Gift Deed Form

What is the Gift Deed Form

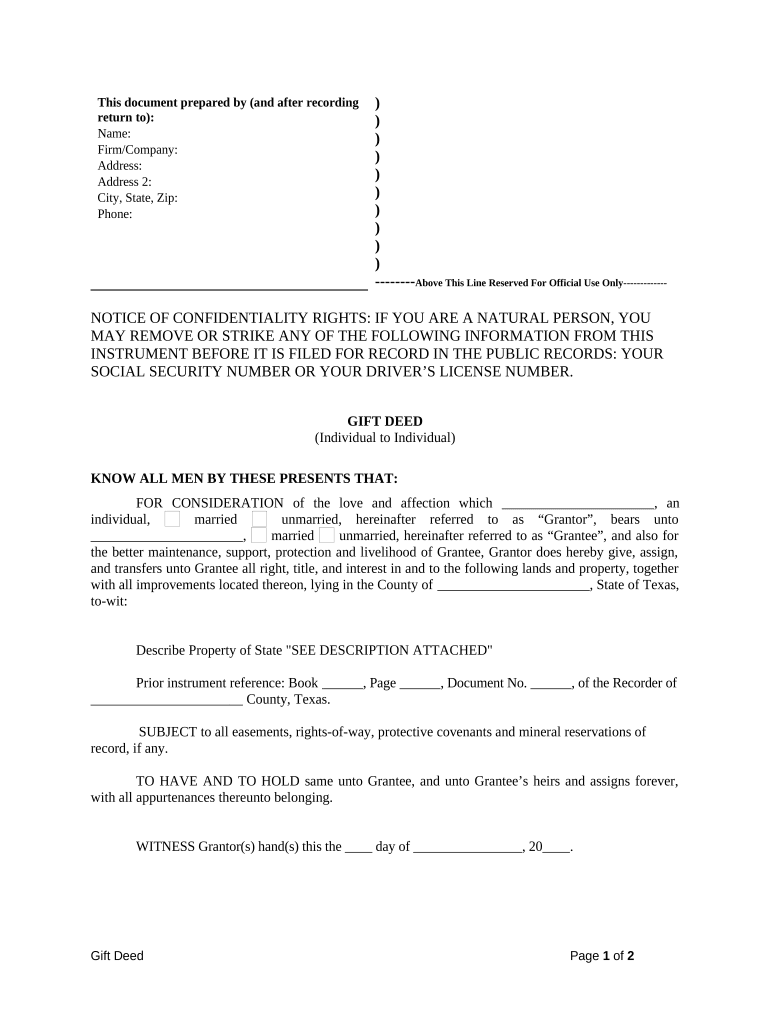

The gift deed form is a legal document used to transfer ownership of property from one individual to another without any exchange of money. This form is crucial in the state of Texas, as it establishes the intent of the donor to give the property as a gift. The gift deed must include specific details such as the names of the parties involved, a description of the property, and the signature of the donor. It is essential for ensuring that the transfer is recognized legally and can help prevent future disputes regarding ownership.

How to Use the Gift Deed Form

To effectively use the gift deed form, follow these steps: First, ensure you have the correct version of the form specific to Texas. Next, fill out the necessary information accurately, including the full names and addresses of both the donor and the recipient, as well as a detailed description of the property being gifted. After completing the form, both parties should sign it in the presence of a notary public to validate the document. Once notarized, the gift deed should be filed with the local county clerk’s office to officially record the transfer of ownership.

Steps to Complete the Gift Deed Form

Completing the gift deed form involves several important steps:

- Obtain the correct gift deed form for Texas.

- Provide the names and addresses of both the donor and the recipient.

- Include a thorough description of the property being gifted.

- Ensure the donor signs the document in front of a notary public.

- File the completed and notarized form with the county clerk’s office.

Following these steps ensures that the gift deed is legally binding and properly recorded.

Key Elements of the Gift Deed Form

Several key elements must be included in the gift deed form to ensure its validity:

- Names of the parties: The full legal names of both the donor and the recipient.

- Description of the property: A detailed description that clearly identifies the property being transferred.

- Intent to gift: A statement expressing the donor's intent to gift the property without any compensation.

- Signatures: The signature of the donor, and in some cases, the recipient, along with notarization.

Including these elements helps prevent legal issues and ensures the transfer is recognized by authorities.

Legal Use of the Gift Deed Form

The gift deed form serves a significant legal purpose in property transfers. In Texas, it is legally binding when properly executed and recorded. This document helps establish clear ownership and can protect the rights of the recipient against claims from third parties. Additionally, it is essential for tax purposes, as it may affect the donor's gift tax obligations. Understanding the legal implications of the gift deed form is crucial for both the donor and the recipient.

State-Specific Rules for the Gift Deed Form

In Texas, specific rules govern the use of the gift deed form. The document must be signed by the donor and notarized to be valid. Additionally, it must be filed with the county clerk's office where the property is located to ensure public record. Texas law also requires that the gift deed clearly states the intent to transfer the property as a gift, without any expectation of payment. Familiarity with these state-specific rules is vital for ensuring compliance and protecting both parties involved in the transaction.

Quick guide on how to complete gift deed form 497327294

Complete Gift Deed Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Handle Gift Deed Form on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest method to edit and eSign Gift Deed Form without any hassle

- Locate Gift Deed Form and then click Get Form to begin.

- Use the tools we provide to finalize your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, either by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require reprinting new document versions. airSlate SignNow satisfies all your document management needs with just a few clicks from your chosen device. Edit and eSign Gift Deed Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas gift deed?

A Texas gift deed is a legal document that allows an individual to transfer ownership of property as a gift without any exchange of money. This deed is essential for ensuring that the transfer is recognized by the state and provides legal protection for both the giver and recipient.

-

How can airSlate SignNow help with Texas gift deeds?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning Texas gift deeds. Our solution simplifies the process, ensuring that all necessary documentation is correctly filled out and complies with Texas laws, making it easier for you to manage your property transfers.

-

What are the benefits of using airSlate SignNow for Texas gift deeds?

Using airSlate SignNow for your Texas gift deeds allows for quick signing and sharing, reducing paperwork time signNowly. You also gain access to secure cloud storage for your documents, ensuring that your Texas gift deed is safe and easily accessible whenever you need it.

-

Are there any costs associated with using airSlate SignNow for Texas gift deeds?

airSlate SignNow offers cost-effective pricing plans tailored to your needs, including options for individual users and businesses. You can manage and eSign Texas gift deeds without breaking the bank, providing you exceptional value for your document management.

-

Can I integrate airSlate SignNow with other software for managing Texas gift deeds?

Yes, airSlate SignNow supports various integrations with other software solutions, making it easy to manage your Texas gift deeds alongside your other business tools. This streamlined approach enhances productivity and ensures a seamless workflow for document management.

-

What features does airSlate SignNow offer for Texas gift deeds?

airSlate SignNow includes features such as templates for Texas gift deeds, eSignature capabilities, and tracking for document progress. These features ensure that you can efficiently create and manage your gift deeds while keeping your transactions secure and legally compliant.

-

How does the eSigning process work for Texas gift deeds with airSlate SignNow?

The eSigning process for Texas gift deeds with airSlate SignNow is straightforward: upload your document, add signers, and send it for signature. Recipients can easily eSign the Texas gift deed from anywhere, making the transfer process faster and more convenient.

Get more for Gift Deed Form

- St 18 tax 2015 2019 form

- 2006 virginia form 502 2018 2019

- What is a w9 virginia 2017 2019 form

- Virginia sales tax exemption form st 11 2016 2019

- Virginia sales tax exemption form st 11 2016 2019 443065685

- 722 vi 2017 2019 form

- Vermont business tax 2015 2019 form

- Form mrt 441 meals and rooms tax return department of taxes

Find out other Gift Deed Form

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document