Texas Notice Default Form

What is the Texas Notice Default

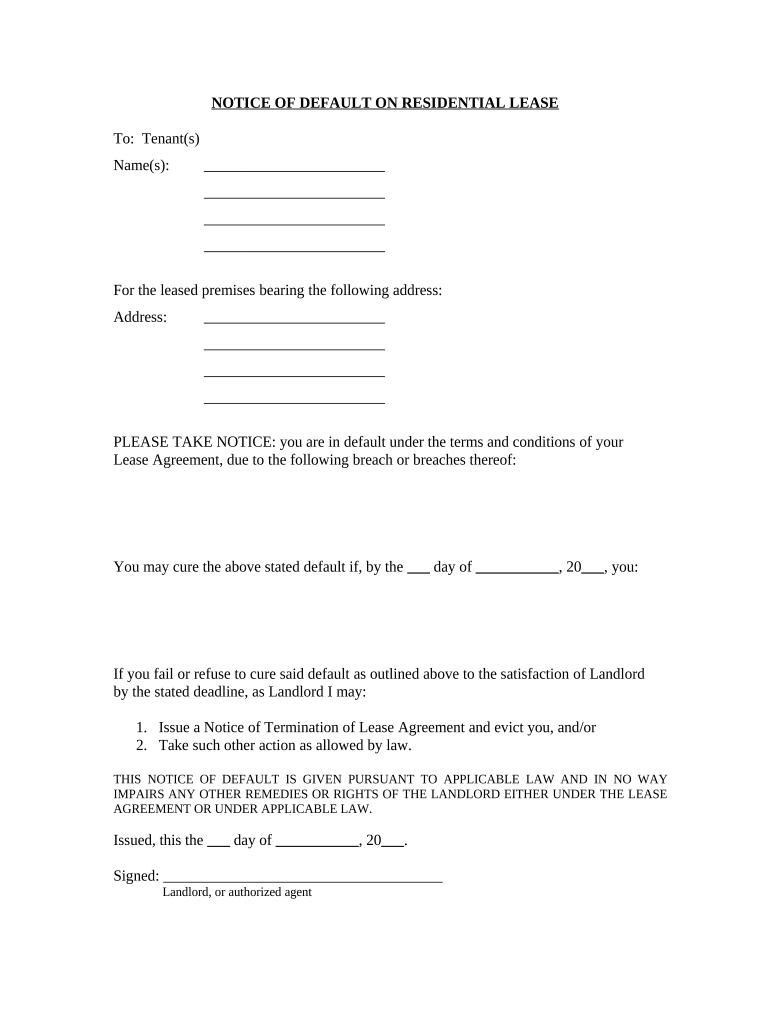

The Texas Notice of Default is a formal document used in the context of real estate and mortgage loans. It serves as a notification to the borrower that they have defaulted on their loan obligations, typically due to missed payments. This notice is a crucial step in the foreclosure process, as it informs the borrower of the specific default and the potential consequences if the situation is not remedied. Understanding the implications of this document is essential for both borrowers and lenders, as it outlines the rights and responsibilities of each party involved.

Key elements of the Texas Notice Default

A Texas Notice of Default must include several key elements to be considered valid. These elements typically consist of:

- The name and address of the borrower.

- The name and address of the lender or mortgage servicer.

- A clear statement indicating the default, including the amount owed.

- The date the default occurred.

- A warning about the potential consequences of failing to remedy the default, including foreclosure.

- Instructions on how to cure the default, if applicable.

Including these elements ensures that the notice is comprehensive and legally enforceable, providing the borrower with the necessary information to address the default.

How to obtain the Texas Notice Default

To obtain a Texas Notice of Default, lenders typically prepare the document based on the specific details of the loan agreement and the default situation. Borrowers may not need to request this notice, as it is usually generated by the lender when a default occurs. However, if a borrower requires a copy for their records or to understand their situation better, they can contact their lender or mortgage servicer directly. It is advisable for borrowers to keep a record of all communications regarding their loan to ensure they have all necessary documentation.

Steps to complete the Texas Notice Default

Completing a Texas Notice of Default involves several important steps:

- Gather all relevant loan information, including account numbers and payment history.

- Clearly state the reason for the default, including missed payment dates and amounts.

- Ensure all required elements are included in the notice, as outlined previously.

- Deliver the notice to the borrower, ensuring it is sent to the correct address.

- Keep a copy of the notice for your records, along with proof of delivery.

Following these steps helps ensure that the notice is properly executed and can serve its intended purpose in the foreclosure process.

Legal use of the Texas Notice Default

The legal use of the Texas Notice of Default is governed by state laws and regulations. It must be executed in compliance with the Texas Property Code, which outlines the procedures for notifying borrowers of defaults. This notice is a prerequisite for initiating foreclosure proceedings, making it essential for lenders to adhere to legal requirements. Failure to comply with these regulations can result in delays or complications in the foreclosure process, emphasizing the importance of proper legal use.

Digital vs. Paper Version

In today’s digital age, the Texas Notice of Default can be completed and signed electronically, offering convenience and efficiency. Digital versions of the notice maintain the same legal validity as paper documents, provided they comply with eSignature laws. Using a digital platform for this process can streamline communication and ensure timely delivery. However, some lenders may still prefer traditional paper methods, so it is essential to confirm the preferred format with the lender or mortgage servicer.

Quick guide on how to complete texas notice default

Prepare Texas Notice Default effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can access the necessary forms and securely archive them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Texas Notice Default on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to alter and electronically sign Texas Notice Default effortlessly

- Find Texas Notice Default and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Texas Notice Default and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a notice of default in Texas?

A notice of default in Texas is a formal declaration that a borrower has failed to meet the repayment terms of their loan. It typically serves as the first step in the foreclosure process and provides the borrower with information on how to remedy the default. Understanding the implications of a notice of default in Texas is crucial for homeowners facing financial difficulties.

-

How can airSlate SignNow help with the notice of default process in Texas?

airSlate SignNow streamlines the document signing process, allowing you to quickly prepare and eSign a notice of default in Texas. Our platform offers a user-friendly interface and templates designed for legal documents, making it easier for lenders and borrowers to handle such notices efficiently. This ensures compliance and saves time during a critical moment.

-

What features does airSlate SignNow offer for handling notices of default?

airSlate SignNow offers extensive features like template creation, bulk sending, and real-time tracking, which are essential for managing notices of default in Texas. You can easily customize documents and set up automated reminders to ensure timely responses. Our platform also ensures your documents are safely stored and easily retrievable.

-

Is airSlate SignNow cost-effective for handling notices of default in Texas?

Yes, airSlate SignNow provides a cost-effective solution for businesses managing notices of default in Texas. Our pricing model is designed to be affordable, especially compared to traditional document delivery methods. This allows organizations to efficiently manage legal documentation without straining their budgets.

-

Can I integrate airSlate SignNow with other tools for managing defaults in Texas?

Absolutely! airSlate SignNow easily integrates with a variety of tools and platforms, helping you manage notices of default in Texas seamlessly. Whether it's CRM or project management software, our integrations enhance functionality and streamline your document workflows, ensuring all your information is in sync.

-

What are the benefits of eSigning a notice of default in Texas?

eSigning a notice of default in Texas offers benefits such as expedited processing and reduced paper waste. With airSlate SignNow, you can eSign documents from anywhere, facilitating quick communication and resolution. Additionally, eSigned documents come with automatic timestamps and audit trails for added security.

-

How secure is the process of executing a notice of default using airSlate SignNow?

The security of executing a notice of default in Texas using airSlate SignNow is a top priority. We utilize advanced encryption methods to protect your documents and data throughout the signing process. With compliance to industry standards, you can trust that your sensitive information is stored securely.

Get more for Texas Notice Default

- 2019 form 940 internal revenue service

- F4506tpdf form 4506 tjune 2019 department of the

- About form 1040 v payment voucherinternal revenue

- Deductions form 1040 itemized internal revenue service

- 2019 form 8962 premium tax credit ptc

- Attach to form 1040 1040 sr or 1040 nr

- Irs f4952 fill online printable fillable blank form

- About form 944 employers annual federal tax return

Find out other Texas Notice Default

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free