Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Texas Form

What is the Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas

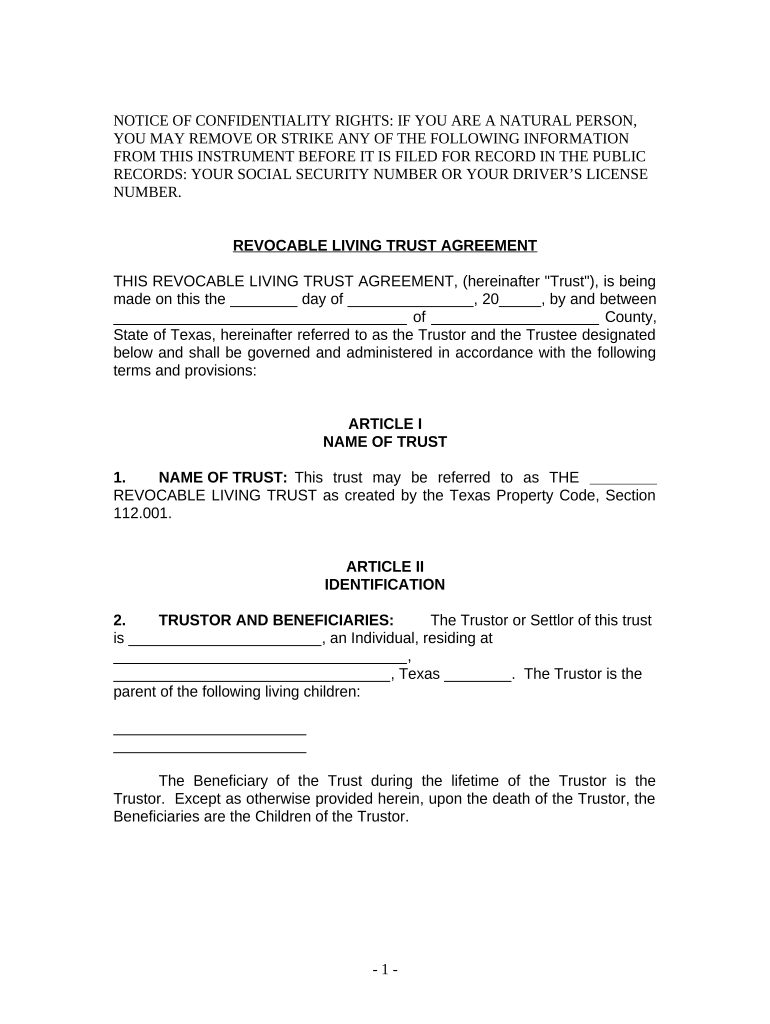

A living trust for individuals who are single, divorced, or widowed with children in Texas is a legal document that allows a person to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust is particularly beneficial for individuals with children, as it ensures that their assets are protected and distributed according to their wishes. The trust can help avoid probate, which is the legal process of distributing a deceased person's assets, thus providing a smoother transition for beneficiaries.

How to Use the Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas

Using a living trust involves several steps. First, the individual must create the trust document, which outlines the terms of the trust, including the trustee, beneficiaries, and how assets will be managed and distributed. Next, assets must be transferred into the trust. This includes real estate, bank accounts, and personal property. Once the trust is established and funded, the individual can manage the assets as they see fit, and upon their death, the trust will dictate the distribution of assets to the named beneficiaries without the need for probate.

Steps to Complete the Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas

Completing a living trust involves several key steps:

- Determine the assets: Identify all assets that will be included in the trust.

- Select a trustee: Choose an individual or institution to manage the trust.

- Draft the trust document: Create a legal document that outlines the terms of the trust.

- Transfer assets: Officially transfer ownership of the identified assets into the trust.

- Review and update: Regularly review the trust to ensure it meets current needs and legal requirements.

Key Elements of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas

Key elements of this living trust include:

- Trustee designation: The person or entity responsible for managing the trust.

- Beneficiaries: Individuals or organizations that will receive the trust assets.

- Asset management: Guidelines on how the trustee should manage the assets within the trust.

- Distribution instructions: Specific instructions on how and when beneficiaries will receive their inheritance.

State-Specific Rules for the Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas

In Texas, specific rules apply to living trusts. The trust must be created in writing and signed by the grantor. Texas law allows for revocable living trusts, meaning the grantor can modify or revoke the trust during their lifetime. Additionally, it is essential to ensure that the trust complies with Texas property laws, particularly when transferring real estate into the trust. Consulting with a legal professional familiar with Texas estate planning is advisable to ensure compliance.

Legal Use of the Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas

The legal use of a living trust in Texas includes asset management during the grantor's lifetime and distribution upon death. It is recognized by Texas law as a valid estate planning tool. The trust can help avoid probate, ensuring that beneficiaries receive their inheritance quickly and efficiently. It is essential to follow proper legal procedures when creating and funding the trust to ensure its validity and enforceability.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children texas

Effortlessly Manage Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Texas on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delay. Handle Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Texas on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-driven process today.

How to Modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Texas with Ease

- Locate Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Texas and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device you choose. Modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Texas to ensure smooth communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas?

A Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas is a legal document that allows you to manage and distribute your assets during your lifetime and after your death. It provides a way to avoid probate, ensuring a smoother transition of your estate to your children or beneficiaries.

-

How can a Living Trust benefit me as a single, divorced, widow, or widower parent in Texas?

Setting up a Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas can help you have greater control over your assets and ensure they are distributed according to your wishes. It also protects your children’s interests and minimizes legal challenges, making it an essential tool for solo parents.

-

What is the cost of creating a Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas?

The cost of creating a Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas can vary depending on the complexity of your estate and the attorney fees involved. However, many find that the long-term benefits outweigh the initial investment, especially when it comes to avoiding probate costs.

-

Can I modify my Living Trust after it's created if my circumstances change?

Yes, one of the key features of a Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas is that it can be amended or revoked at any time while you're alive. This flexibility allows you to adjust your trust to reflect changes in your life situation or estate planning goals.

-

Are there tax benefits associated with a Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas?

While a Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas does not directly provide tax benefits, it can help manage the timing of asset distribution. This can potentially minimize estate taxes and provide financial advantages for your heirs.

-

How does airSlate SignNow fit into setting up my Living Trust?

airSlate SignNow offers a cost-effective solution to help you prepare, send, and eSign documents needed for a Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas. Our platform streamlines the process, making it easy for you to manage your important legal documents without hassle.

-

What key features should I look for in a Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas?

When considering a Living Trust for Individual Who Is Single, Divorced or Widow or Widower with Children in Texas, look for features such as ease of management, the ability to name a successor trustee, and clear instructions for asset distribution. Ensure it provides legal protections for your children and suits your estate planning needs.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Texas

- Complaint form packet idaho state bar state of idaho

- Al request 2011 form

- It 2663 form 2016

- Form it 214 department of taxation and finance

- State form 2837 2005

- Annual report of guardian on condition of minor michigan courts form

- Hcd form 2009

- What is non ownership motor affidavit texas harris 2009 form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children Texas

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free