?

AirSlate SignNow empowers Tennessee owner LLCs by providing a cost-effective and user-friendly platform for document signing and management. With its intuitive interface, business owners can easily send, track, and manage eSigned documents. This not only saves time but also enhances security and compliance in business transactions.

-

Is airSlate SignNow compliant with Tennessee state regulations?

Yes, airSlate SignNow complies with all applicable Tennessee state regulations regarding electronic signatures and document management. This ensures that your agreements and contracts are legally binding and recognized in the state. Adopting a compliant eSigning solution is essential for protecting your Tennessee owner LLC's interests.

Get more for Tennessee Transfer Form

- Request for information rfi form atcplancom

- Sheppard pratt health system inc sheppard pratt at mhcc maryland form

- Maturational assessment of gestational age new residents fammed form

- Mary kay bprizeb bentryb bformb jennifer bouse

- Option agreement for the sale and purchase of real estate form

- Hyperbaric oxygen therapy intake form nardella clinic

- My asthma action plan calviva health calvivahealth form

- 8020 exam 3 answers bmbiris bmb uga form

Find out other Tennessee Transfer Form

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form