Texas Installments Fixed Rate Promissory Note Secured by Residential Real Estate Texas Form

What is the Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas

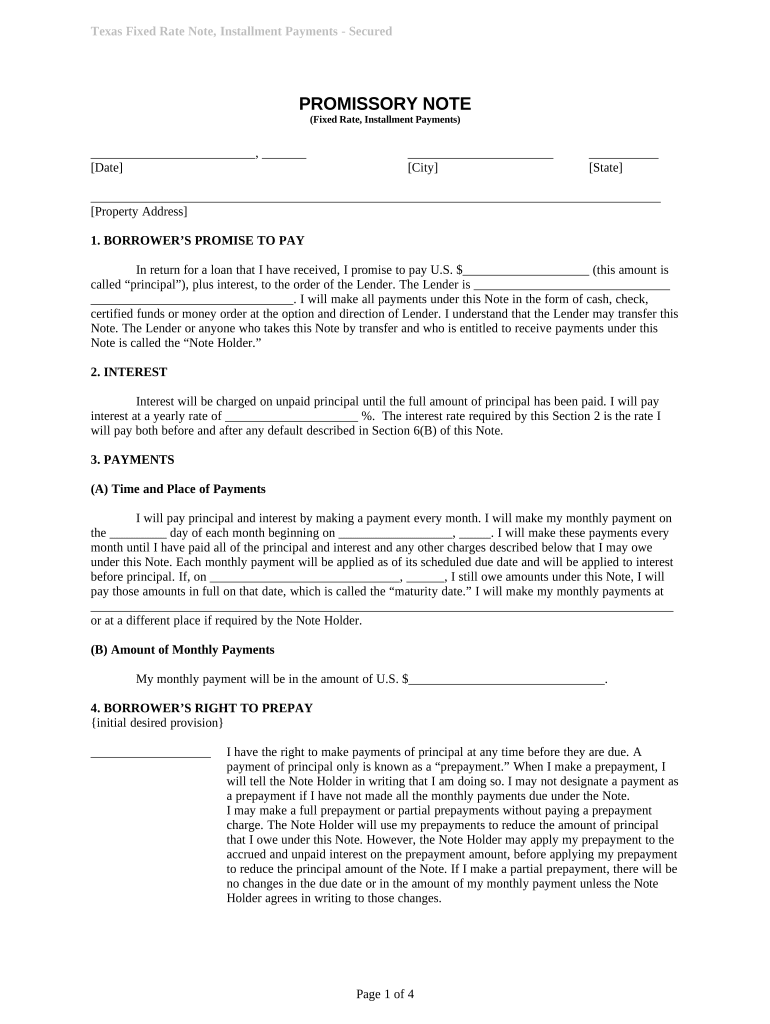

The Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by residential property in Texas. This note serves as a promise to repay a specified amount over a set period, with a fixed interest rate. It is typically used in real estate transactions where the borrower agrees to repay the lender in installments, making it an essential tool for both lenders and borrowers in the state.

Key elements of the Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas

This promissory note includes several critical components that ensure its validity and enforceability. Key elements often include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the principal.

- Payment Schedule: Details on the frequency and amount of each installment payment.

- Loan Term: The duration over which the loan will be repaid.

- Collateral Description: A detailed description of the residential real estate securing the loan.

- Default Terms: Conditions under which the borrower may be considered in default.

Steps to complete the Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas

Completing the Texas Installments Fixed Rate Promissory Note involves several important steps:

- Gather necessary information, including borrower and lender details, property description, and loan terms.

- Fill in the principal amount and interest rate, ensuring accuracy to avoid future disputes.

- Specify the payment schedule, including the amount and frequency of payments.

- Review the terms of the note, including default conditions and any penalties.

- Both parties should sign the document in the presence of a notary public to ensure its legal validity.

Legal use of the Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas

This promissory note is legally binding when executed correctly. To ensure compliance with Texas law, it must include all required elements and be signed by both parties. Additionally, adhering to state-specific regulations regarding secured transactions is crucial. The note can be enforced in a court of law, providing protection for both the lender and borrower.

How to use the Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas

The Texas Installments Fixed Rate Promissory Note can be used in various scenarios, primarily in real estate transactions. Lenders utilize this document to formalize the loan agreement, while borrowers can use it to understand their repayment obligations. It is essential for both parties to keep a copy of the signed note for their records, ensuring clarity regarding the terms of the loan.

State-specific rules for the Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas

Texas has specific regulations governing promissory notes and secured transactions. These rules dictate how the note must be structured, including requirements for signatures, notary acknowledgments, and disclosures. Familiarity with these regulations is essential to ensure that the promissory note is enforceable and compliant with state law.

Quick guide on how to complete texas installments fixed rate promissory note secured by residential real estate texas

Complete Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas effortlessly on any device

Digital document management has gained traction with organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly and without interruptions. Manage Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to modify and eSign Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas without hassle

- Obtain Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas?

A Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas is a financial document where a borrower agrees to repay a loan, with fixed installments over time. This note is secured by residential real estate, providing lenders with a higher level of security. Understanding its structure is vital for both borrowers and lenders involved in real estate transactions in Texas.

-

How does the pricing work for a Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas?

The pricing for a Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas typically varies depending on the loan amount and terms. Interest rates may also play a signNow role in determining overall costs. It's essential to review your options and consult with a financial expert to ensure you're getting the best deal.

-

What features are included in a Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas?

A Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas includes features such as fixed installment payments, a specified interest rate, and a clear repayment schedule. Additionally, it usually outlines the rights and obligations of both parties involved. This clarity helps reduce disputes and makes the borrowing process more straightforward.

-

What are the benefits of using a Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas?

The primary benefit of a Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas is the security it offers to lenders, as the loan is backed by real estate. Borrowers also benefit from fixed payments, allowing for better financial planning. This arrangement can foster trust and transparency between lenders and borrowers.

-

Can I customize my Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas?

Yes, you can customize your Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas to meet the specific needs and terms agreed upon by both parties. Customizations may include payment schedules, interest rates, and other terms. It's recommended to consult a legal expert when making adjustments to ensure compliance with Texas laws.

-

How long does it take to process a Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas?

Processing a Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas can take anywhere from a few days to a few weeks, depending on the lender's requirements and document preparation. Factors such as buyer and seller readiness, as well as appraisal and inspection processes, can influence timing. Planning ahead will help expedite the process.

-

What integrations does airSlate SignNow offer for Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas?

airSlate SignNow offers seamless integrations with various platforms that facilitate the management of Texas Installments Fixed Rate Promissory Notes Secured By Residential Real Estate Texas. These integrations help streamline eSigning and document management processes, making transactions smoother and more efficient. Popular integrations include CRM systems and payment processing platforms.

Get more for Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas

- 990 ez instructions form 2017

- Form 5227 irs

- 2017 instructions for schedule f 2017 instructions for schedule f profit or loss from farming form

- Pa 40 2016 form

- New york state department of taxation and finance publication 83 313 specifications for reproduction of new york state form

- St 125 2014 form

- 2017 form 540nr

- Nyc 210 form 2015

Find out other Texas Installments Fixed Rate Promissory Note Secured By Residential Real Estate Texas

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy